Subscribe for Weekly Updates

Winning New Business, Acquiring Talent: COVID's Impact on Accounting Firms

By Lindsay Ashcraft and Lee W. Frederiksen, PhD

By Lindsay Ashcraft and Lee W. Frederiksen, PhD

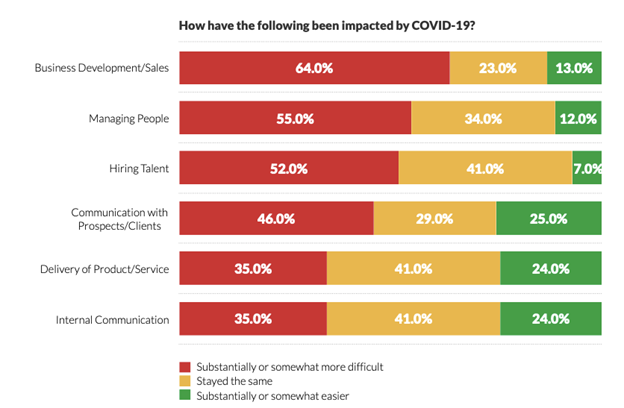

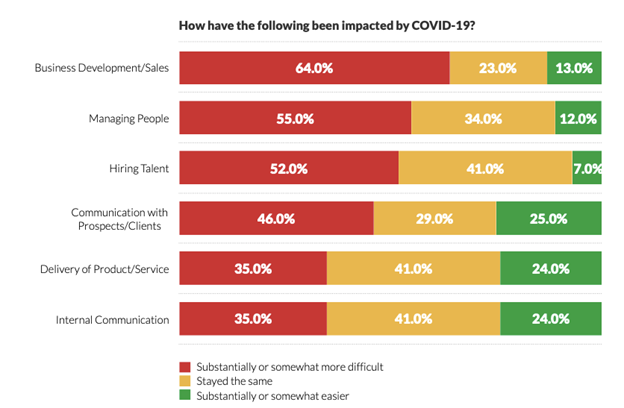

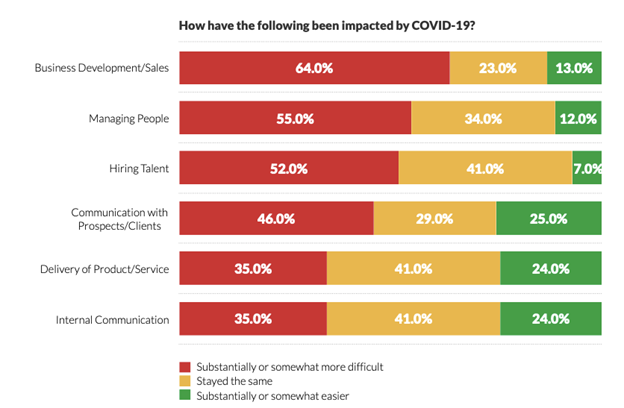

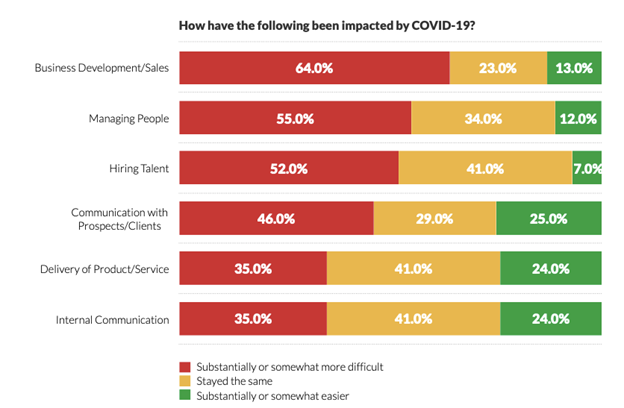

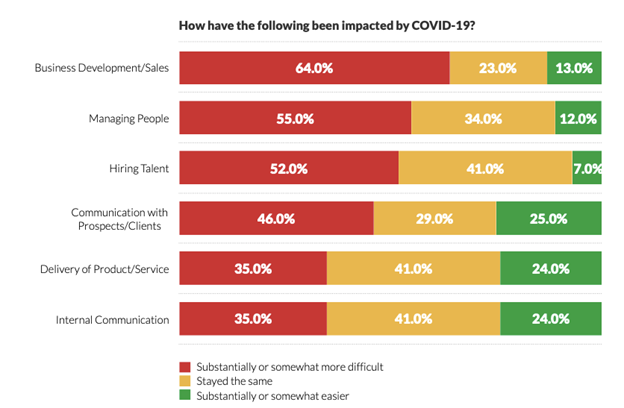

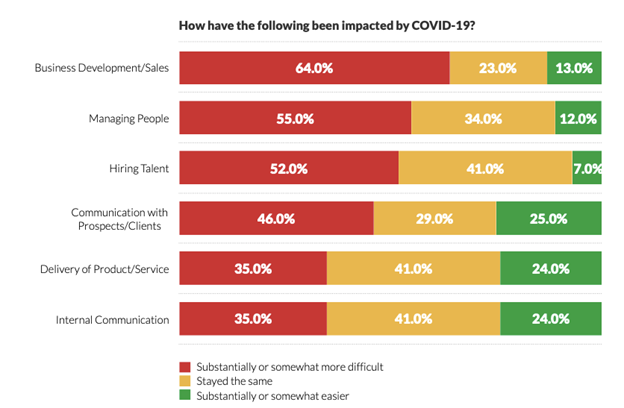

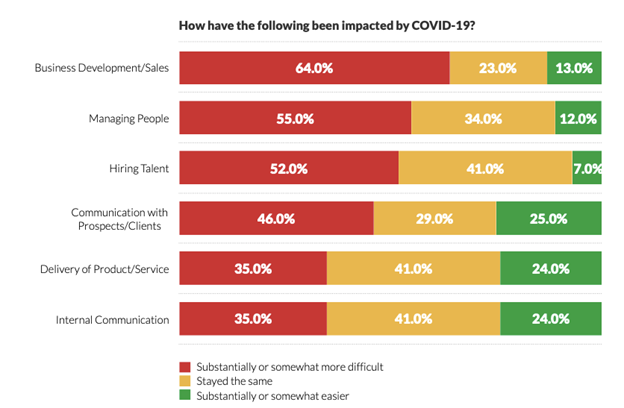

Today, accounting and finance firms face a multipronged challenge: find ways to grow in the coming years and take advantage of the opportunities in this rapidly changing environment. The ripple effects from the COVID-19 pandemic, however, continue to cause uncertainty and delays around growth for these firms. A LexisNexis and Hinge Research Institute study, 2021 Marketing & Business Development Report: Accounting & Financial Services, reveals that 64% of firms found business development and sales difficult due to the pandemic, but these aren't the only areas feeling the impact. Over 50% of firms found hiring and maintaining staff to be challenging. "The Great Resignation" is dramatically shifting the workforce, with, according to the Bureau of Labor Statistics, over 4 million people having quit their jobs in September 2021 alone. These shifts in the labor force, especially among mid-career professionals, are leaving financial services and accounting firms hard hit.

