Subscribe for Weekly Updates

CPA Evolution: More than a Few CPA Exam Changes

By Rachel Parsia, CPA

When I graduated from college, I never would have imagined that only a few years later the Tax Cuts and Jobs Act would completely redefine the tax code, or that I would encounter cutting-edge technologies like robotic process automation. I quickly learned to accept and embrace frequent and unexpected changes as a normal part of accounting.

All that change eventually winds its way down to the gate of the CPA profession: the CPA Exam. The CPA Exam is designed to test the applicable skills of candidates for the profession. And as the profession changes, the exam will frequently undergo revision. The current movement in revision is the CPA Evolution initiative, a joint effort by the AICPA and National Association of State Boards of Accountancy (NASBA). The advocates for alteration stress that many of the tasks that newly licensed CPAs performed in the past are now completed by offshore teams or automated through sophisticated programs. More than ever, CPAs must possess critical thinking and problem-solving skills, as well as an increased understanding of technology and data analysis. The CPA Evolution Initiative intends to change the CPA licensure model in order to align it with these demands.

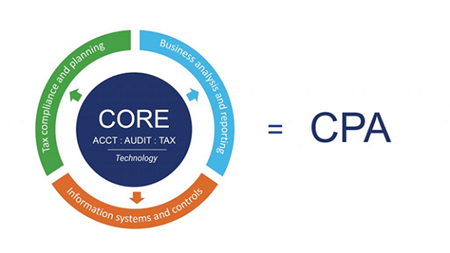

This new model for CPA licensure is expected to take effect in January 2024. As a result, current college sophomores and freshmen will be among the first candidates to take the revised Uniform CPA Examination in 2024. The fundamental shift encompasses a new core-plus-discipline licensure model. This features a “core” section of three parts that all candidates must complete, as well as a “discipline” section that candidates choose as a specialty knowledge area. The core comprises financial accounting, auditing, and tax, with technology and digital acumen integrated across these areas. To assist educators in preparing students for the new testing model, the AICPA and NASBA released the CPA Evolution Model Curriculum, highlighting the topics that each core section will cover. The accounting and data analytics section focuses on topics such as financial statement accounts and analysis, critical thinking, and digital acumen. The audit and accounting information systems section includes topics such as information technology, audit evidence and procedures, audit reports, and materiality. The tax section focuses on topics such as federal tax procedures, entity type, and legal duties and responsibilities.

This new model for CPA licensure is expected to take effect in January 2024. As a result, current college sophomores and freshmen will be among the first candidates to take the revised Uniform CPA Examination in 2024. The fundamental shift encompasses a new core-plus-discipline licensure model. This features a “core” section of three parts that all candidates must complete, as well as a “discipline” section that candidates choose as a specialty knowledge area. The core comprises financial accounting, auditing, and tax, with technology and digital acumen integrated across these areas. To assist educators in preparing students for the new testing model, the AICPA and NASBA released the CPA Evolution Model Curriculum, highlighting the topics that each core section will cover. The accounting and data analytics section focuses on topics such as financial statement accounts and analysis, critical thinking, and digital acumen. The audit and accounting information systems section includes topics such as information technology, audit evidence and procedures, audit reports, and materiality. The tax section focuses on topics such as federal tax procedures, entity type, and legal duties and responsibilities.

For the discipline requirement, candidates may choose from business analysis and reporting (BAR), information systems and controls (ISC), or tax compliance and planning (TCP). Similar to the core sections, the CPA Evolution Model Curriculum discusses the topics covered in discipline sections. BAR focuses on topics such as accounting research, cost accounting, employee benefit plan accounting, and planning techniques. ISC covers topics such as governance and risk assessment, testing internal controls, information security, and data management. TCP concentrates on individual taxation and planning, multijurisdictional tax, tax research, and tax planning for entities.

An AICPA and NASBA survey of students found that about 50% of students would be interested in pursuing the BAR discipline, 25% would pursue the ISC discipline, and the remaining 25% would pursue the TCP discipline. While candidates may select only one discipline section for exam purposes, they are not limited to practicing solely in that selected discipline. All candidates who pass the exam, regardless of which individual discipline they choose, will become licensed CPAs: all paths result in one CPA license.

The CPA Evolution initiative is a significant overhaul from the current exam format, which consists of four sections that all candidates must pass: auditing and attestation, business environment and concepts, financial accounting and reporting, and regulation. While the CPA licensure model will transform over the next few years, the one thing that will not change is the importance and value of the CPA license.

For more on the CPA Evolution, check out “The New & Improved CPA Exam: A Look Inside the CPA Evolution Updates” in the winter 2022 Pennsylvania CPA Journal.

Rachel Parsia, CPA, is director, tax and advisory content, for Surgent Accounting & Financial Education, where she co-authors a variety of tax CPE courses.

Sign up for weekly professional and technical updates from PICPA's blogs, podcasts, and discussion board topics by completing this form.

Leave a commentOrder by

Newest on top Oldest on top