Subscribe for Weekly Updates

2017 CPA Firm Survey – Talent a Top Issue

By Michael D. Colgan, CEO and executive director

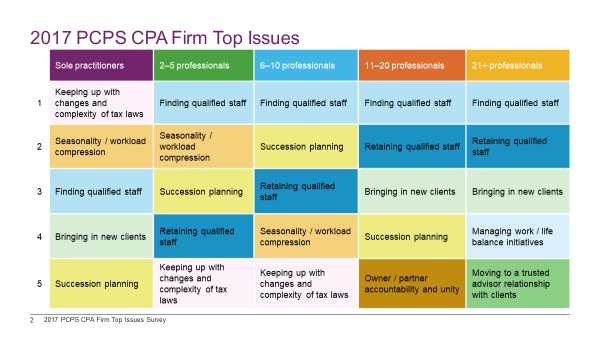

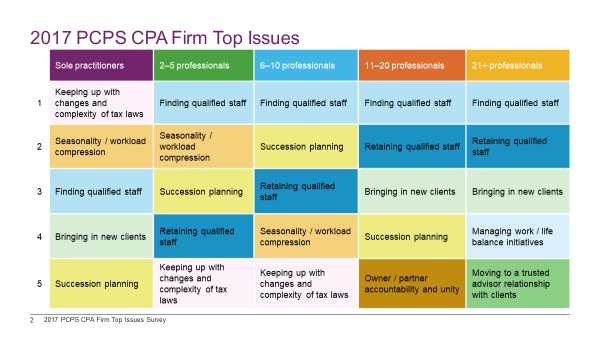

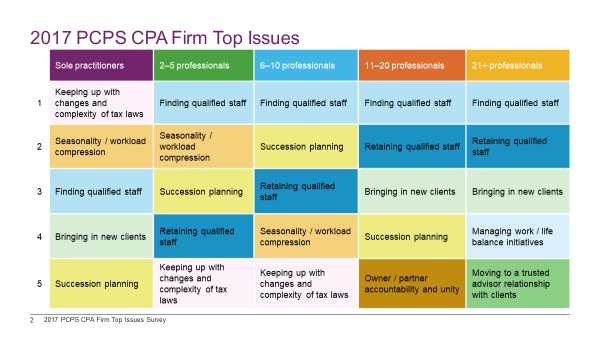

Finding and retaining qualified staff are the top issues facing CPA firms this year, and talent-pool challenges are expected to have a big impact on public accounting practice operations over the next five years, according to research by the American Institute of Certified Public Accountants (AICPA). Every two years AICPA’s Private Companies Practice Section (PCPS) conducts the CPA Firm Top Issues Survey. The results, while segmented by firm size from large firms to sole proprietors, continue to identify talent challenges as a common concern.