A Tale of Two Firms

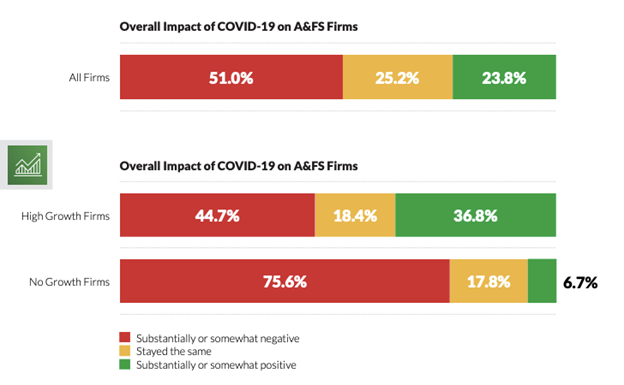

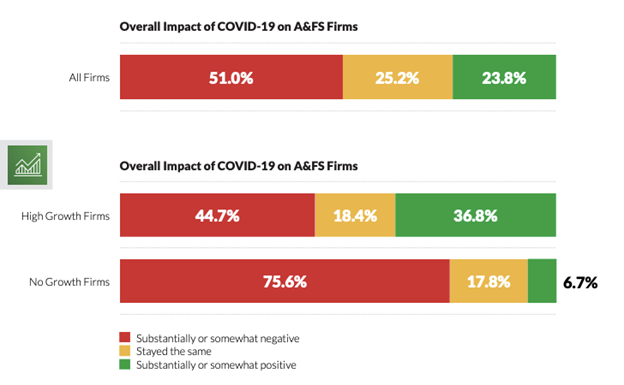

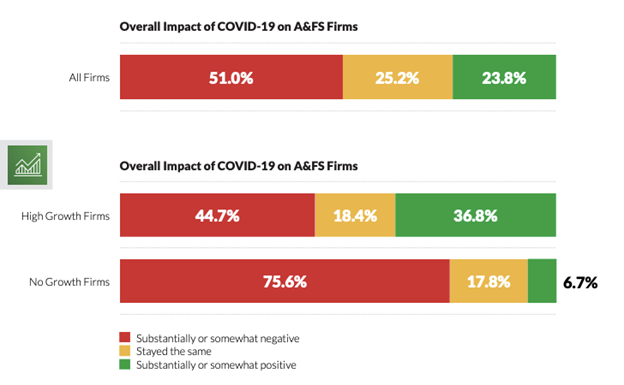

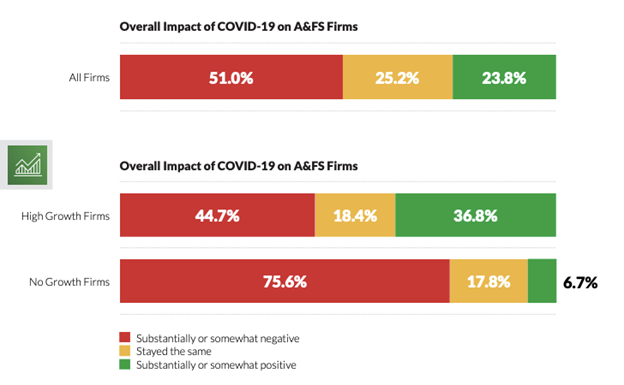

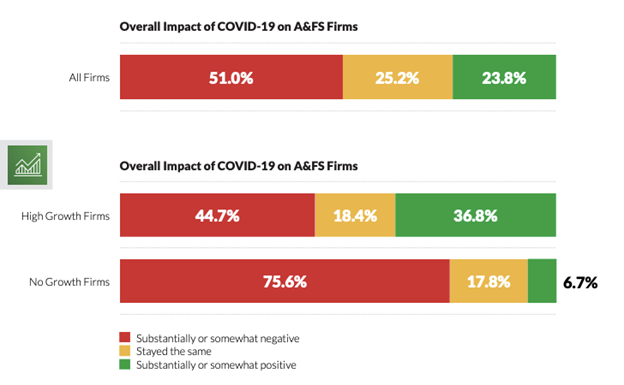

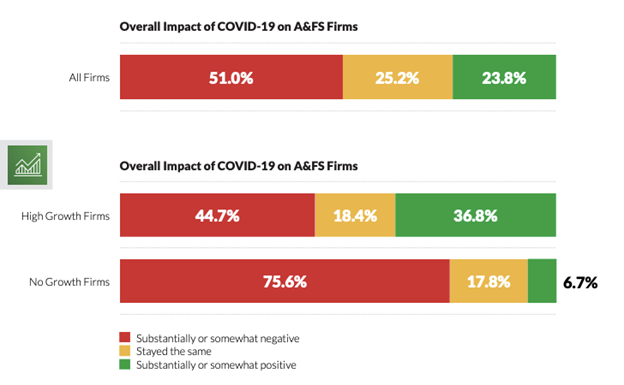

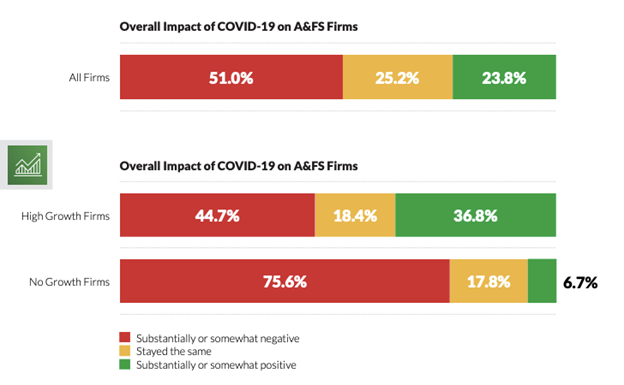

The Marketing & Business Development Report shows that 51% of firms point to COVID-19 as negatively affecting marketing and business development efforts. However, when you look deeper, a different story emerges.

For high growth firms (those seeing at least a 15% annual revenue increase between 2019 and 2020), fewer than half of the respondents claimed the pandemic had a negative impact, and nearly 40% reported a positive effect for business development. However, three-quarters of low-growth firms (those who saw negative growth year-over-year), reported that their business development was hurt by the pandemic. Just under 7% claimed a positive impact. It may not come as a surprise that high-growth firms spent nearly triple the amount of revenue on marketing than other firms during the pandemic.

