Subscribe for Weekly Updates

CPA Evolution Changes that Will Impact Your CPA Exam Experience

This blog was provided by Surgent CPA Review, a Partner Level sponsor of the Pennsylvania CPA Foundation.

By Jack Castonguay, CPA, PhD

By Jack Castonguay, CPA, PhD

If you are entering your CPA Exam journey and were worried that you would need to pass all four sections of the current CPA Exam before the CPA Evolution goes into effect in January 2024, you can breathe easier. You still will get the same 18-month window to pass all four parts and you will not lose passed sections just because the Evolution is live. Even though the content is changing, previously passed sections will count under the new model. Even BEC, which is going away, will still count as long as you pass it before 2024.

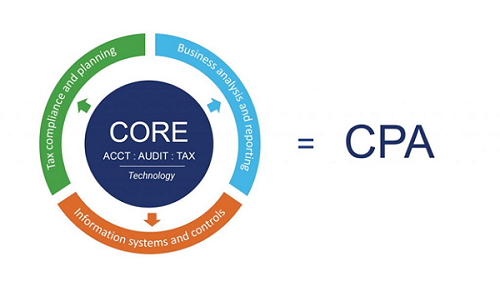

Under the CPA Evolution model, the core of the exam (which everyone must mass) will be auditing and attestation, financial accounting and reporting, and regulation and taxation, which roughly align with the three traditional sections of audit and attestation (AUD), financial accounting reporting (FAR), and regulation (REG). The current business environment and concepts (BEC) section is being eliminated and is being replaced by three discipline options: business analysis and reporting (BAR), information systems and controls (ISC), and tax compliance and planning (TCP). Students will select one, and only one, of the three disciplines to complete their CPA Exam if they didn’t previously pass BEC.

Under the CPA Evolution model, the core of the exam (which everyone must mass) will be auditing and attestation, financial accounting and reporting, and regulation and taxation, which roughly align with the three traditional sections of audit and attestation (AUD), financial accounting reporting (FAR), and regulation (REG). The current business environment and concepts (BEC) section is being eliminated and is being replaced by three discipline options: business analysis and reporting (BAR), information systems and controls (ISC), and tax compliance and planning (TCP). Students will select one, and only one, of the three disciplines to complete their CPA Exam if they didn’t previously pass BEC.

Exam Planning Tips

Try to pass all four parts before January 2024. Yes, the three core sections remain and you will get to choose a discipline exam that appeals to you instead of having to take BEC, but over the past two years the BEC pass rate has exceeded 60%. This is the highest rate of any of the four current parts. Plus, the current accounting program at your school may not be ready to transition fast enough to teach you the materials covered on the new exam before you are ready to take it.

If you can’t pass all four parts and want to prioritize what to pass as 2024 nears, pass BEC first. Again, this section has the highest pass rate of the four sections and will grandfather over.

If you have more time before 2024, consider making AUD the next priority on your pretransition list. Under the CPA Evolution, AUD will be adding more content on controls, more emphasis on service organizations, and more analytical procedures. After AUD, take FAR. The FAR section today resembles what you learned in intermediate and advanced accounting. If you still have time before the transition, take REG last. We recommend this because tax laws change often – taxable thresholds, rates, deductions, and limitations are changed annually. You would need to relearn some of this material even if the CPA Evolution wasn’t happening.

As noted above, the 18-month completion window still applies, so you still need to pass all four parts of the new CPA Exam within 18 months of passing your first section, regardless of whether it occurs before or after the launch of the CPA Evolution.

In addition to the CPA Evolution-related changes, question format, question type, and user experience also will be changing across all sections of the exam. Here are some of the other things changing in 2024.

Essays Are Out

The written communication tasks, commonly referred to as essays, were only tested in BEC. With the elimination of the BEC section as part of the revised exam the written communication tasks also are being eliminated.

While BEC is being eliminated as a stand-alone section, much of the content will continue to be tested in other sections. Economic concepts will move to the AUD core section and cost accounting will appear in BAR. Other BEC content will move into the ISC discipline.

Authoritative Guidance Resources Gone

Currently, when you get a task-based simulation in REG, AUD, or FAR, there is authoritative guidance you can use as a resource to look up how to solve the problem. The exam also contains research-focused simulations where you must determine what section of the code, codification, or other authoritative guidance applies to a given scenario. In 2024, those pure research simulations will be gone, as will the authoritative guidance as a resource. Instead, guidance will only appear in select simulations as an exhibit.

Task-Based Simulations Redesigned

As part of the elimination of authoritative guidance, you will see a new type of task-based simulation during the transition that provides you with sections, paragraphs, or snippets of the authoritative guidance. From there, you will need to determine which parts of the provided evidence, if any, apply to a given simulation. You will not have the entire guidance to search through.

Similar simulations already appear, but the authoritative guidance is provided separately from the exhibits and evidence presented. Now, relevant guidance will be presented along with the exhibits and evidence. You will no longer need to search through pages of text to find the information relevant to your task. This new simulation format is eligible for testing today.

Adaptive Multiple Choice Removed

You may have heard that current multiple-choice testlets adjust to your performance early on when taking the exam. If you are scoring well, you will be shown more difficult questions. If you start off by missing several questions, you will be shown easier options. Most of the time the candidate does not even realize this is occurring. Beginning in 2024, this “adaptive question presentation” will cease; the question testlets will not change based on performance.

Excel Out, JavaScript SpreadJS In

SpreadJS, like Microsoft Excel, is a spreadsheet tool, but it won’t have all the features of Excel. We expect much of the basic formulas and calculation tools will be similar to the tools in Excel.

Key Takeaway

The transition policy is quite simple. Candidates who have credit for AUD, FAR, or REG on the current CPA Exam will not need to take the corresponding core section of the new CPA Exam in 2024. Candidates who have credit for BEC on the current CPA Exam will not have to take one of the three new discipline sections.

If, however, a candidate loses credit for AUD, FAR, or REG after Dec. 31, 2023, then they must take the corresponding new core section. A candidate who loses credit for BEC after Dec. 31, 2023, must select one of the three discipline sections to be tested.

The key to passing the CPA Exam is to be well-prepared for the material and upcoming changes to the exam. With proper planning and the right study plan, you will be well on your way to passing the CPA Exam, whether it happens before or after the CPA Evolution takes place.

Jack Castonguay, CPA, PhD, serves as the vice president of strategic content development for Surgent CPA Review in Radnor, Pa. He can be reached at castonguayj@knowfully.com.

Learn more about becoming a CPA and taking the CPA Exam at PICPA's Become a CPA. Also, don't forget to sign up for weekly professional and technical updates from PICPA's blogs, podcasts, and discussion board topics by completing this form.

Leave a commentOrder by

Newest on top Oldest on top