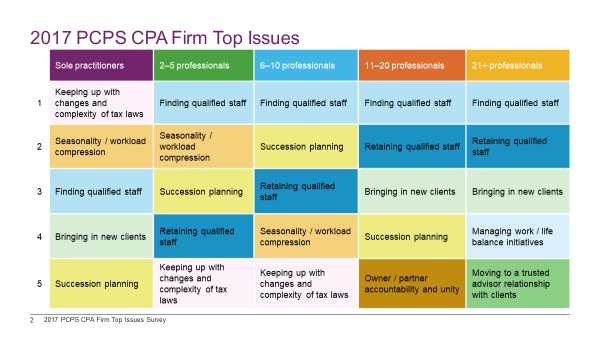

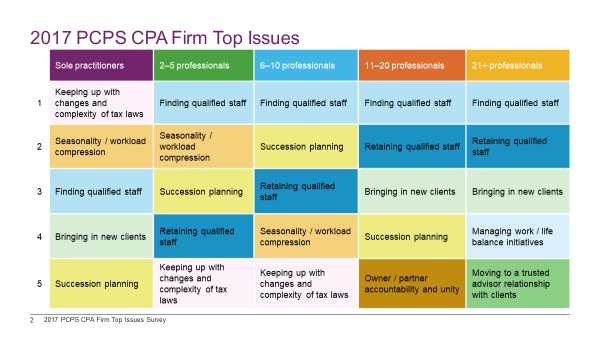

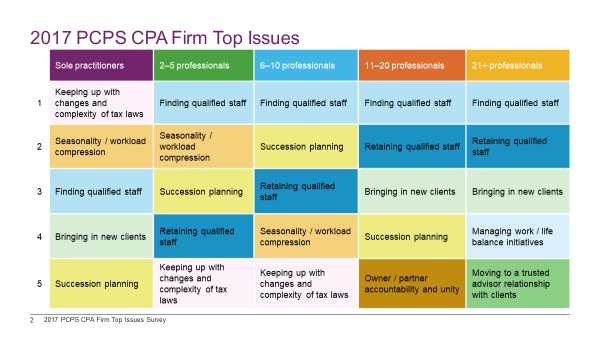

As you can see from the results below, finding qualified staff ranked No. 1 in all firm size categories except sole practitioners, where it ranked No. 3. Retaining qualified staff appeared among the top four issues of all firm sizes except sole practitioners. Other common top five issues include succession planning, acquisition of new clients, workload compression, and keeping up with tax law complexity.

