Subscribe for Weekly Updates

Tax Resources for CPAs: PICPA’s Got ‘Em

By Maureen Renzi, vice president – communications

The 2018 tax filing season is officially at an end since the Oct. 15 extension deadline has arrived. CPAs I’ve talked to resoundingly agree that this year was particularly challenging. Filing tax extensions not only provided some extra time to prepare returns, but also provided more opportunity to get clarifications on the more sticky issues resulting from the Tax Cuts and Jobs Act of 2017.

A quick poll of members of PICPA’s Federal Taxation Committee along with contributors to the PICPA Connect taxation discussion board revealed numerous areas where additional guidance was needed.

|

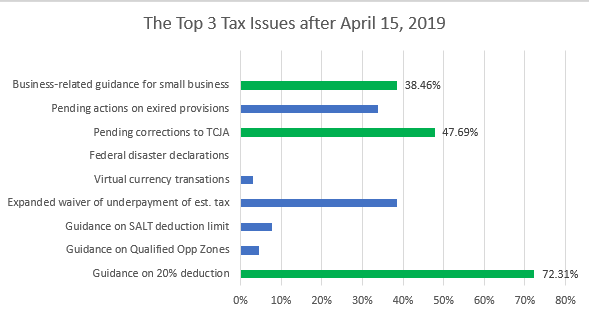

The PICPA asked: Extensions this tax season provided more time to clarify sticky issues related to the 2018 tax year. Of the followig, which have been the most relevant issues that occurred after April 15, 2019. (Top three are noted in greeen.) |

The No. 1 issue that needed additional guidance was the 20% deduction for pass-through entities. Nearly 75% of respondents indicated this guidance was most relevant to their clients. PICPA and IRS resources on this issue include the following:

- CPA Conversations podcast on "Qualified Business Income Deduction’s Impact on Your Clients"

- CPA Now blog on "Qualified Business Income Deductions Big Impact on Your Clients"

- IRS FAQs

- Notices addressing 199A, including Methods for Calculating W-2 Wages for Purposes of Section 199A and Section 199A Trade or Business Safe Harbor: Rental Real Estate

Another area where extension-takers required additional guidance was on Qualified Opportunity Zones. The PICPA produced the podcast “How CPAs Can Advise on Qualified Opportunity Zones” featuring CPAs Chris Catarino and Steven Rossman, to shed some light on the issue.

The implications of the TCJA on states continue to evolve, and the PICPA provided some early guidance in our Tax Reform Guide presented by the Pennsylvania CPA Journal. CPAs Drew VandenBrul and Matt Melinson co-authored “State Tax Considerations of Federal Tax Reform.” Members can stay apprised of arising state tax news by subscribing to the PICPA-produced Legislative Update email newsletter.

When we asked survey participants to identify three issues regulators and legislators should focus on, the top responses were corrections to the TCJA (77%) and action on expired tax provisions still not undertaken (68%). The third-greatest concern, business-related guidance that could affect sole proprietors, partners, and S corporation shareholders (55%), demonstrates CPAs’ ongoing role as advocates for the small-business community.

When the surveyed PICPA members were asked what one issue they would like to know more about, and more than 40% indicated that they wanted to stay apprised of pending corrections as well as several areas of business-related guidance. The PICPA has resources available to members to help them cut through the clutter and get the information they need:

- Subscribe to PICPA’s weekly digest that highlights the blogs and podcasts published by the PICPA over the past week.

- Take advantage of Wolters Kluwer Tax Aware Center subscription, which is free to PICPA members or purchase a tax guide for 30% off.

- Attend some of the more than 150 tax courses and webinars the PICPA has scheduled before the end of the year to be sure you are on track.

Not a PICPA member? We can help with that too. Apply online or give us a call and we will be happy to assist you (215) 972-6185.

Sign up for weekly professional and technical updates in PICPA's blogs, podcasts, and discussion board topics by completing the form here.

Leave a commentOrder by

Newest on top Oldest on top