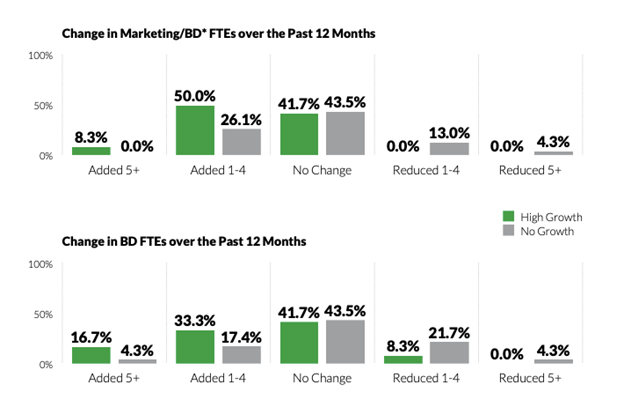

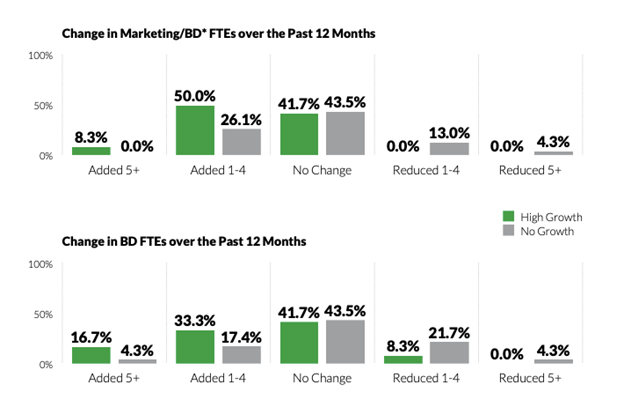

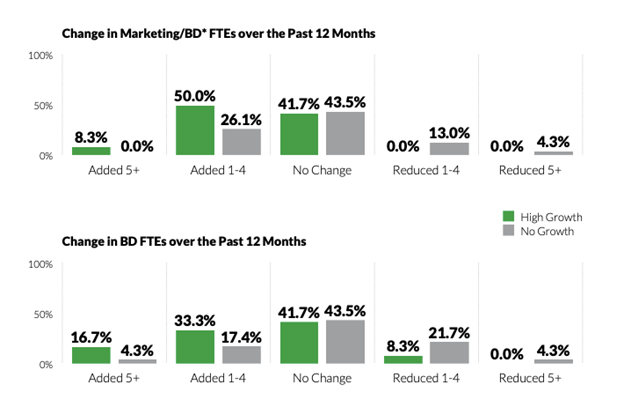

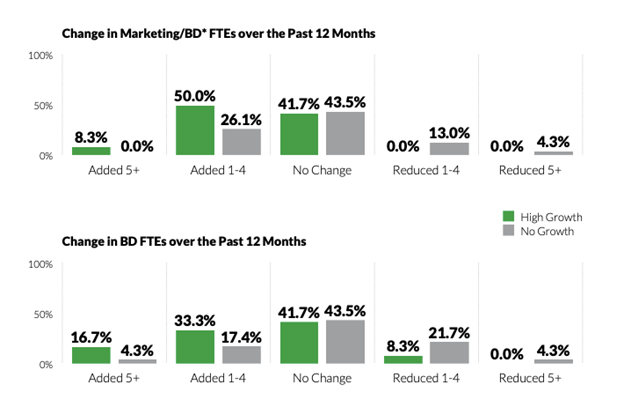

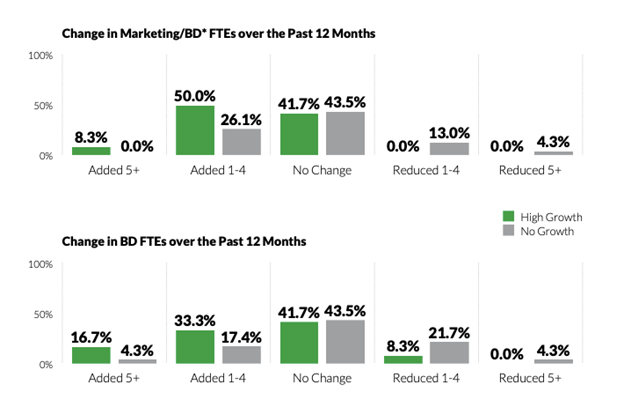

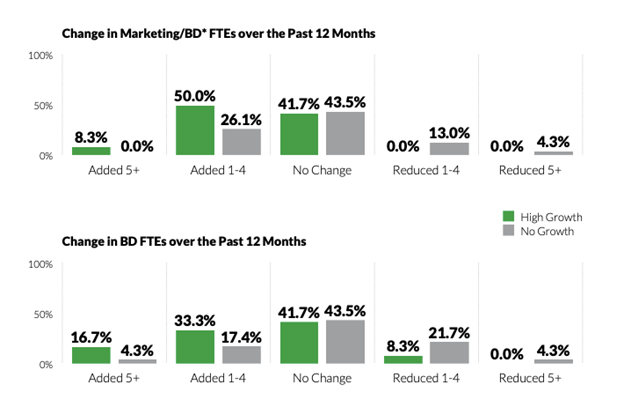

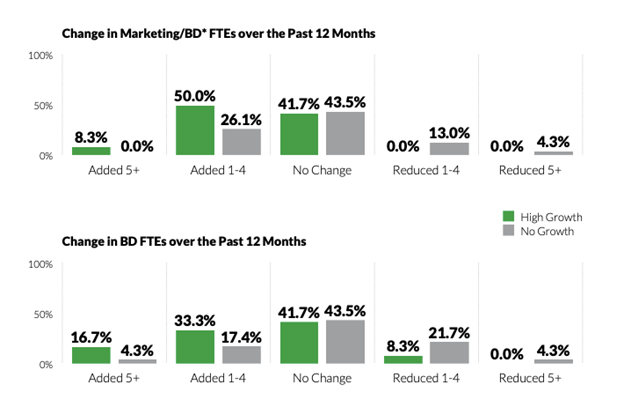

Talent plays a significant role in marketing and business development success, too. For example, when high-growth firms in the Marketing & Business Development Report made changes, it was more often to add talent to their respective marketing and business development departments. Low-growth firms tended to reduce headcounts more significantly than their high-growth counterparts.

Talent plays a significant role in marketing and business development success, too. For example, when high-growth firms in the Marketing & Business Development Report made changes, it was more often to add talent to their respective marketing and business development departments. Low-growth firms tended to reduce headcounts more significantly than their high-growth counterparts.

Understanding the Risks

A digital transformation has been underway at firms for years, but the pandemic accelerated the need to embrace it. Now, firms are leveraging technology to connect with prospects and nurture current clients to sustain long-term growth.