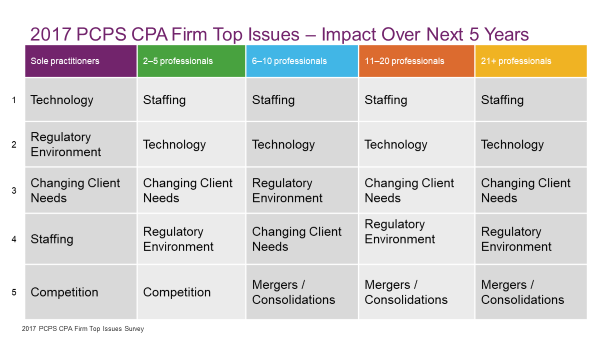

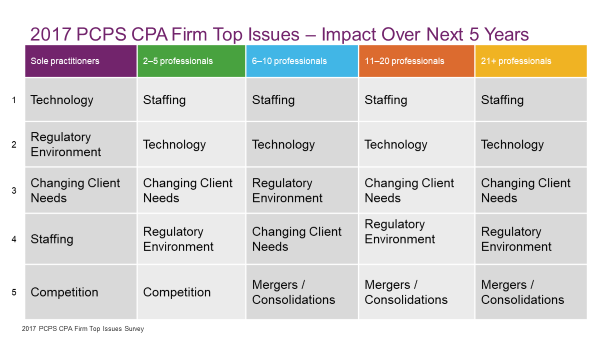

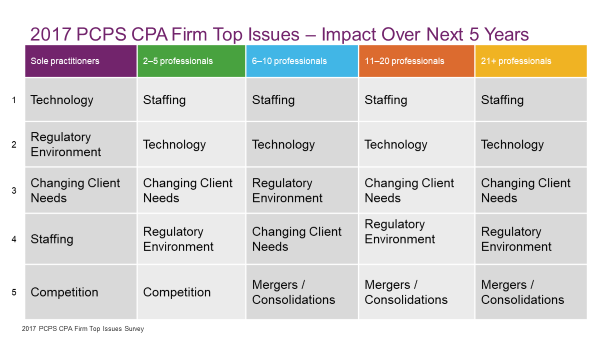

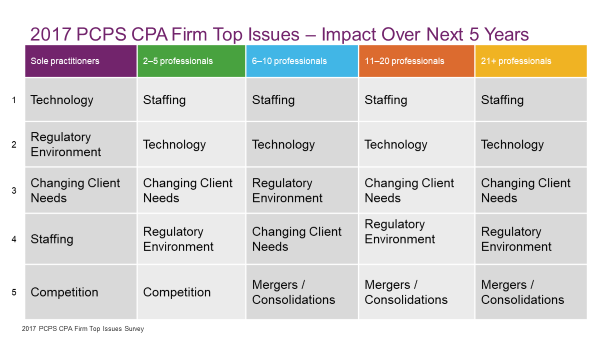

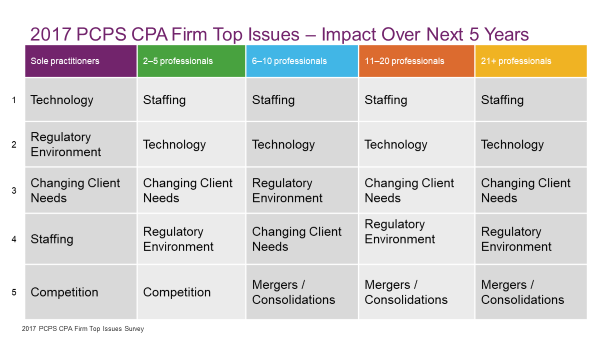

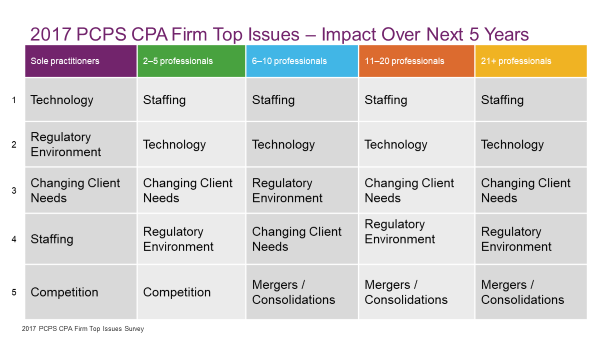

This year the survey also asked respondents to rank the issues that they expected to have the greatest impact on how their practice operates over the next five years. Talent, again, was the top answer for all segments except sole practitioners, while technology was the No. 2 answer. Sole practitioners ranked technology No. 1 and contending with the regulatory environment as No. 2.

The PICPA has many resources and thought leadership to help firms address these practice challenges available to members on our website.

The survey results validate our recent initiative to create the Pennsylvania CPA Foundation several months ago. The Foundation will drive many of the PICPA strategies to help our members adjust and succeed in the changing talent environment over the next several years.

I encourage you to consider supporting the future of the profession in Pennsylvania, as it is both a concern of yours and ours.

Accounting & Auditing

2017 CPA Firm Survey – Talent a Top Issue

By Michael D. Colgan, CEO and executive director

Finding and retaining qualified staff are the top issues facing CPA firms this year, and talent-pool challenges are expected to have a big impact on public accounting practice operations over the next five years, according to research by the American Institute of Certified Public Accountants (AICPA). Every two years AICPA’s Private Companies Practice Section (PCPS) conducts the CPA Firm Top Issues Survey. The results, while segmented by firm size from large firms to sole proprietors, continue to identify talent challenges as a common concern.

As you can see from the results below, finding qualified staff ranked No. 1 in all firm size categories except sole practitioners, where it ranked No. 3. Retaining qualified staff appeared among the top four issues of all firm sizes except sole practitioners. Other common top five issues include succession planning, acquisition of new clients, workload compression, and keeping up with tax law complexity.

This year the survey also asked respondents to rank the issues that they expected to have the greatest impact on how their practice operates over the next five years. Talent, again, was the top answer for all segments except sole practitioners, while technology was the No. 2 answer. Sole practitioners ranked technology No. 1 and contending with the regulatory environment as No. 2.

The PICPA has many resources and thought leadership to help firms address these practice challenges available to members on our website.

The survey results validate our recent initiative to create the Pennsylvania CPA Foundation several months ago. The Foundation will drive many of the PICPA strategies to help our members adjust and succeed in the changing talent environment over the next several years.

I encourage you to consider supporting the future of the profession in Pennsylvania, as it is both a concern of yours and ours.

Ethics

2017 CPA Firm Survey – Talent a Top Issue

By Michael D. Colgan, CEO and executive director

Finding and retaining qualified staff are the top issues facing CPA firms this year, and talent-pool challenges are expected to have a big impact on public accounting practice operations over the next five years, according to research by the American Institute of Certified Public Accountants (AICPA). Every two years AICPA’s Private Companies Practice Section (PCPS) conducts the CPA Firm Top Issues Survey. The results, while segmented by firm size from large firms to sole proprietors, continue to identify talent challenges as a common concern.

As you can see from the results below, finding qualified staff ranked No. 1 in all firm size categories except sole practitioners, where it ranked No. 3. Retaining qualified staff appeared among the top four issues of all firm sizes except sole practitioners. Other common top five issues include succession planning, acquisition of new clients, workload compression, and keeping up with tax law complexity.

