2018 Federal Income Taxes: Did Tax Reform Provide a Simpler, Shorter Form?

One of the most highly publicized features of tax reform was its “simplifications.” The 2018 Form 1040 is half the size of previous iterations of the form. However, that giant streamlining may be a bit misleading. Learn more about the new 1040 before you file.

By James J. Newhard, CPA, CGMA

By James J. Newhard, CPA, CGMA

The Tax Cuts and Jobs Act (TCJA) of 2017 turned traditional federal income tax law a little bit on its head. It brings some lower tax rates, a larger standard deduction, higher tax credits, and some extra deductions for businesses. However, the TCJA also eliminated some deductions, limited others, took away deduction benefits for personal exemptions, and added new layers of complexity.

The Tax Cuts and Jobs Act (TCJA) of 2017 turned traditional federal income tax law a little bit on its head. It brings some lower tax rates, a larger standard deduction, higher tax credits, and some extra deductions for businesses. However, the TCJA also eliminated some deductions, limited others, took away deduction benefits for personal exemptions, and added new layers of complexity.

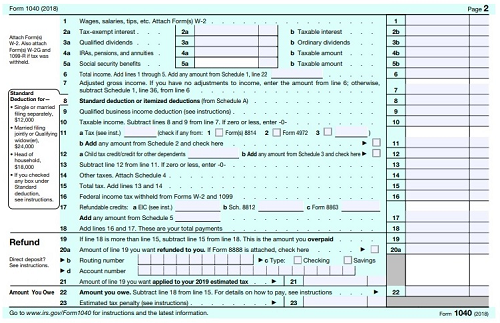

One of the most highly publicized features of tax reform was its “simplifications.” The 2018 Form 1040 is half the size of previous iterations of the form. That is, instead of a jam-packed two page form, it is now a very relaxed two-sided half page. The number of lines for tax data has gone from 79 in 2017 down to a meager 23 in 2018. However, that giant streamlining is actually a bit misleading. The basic Form 1040 has always been a “summary” of other supporting tax data, and that has not been changed. Supporting schedules for itemized deductions (A), interest and dividends (B), self-employment income (C), capital gains (D), rents, royalties and pass-throughs (E), farming (F), household employees (H), self-employment tax (SE), and many more are still necessary and required.

Further, six new sub-schedules have been created to report information that is summarized and carried forward to the new 1040.

- If you have other income, including unemployment, prizes or awards, gambling, capital gains, taxable alimony, self-employment income, and others (many coming from other schedules previously addressed above), or if you have a number of deductions, such as student loan interest, educator expenses, self-employment tax deduction, IRA contributions, health savings account (HSA) deductions, or some others, you will need to complete Schedule 1. Schedule 1 has 36 separate lines.

- If you have the alternative minimum tax (AMT) or an excess advance premium credit repayment, you will need to complete Schedule 2.

- If you are claiming tax credits – such as the foreign tax credit, education credits, child care credits, or residential energy credits – you’ll complete Schedule 3 (along with supporting schedules).

- If you owe additional federal taxes, including self-employment tax, household employment tax, or penalty tax of retirement or other tax-favored accounts, you will need to complete Schedule 4 (plus supporting schedules).

- If you have other tax/payment credits, including estimated payments, net premium health insurance credit, excess Social Security, or a payment made with an extension request, you must complete Schedule 5.

- If you have any foreign addresses or wish to designate your preparer as the third-party designee for administrative question purposes, complete Schedule 6.

Let’s look at two examples to see the impact of the changes.

Example A

Jack graduated from college in December 2017. He started a new job in January 2018 and moved into a new apartment, which he would share with a friend to split the rent. Jack gets a W-2 for his new job. He did not earn any interest, as all his money was kept in a checking account.

On Jack’s 2018 federal income tax return, he files as single. Jack does not need to use any of the six new schedules to the 1040. Page 2 of his 1040 will have entries on lines …

- 1, for his wages

- 7, for the net adjusted gross income

- 8, for the standard deduction being claimed

- 10, for taxable income

- 11, for the applicable income tax – which is then carried to line 15 as the adjusted total tax

Line 16 will reflect the federal tax withheld on his W-2, which will be carried down to line 18 as the total withholding. This is compared against the line 15 total tax to determine whether Jack owes a net tax due to the IRS (line 22) or is due a refund (lines 19 and 20).

Example B

Carol and Bob divorced in 2016. Carol has custody of their five-year-old daughter. Carol is a part-time employee as a bookkeeper for a chiropractor, as well as being self-employed doing freelance accounting and taxes for a handful of clients. Carol receives $18,000 a year from Bob in alimony (taxable to Carol and deductible to Bob). Carol has health insurance from the Marketplace (the daughter is covered under Bob’s health plan), and she uses child care assistance when she must work. Additionally, Carol’s grandmother passed away in 2017, and Carol has some inheritance in the bank earning interest and in a couple of mutual funds earning dividends and capital gains. She also had to begin taking mandatory distributions from IRAs she inherited (taxable retirement distributions not subject to penalty). On Carol’s 2018 federal income tax return, Carol files as head of household, claiming her daughter as a dependent.

On Schedule 1 of the 1040, Carol will have income entries on lines …

- 11, for the alimony

- 12, for her net self-employment income (supported by Schedule C)

- 13, for capital gains from the mutual fund (supported by Schedule D and 8949)

She will have deduction entries on lines …

- 27, for half of her self-employment tax

- 29, for her health insurance deduction related to self-employment

- 32, for the IRA contribution she made

- 33, for the interest she paid on old student loans

The net total of Schedule 1 will be on line 36.

Page 2 of her 1040 will have entries on lines …

- 1, for her wages

- 2 and 3, for her interest and dividend income (supported by Schedule B)

- 4, for the inherited IRA distribution

- 6, for the total from Schedule 1 line 36

- 7, for the net adjusted gross income

- 8, for the standard deduction being claimed

- 9, for the qualified business income deduction from her net self-employment income

- 10, for taxable income

- 11, for the income tax calculated

Carol enters her child tax credit for her daughter on line 12; net tax on line 13; other taxes (self-employment tax calculated on Schedule SE and reported on Schedule 4 of the 1040) on line 14; the adjusted total tax on line 15; federal tax withheld on her W-2 on line 16; and the tax credits for dependent care for her daughter (from 1040 Schedule 3, as supported by Form 2441) as well as her estimated tax payments (from 1040 Schedule 5) on line 17. Line 18 is the total withholding, estimates, and child dependent care tax credit, which is compared against line 15’s total tax to determine whether Carol owes a net tax due to the IRS (line 22) or is due a refund (lines 19 and 20).

These two relatively straightforward examples reflect both the simplicity and complexity in 2018 individual income taxes. Yes, for some, as presented in Example A, this year’s taxes should be fairly easy, with little pain in preparation. However, when life’s circumstances are a little bit more complex, as presented in Example B, things get more challenging. Accordingly, not every taxpayer will need a professional income tax preparer, but for many, the complexity level can hit fast and hard. You should carefully consider your situation and weigh whether or not seeking the advice of an expert would be in your best interest.

James J. Newhard, CPA, CGMA, is the owner of James J. Newhard, CPA. He is a past president of the PICPA Greater Philadelphia Chapter, is a recipient of the Volunteer Service Award and the Champion Service Award, and serves on several PICPA committees at the state level. Newhard is also a member of the AICPA.

PICPA Staff Contributors

Disclaimer

Statements of fact and opinion are the authors’ responsibility alone and do not imply an opinion on the part of PICPA officers or members. The information contained in herein does not constitute accounting, legal, or professional advice. For professional advice, please engage or consult a qualified professional.