Subscribe for Weekly Updates

COVID Makes Everything Difficult, but Philly Makes Tax Refunds Easier

By Joseph Bamat

By Joseph Bamat

The coronavirus pandemic has caused huge disruptions to Philadelphia businesses and workers. Many employees have been ordered to work from home or are struggling with income loss. The Philadelphia Department of Revenue expects to receive many 2020 wage tax refund requests this tax season. To simplify the process, the department has introduced a new employer-request form for income-based refunds as well as online forms and streamlined paper forms for these requests.

Employer-Requested Refunds

For tax year 2020 only, because so many people were ordered to work from home, businesses can submit a city wage tax refund request on behalf of a group of their nonresident employees.

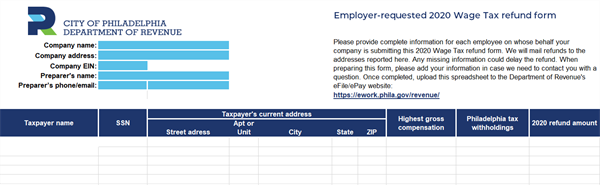

To do so, the department created a new form that employers can download now. Employers must provide accurate and complete tax information for each of their nonresident workers.

Starting this month (February), employers will be able to upload the form on the Philadelphia’s eFile/ePay website. We will mail wage tax refund checks directly to employees, so please ensure that employee mailing addresses are current.

All forms (both paper and online) will be available starting in February.

Submit Forms Online

If an employer is submitting a petition on an employee’s behalf, that employee must not submit a duplicate refund petition on his or her own. However, if an employee needs to submit a petition because their employer is not doing so, they should use one of our forthcoming online wage tax refund petitions.

The first petition form is for nonresident employees who were required to work from home by their employer. It will be streamlined, but like paper filings the petition must include the following:

- A letter from your employer indicating the dates you were required to work outside Philadelphia

- A full copy of your W-2, which includes taxes paid to Philadelphia

Remember, city residents are not eligible to request a refund for wage tax withheld in 2020.

The new forms described above, are not for employees who would like to request a wage tax refund for out-of-city travel, stock options, and/or business expenses. If this is your case, you must continue to use the longer paper forms.

A second online form is for income-based petitions. It can be signed by the employee or a preparer, and must include the following:

- A full copy of a W-2 for each employer (if you have more than one)

- A copy of the PA 40-SP form (Special Tax Forgiveness) filed with the Commonwealth of Pennsylvania

Recent legislative changes mean income-based wage tax refund amounts could be higher this year. The Philadelphia Department of Revenue has done its best to simplify the 2020 income-based paper form.

Taxpayers should note that we will accept digital employer signatures and have created a uniform travel worksheet.

The Philadelphia Department of Revenue understands that many taxpayers are anxious to obtain the new forms, and we thank you for your patience. If you have questions, please email refund.unit@phila.gov.

Joseph Bamat is communications and outreach manager at the Philadelphia Department of Revenue. He can be reached at revenue@phila.gov.

Sign up for weekly professional and technical updates from PICPA's blogs, podcasts, and discussion board topics by completing this form.

Leave a commentOrder by

Newest on top Oldest on top