Subscribe for Weekly Updates

The New W-4 Form: Easier than It Seems

By Jeffrey I. Kim, CPA

By Jeffrey I. Kim, CPA

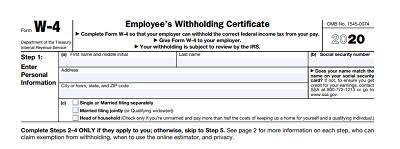

The Tax Cuts and Jobs Act of 2017 (TCJA) altered the income tax brackets as well as numerous tax deduction allowances. This means many people need to adjust their tax withholding to account for these changes. To better align tax withholding with the new tax law, the IRS recently redesigned Form W-4, Employee’s Withholding Certificate. The new form looks significantly different than the one taxpayers have been filing for decades, and at first glance it seems complicated and hard to complete. Don’t be put off! I think the form is straight forward and can help filers be more accurate with their payroll withholding.

The Tax Cuts and Jobs Act of 2017 (TCJA) altered the income tax brackets as well as numerous tax deduction allowances. This means many people need to adjust their tax withholding to account for these changes. To better align tax withholding with the new tax law, the IRS recently redesigned Form W-4, Employee’s Withholding Certificate. The new form looks significantly different than the one taxpayers have been filing for decades, and at first glance it seems complicated and hard to complete. Don’t be put off! I think the form is straight forward and can help filers be more accurate with their payroll withholding.

There are five steps in this one-page form. Steps 1 and 5 are required and really easy. Step 1 is filling out your personal information and checking off your filing status. Step 5 is signing your John Hancock. If this is all you fill out, your withholding will be computed based on your filing status’s standard deduction and tax rates, with no other adjustments.

But I’m sure you want more accurate withholding done, so you need to complete Steps 2 through 4, too.

Step 2 is required if you have more than one job or if you are married and both you and your spouse work. This step ensures that you have enough withholding. There are three options you can use to calculate your withholding in Step 2. The first option is the IRS tax withholding estimator, which is both the most accurate option and the most time consuming. The second option is to use the multiple jobs worksheet based on two wage (highest and lowest) amounts. Use this option if you and your spouse have a total of only two jobs and the pay at the higher paying job is more than double the pay at the lower paying job. The third option, the least accurate of the three, is just checking off the box on the form. Use this option if your pay at each job is similar. Complete a Form W-4 for each job with the box checked since the standard deduction and tax brackets with be cut in half for each job to calculate withholding.

We are almost done. Steps 3 and 4 are optional. Step 3 has to do with your dependent credits, so this will affect your withholding based on the number of dependents you claim on your tax returns. Step 4 has to do with investment income, retirement income, itemized deductions, and extra withholding. The amount calculated from Step 2 will be entered here. If you are completing steps 3 and 4, you only need to do it once. Leave those steps blank for secondary jobs. (Your withholding will be most accurate if you complete Steps 3 through 4(b) on Form W-4 for the highest paying job.)

That’s it! The new Form W-4 is required for all new employees hired in 2020. If you do not fill out the form, your withholding will default to the single rate with no adjustments. Tax surprises can be mitigated through proper withholding and doing some tax projection calculations. Your goal is to have the amount of tax withheld close to the amount of tax owed. Big tax refunds may seem great, but that’s actually money you are not getting in each paycheck that you are due. So, take the time, get rid of the fear, and make sure your tax withholding is accurate with the new Form W-4.

Jeffrey I. Kim, CPA, is with McCarthy & Company PC in Lafayette Hill, Pa. He serves on PICPA’s CPA Image Enhancement Committee.

To get more personal finance and small-business tips, visit PICPA's Money & Life.

Leave a commentOrder by

Newest on top Oldest on top