Subscribe for Weekly Updates

Pennsylvania 2017-2018 Budget Battle Begins

By Peter N. Calcara, vice president - government relations

On Feb. 7, Gov. Tom Wolf unveiled his fiscal year (FY) 2017-2018 state budget proposal to a joint session of the Pennsylvania General Assembly. Wolf’s presentation was notable for its brevity, its conciliatory nature, and its themes of no taxes and cutting spending.

“I’m offering a budget proposal that represents a responsible solution to our deficit challenge – and a different approach from the way things have been done in Harrisburg for almost a generation. Let’s start here: In my proposed budget, there are no broad-based tax increases,” Wolf said. “At the same time, my budget protects the investments we’ve made in education, in senior services, in fighting the scourge of opioids, and in growing Pennsylvania’s economy.”

Some Republicans lauded Wolf’s proposal.

“It is a more realistic starting point to the budget process,” said Rep. Dave Reed, House Majority Leader. “We are very pleased he has joined us in looking at ways to reshape how we do budgeting in the commonwealth.”

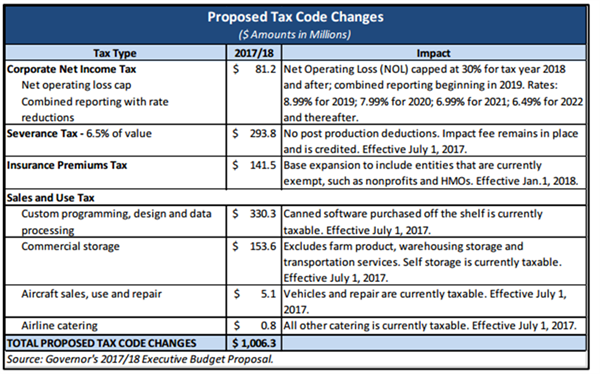

The $32.3 billion spending plan contains no new broad-based taxes, but does include about $1 billion in new, recurring revenues (see chart below). Overall spending would increase by more than $570 million, or 1.8 percent, above the FY 2016-2017 budget.

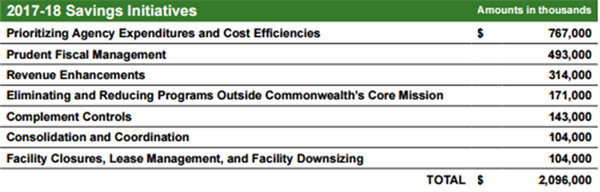

The proposal includes increases in spending for public education, special education, early childhood education, and higher education; creates a new, unified Department of Health and Human Services; expands efforts to address the heroin and opioid epidemic; and provides for new economic development initiatives, including increasing the state minimum wage to $12 per hour. It also identifies more than $2 billion in cuts and other cost savings across several categories (see chart below).

Source: Governor’s 2017-2018 Executive Budget-in-Brief

But if you think it will be smooth sailing to the new fiscal year that begins July 1, there are still some issues that could muddy the legislative waters.

Pat Browne, CPA (R-Lehigh), chair of the Senate Appropriations Committee, said, “On the surface, this budget proposal provides significant savings and spending reductions, while still providing funding for vital programs and services. However, it is now the responsibility of legislators to look at these proposals more closely and determine if they will actually provide the results and savings the governor projects. The most significant question that will need to be answered during our review is whether this budget proposal addresses the primary cost-drivers the commonwealth faces: pensions, mandated human services, and corrections.”

The House and Senate appropriations committee will begin their respective budget hearings later this month. This is when state lawmakers dive into the details of the $32 billion plan. House lawmakers officially return to session the week of March 13, while senators are back in session the following week.

The PICPA government relations team will be monitoring budget hearings, which members can follow through Legislative Update, our electronic newsletter, or you can sign up for our Legislative Update Budget webinar scheduled for Feb. 14. The PICPA stands ready to work with the Wolf administration and state lawmakers as they work toward crafting a responsible 2017-2018 state budget.

You can find more information on Wolf’s proposed budget in the Governor’s Executive Budget-In-Brief document online.

Leave a commentOrder by

Newest on top Oldest on top