This year the survey also asked respondents to rank the issues that they expected to have the greatest impact on how their practice operates over the next five years. Talent, again, was the top answer for all segments except sole practitioners, while technology was the No. 2 answer. Sole practitioners ranked technology No. 1 and contending with the regulatory environment as No. 2.

The PICPA has many resources and thought leadership to help firms address these practice challenges available to members on our website.

The survey results validate our recent initiative to create the Pennsylvania CPA Foundation several months ago. The Foundation will drive many of the PICPA strategies to help our members adjust and succeed in the changing talent environment over the next several years.

I encourage you to consider supporting the future of the profession in Pennsylvania, as it is both a concern of yours and ours.

Leadership

2017 CPA Firm Survey – Talent a Top Issue

By Michael D. Colgan, CEO and executive director

Finding and retaining qualified staff are the top issues facing CPA firms this year, and talent-pool challenges are expected to have a big impact on public accounting practice operations over the next five years, according to research by the American Institute of Certified Public Accountants (AICPA). Every two years AICPA’s Private Companies Practice Section (PCPS) conducts the CPA Firm Top Issues Survey. The results, while segmented by firm size from large firms to sole proprietors, continue to identify talent challenges as a common concern.

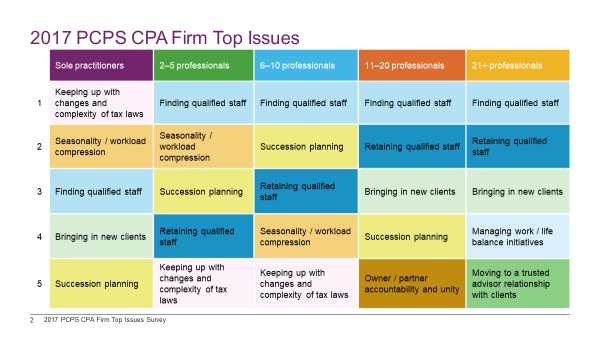

As you can see from the results below, finding qualified staff ranked No. 1 in all firm size categories except sole practitioners, where it ranked No. 3. Retaining qualified staff appeared among the top four issues of all firm sizes except sole practitioners. Other common top five issues include succession planning, acquisition of new clients, workload compression, and keeping up with tax law complexity.

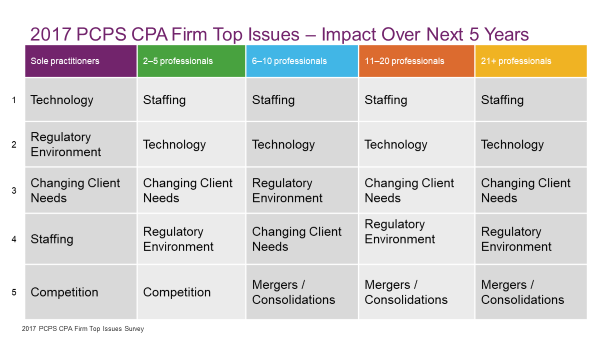

This year the survey also asked respondents to rank the issues that they expected to have the greatest impact on how their practice operates over the next five years. Talent, again, was the top answer for all segments except sole practitioners, while technology was the No. 2 answer. Sole practitioners ranked technology No. 1 and contending with the regulatory environment as No. 2.

The PICPA has many resources and thought leadership to help firms address these practice challenges available to members on our website.

The survey results validate our recent initiative to create the Pennsylvania CPA Foundation several months ago. The Foundation will drive many of the PICPA strategies to help our members adjust and succeed in the changing talent environment over the next several years.

I encourage you to consider supporting the future of the profession in Pennsylvania, as it is both a concern of yours and ours.

Practice Management

2017 CPA Firm Survey – Talent a Top Issue

By Michael D. Colgan, CEO and executive director

Finding and retaining qualified staff are the top issues facing CPA firms this year, and talent-pool challenges are expected to have a big impact on public accounting practice operations over the next five years, according to research by the American Institute of Certified Public Accountants (AICPA). Every two years AICPA’s Private Companies Practice Section (PCPS) conducts the CPA Firm Top Issues Survey. The results, while segmented by firm size from large firms to sole proprietors, continue to identify talent challenges as a common concern.

