Subscribe for Weekly Updates

The ABCs of ACA Compliance

By Guest Blogger William L. Stunkel, CPA

By Guest Blogger William L. Stunkel, CPAOne of the hardest things for business owners is making sure they’ve filed all of the various forms required by the IRS, states, and local governments. I sometimes refer to the many requirements as the ABCs of business ownership. Hopefully, as a business owner, you’ve learned most of those “letters” well before any governmental agency has contacted you to say you missed one.

With the implementation of the Affordable Care Act (ACA), we now have some new letters (and numbers) we need to learn.

Why Is Reporting Necessary?

When discussing the ABCs of compliance, many times clients and potential clients ask, “What’s the big deal?” They want to know why they have to fulfill a particular requirement. With the ACA, the necessity comes down to potential tax penalties and fines. The information being requested by the IRS – health insurance coverage reporting – will be used to determine whether an employer has complied with ACA insurance requirements.

The main requirement for employers is whether they have offered affordable insurance coverage to their employees. There is also a requirement on individual taxpayers to have health insurance or face their own potential fine for not obtaining coverage.

For employers, generally, only those who have more than 50 full-time equivalent (FTEs) employees in the prior calendar year will have additional filing requirements to comply with the ACA. The two questions that must be answered to determine the exact requirements are as follows:

- Is the employer an Applicable Large Employer (ALE) or a small employer?

- Is the employer self-insured or fully insured?

The definitions of whether an employer is an ALE or a small employer, and being fully insured or self-insured, are a beyond the scope of this blog; however, the above links to the IRS and Bureau of Labor Statistics websites provide more details regarding the respective definitions. In general, though, most small employers (less than 50 employees) are typically fully-insured for health insurance coverage.

Form Filing Requirements

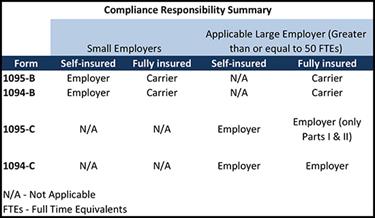

If an employer is a small employer and fully insured, the insurance company or carrier often will prepare and file the required Forms 1094-B and 1095-B. If the employer is a small employer and self-insured, then the employer would be required to file these forms.

If the employer is an ALE and fully insured, the insurance company or carrier would prepare and file the required 1094-B and 1095-B; however, the employer would be responsible for filing Forms 1094-C and parts of 1095-C. If the employer is an ALE and self-insured, the employer would fill out and file only Forms 1094-C and 1095-C.

(See chart illustrating the requirements.)

What Is Being Reported?

The information being reported on 1094-B, 1095-B, 1094-C, and 1095-C is what health coverage each employee at the organization has.

Forms 1094-B and 1094-C are transmittal forms for multiple 1095-Bs or 1095-Cs, respectively. They are similar in function and information as Form 1096, which is used to transmit IRS Forms 1099-INT or 1099-MISC, among others.

Forms 1095-B and 1095-C are used to actually provide detailed employee and employer information about health care coverage offered to the IRS. Both forms provide information about the employee, the coverage offered by the employer for that employee, and a listing of the “Covered Individuals” (generally family members) that are insured under the employee’s employer-provided coverage.

In Summary

Most small employers will simply need to be aware that the insurance company they use will be sending employees a new form (Form 1095-B). If an employer would meet the definition of an ALE, the employer will need to ensure they take the necessary steps to compile the information required on Form 1095-C.

William L. Stunkel, CPA, is director of small business services with Holsinger PC in Wexford, Pa. and serves on the CPA Image Enhancement Committee.

Leave a commentOrder by

Newest on top Oldest on top