Subscribe for Weekly Updates

The 2024 CPA Exam Evolution: A Welcomed Change

This blog was provided by UWorld Roger CPA Review, an Ambassador Level sponsor of the Pennsylvania CPA Foundation.

By Jonathan Zigman, CPA

By Jonathan Zigman, CPA

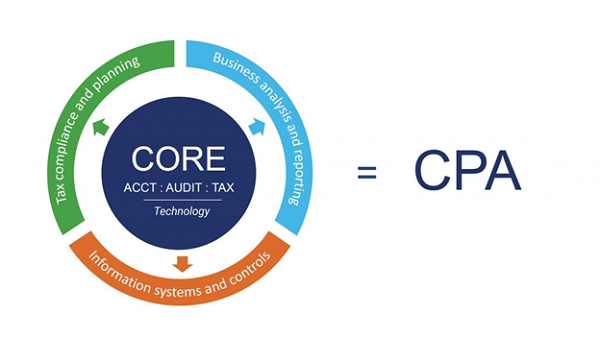

The CPA Exam is evolving to reflect the skills and knowledge CPAs need in a technology-driven marketplace. The new licensure model is being developed by the American Institute of CPAs (AICPA) and the National Association of State Boards of Accountancy (NASBA), and is expected to launch in January 2024. Candidates still will have to demonstrate core skills in accounting, audit, and tax, but technology will have a greater emphasis and be embedded into each of the exams. Candidates also will choose one additional discipline in which to demonstrate more in-depth knowledge. The three discipline exams are Business Analysis and Reporting, Tax Compliance and Planning, and Information Systems and Controls. This is being called the Core Plus Discipline model.

Image courtesy of This Way to CPA

As a CPA who formerly worked at a Big Four firm, I believe these changes to the CPA Exam will be key to connecting candidates to the accounting profession. Today’s newly licensed CPAs perform more advanced tasks and contribute to increasingly complex projects earlier on in their accounting careers. The 2024 CPA Exam will aid in keeping the exam relevant as a measure of the knowledge and skills CPAs need to practice their profession as effectively as possible.

When I was a CPA candidate fresh out of college, studying for the CPA Exam helped prepare me for many of the challenges I would encounter as an emerging accounting professional. The ability to process an influx of new information to make quick, informed decisions, for example, were critical skills needed on the exam and in public accounting. However, studying for the CPA Exam did not prepare me for the types of technology I would encounter once I started at the firm. It took months in my position (along with firm-provided training) to learn the specific technological skills needed for my day-to-day responsibilities.

It is easy to see how the hours spent on job training accumulate to the detriment of firms. For this reason, I believe the CPA Exam’s enhanced focus on technology will be beneficial for the profession.

Benefits of the Core Plus Discipline Curriculum Model

The new Core Plus Discipline model for the 2024 CPA Exam is a step toward bolstering the profession’s confidence that newly licensed CPAs have the skill sets required to be effective on the job. When I worked as a first-year CPA in tax, a large portion of my job revolved around state taxes, including state return preparation, consulting, and research. I had never received previous exposure from school or the CPA Exam to state tax rules. I recall recognizing that I would have greatly benefited from having a foundation in state taxes prior to starting in public accounting.

Under the new model, candidates will be able to specialize in tax by selecting the Tax Compliance and Planning optional discipline. Therefore, studying for the CPA Exam can provide an opportunity for a deeper dive into that specific area of the profession if that is where a candidate believes his or her professional path may lead.

The AICPA continues to survey and solicit feedback from those working in the profession, and the feedback it is receiving seems to be informing new versions of the CPA Exam. As the AICPA receives more feedback, it will likely begin removing exam content that first- and second-year CPAs are not expected to know, replacing it with topics that are more real-world relevant.

Specialization Structure Benefits CPA Candidates

With the incorporation of the upcoming optional disciplines, I believe it will greatly benefit those already focused on specialized areas. For those who want to gain highly sought-after information technology skills, the Information Systems and Controls discipline would likely be a great option. For those interested in working in tax consulting, the Tax Compliance and Planning option will be an obvious choice. The Business Analysis and Reporting discipline will likely be the best choice for candidates who want to keep their options open or are leaning toward a more traditional financial reporting role.

Of course, not everyone knows what they want to specialize directly after college. It can be difficult, for instance, to determine if you will like working in tax compliance until you have actually been exposed to the minutiae of information included on a tax return. Therefore, the new CPA Exam structure will expose candidates early to the different tracks they can pursue as a CPA. That way, if a candidate starts studying tax compliance and realizes that it is not for them, they can refocus the start of their career before they've even accepted a position.

No matter what specialization a candidate chooses, having the CPA credential will continue to give them an advantage in their career. Those who have passed the CPA Exam are generally more equipped versus someone who does not have a CPA. Most employers will choose a CPA with the same skill set as a non-CPA based on the extra layer of assurance that the CPA will be more prepared for the responsibilities needed to be effective on the job.

The Future Is Bright

As I look at the evolution of the CPA Exam, I have high hopes for the incoming generations of CPAs and all that they will be able to accomplish with higher-level skill sets. In my role as a senior content developer for UWorld Roger CPA Review, I am inspired daily by our outstanding students and how they continue to adapt to the ever-changing environment.

Our team at UWorld will continue to find the most creative and concise ways to make very dense information more digestible for candidates. Ultimately, our goal is to ensure our students successfully pass the CPA Exam quickly and the first time, no matter when they plan to take the exam.

Jonathan Zigman, CPA, is a senior content developer at UWorld Roger CPA Review. He has worked at Ernst & Young (EY) and Alvarez & Marsal before joining the UWorld Roger CPA Review team. He can be reached at jzigman@uworld.com.

Sign up for weekly professional and technical updates from PICPA's blogs, podcasts, and discussion board topics by completing this form.

Leave a commentOrder by

Newest on top Oldest on top