As you can see from the results below, finding qualified staff ranked No. 1 in all firm size categories except sole practitioners, where it ranked No. 3. Retaining qualified staff appeared among the top four issues of all firm sizes except sole practitioners. Other common top five issues include succession planning, acquisition of new clients, workload compression, and keeping up with tax law complexity.

This year the survey also asked respondents to rank the issues that they expected to have the greatest impact on how their practice operates over the next five years. Talent, again, was the top answer for all segments except sole practitioners, while technology was the No. 2 answer. Sole practitioners ranked technology No. 1 and contending with the regulatory environment as No. 2.

The PICPA has many resources and thought leadership to help firms address these practice challenges available to members on our website.

The survey results validate our recent initiative to create the Pennsylvania CPA Foundation several months ago. The Foundation will drive many of the PICPA strategies to help our members adjust and succeed in the changing talent environment over the next several years.

I encourage you to consider supporting the future of the profession in Pennsylvania, as it is both a concern of yours and ours.

Technology

2017 CPA Firm Survey – Talent a Top Issue

By Michael D. Colgan, CEO and executive director

Finding and retaining qualified staff are the top issues facing CPA firms this year, and talent-pool challenges are expected to have a big impact on public accounting practice operations over the next five years, according to research by the American Institute of Certified Public Accountants (AICPA). Every two years AICPA’s Private Companies Practice Section (PCPS) conducts the CPA Firm Top Issues Survey. The results, while segmented by firm size from large firms to sole proprietors, continue to identify talent challenges as a common concern.

As you can see from the results below, finding qualified staff ranked No. 1 in all firm size categories except sole practitioners, where it ranked No. 3. Retaining qualified staff appeared among the top four issues of all firm sizes except sole practitioners. Other common top five issues include succession planning, acquisition of new clients, workload compression, and keeping up with tax law complexity.

This year the survey also asked respondents to rank the issues that they expected to have the greatest impact on how their practice operates over the next five years. Talent, again, was the top answer for all segments except sole practitioners, while technology was the No. 2 answer. Sole practitioners ranked technology No. 1 and contending with the regulatory environment as No. 2.

The PICPA has many resources and thought leadership to help firms address these practice challenges available to members on our website.

The survey results validate our recent initiative to create the Pennsylvania CPA Foundation several months ago. The Foundation will drive many of the PICPA strategies to help our members adjust and succeed in the changing talent environment over the next several years.

I encourage you to consider supporting the future of the profession in Pennsylvania, as it is both a concern of yours and ours.

Tax

2017 CPA Firm Survey – Talent a Top Issue

By Michael D. Colgan, CEO and executive director

Finding and retaining qualified staff are the top issues facing CPA firms this year, and talent-pool challenges are expected to have a big impact on public accounting practice operations over the next five years, according to research by the American Institute of Certified Public Accountants (AICPA). Every two years AICPA’s Private Companies Practice Section (PCPS) conducts the CPA Firm Top Issues Survey. The results, while segmented by firm size from large firms to sole proprietors, continue to identify talent challenges as a common concern.

As you can see from the results below, finding qualified staff ranked No. 1 in all firm size categories except sole practitioners, where it ranked No. 3. Retaining qualified staff appeared among the top four issues of all firm sizes except sole practitioners. Other common top five issues include succession planning, acquisition of new clients, workload compression, and keeping up with tax law complexity.

This year the survey also asked respondents to rank the issues that they expected to have the greatest impact on how their practice operates over the next five years. Talent, again, was the top answer for all segments except sole practitioners, while technology was the No. 2 answer. Sole practitioners ranked technology No. 1 and contending with the regulatory environment as No. 2.

The PICPA has many resources and thought leadership to help firms address these practice challenges available to members on our website.

The survey results validate our recent initiative to create the Pennsylvania CPA Foundation several months ago. The Foundation will drive many of the PICPA strategies to help our members adjust and succeed in the changing talent environment over the next several years.

I encourage you to consider supporting the future of the profession in Pennsylvania, as it is both a concern of yours and ours.

Leave a commentOrder by

Newest on top Oldest on top