Retaining talent is critical as well. Firms need to take a holistic look at how company culture impacts employees. Dissatisfaction with how former employers handled the pandemic is nearly universal among those who left jobs and are on the hunt in the COVID-19 era.

Marketing and Business Development Risks

Firms today compete on a global stage for business. Financial services and accounting firms must dedicate time and investment to make the most of the opportunities that technologies bring. That means more than simply adding new tools and resources. Time, training, and process development all need to be part of the strategic shift.

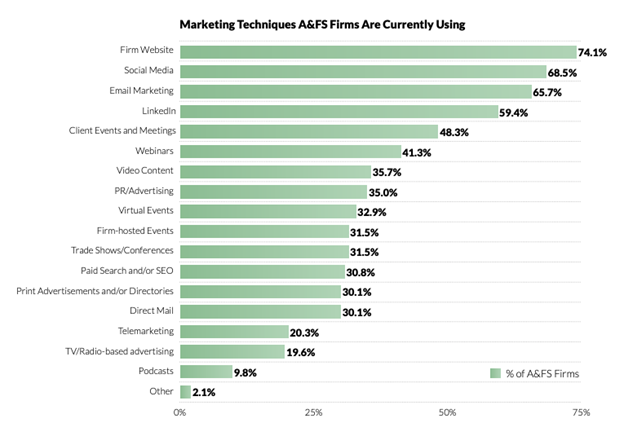

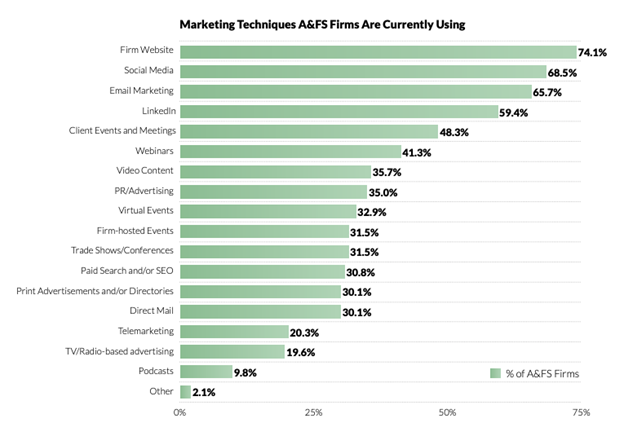

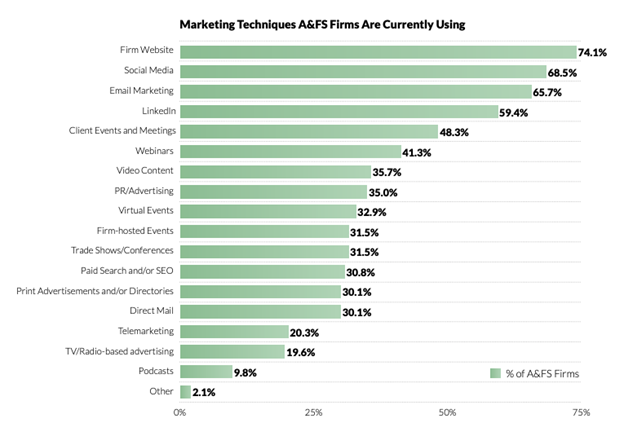

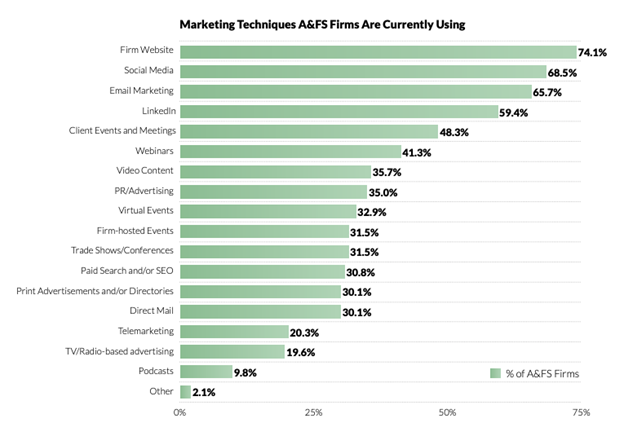

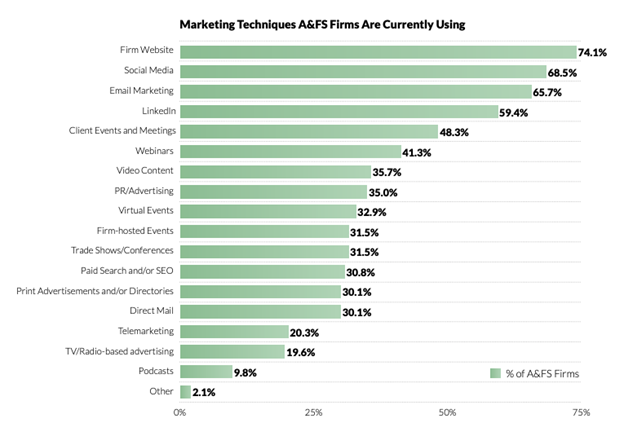

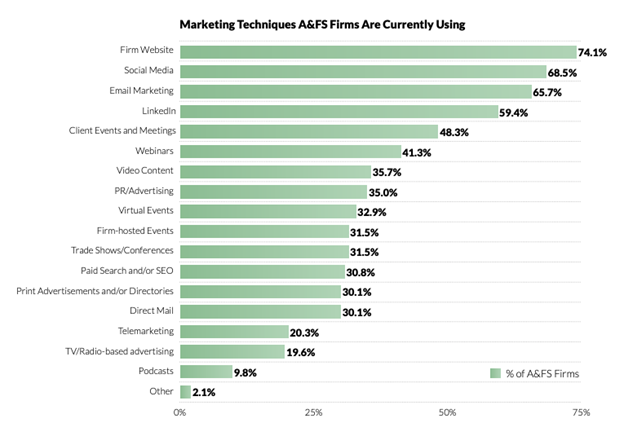

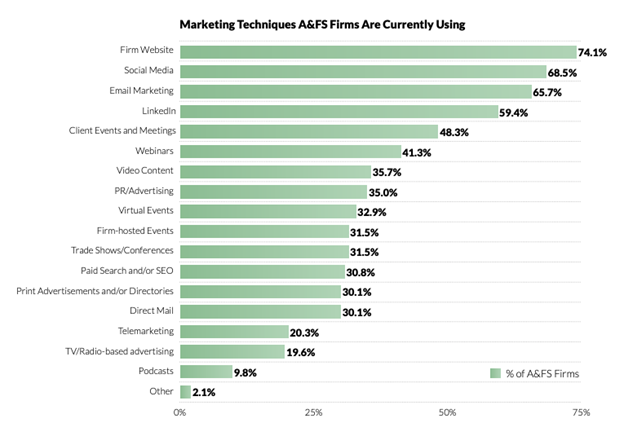

According to the Marketing & Business Development Report, firms understand this shift. More than 75% said strategies to win new business changed significantly last year, while another two-thirds reported business development and sales as more difficult than 2019. Looking at the marketing techniques financial services and accounting firms use, relying on a website, email marketing, and social media are common. Yet, email marketing, which typically generates more brand awareness and leads, is still not used by nearly 35% of firms.

Here is something else to consider: while 83% of firms cite marketing as a vital part of overall brand strategy, only 33% found their efforts highly successful. Many low-growth firms struggle with marketing challenges, including a lack of access to good data, content creation, and generating awareness compared with their high-growth counterparts. A lack of technology may play a role, too.

Talent Risks

Business development and talent go hand in hand. Without the right talent in place, it becomes harder to execute strategic visions and be proactive with opportunities. Over half of firms cited difficulties in managing and hiring new talent over the past year.

Struggling to recruit and develop new talent can hamper the ability to adapt and leverage new technologies, impacting strategic goals and plans. Something accounting and financial services firms also need to face directly is the shortage of CPAs. With a shrinking pool of professionals over the past decade, the pandemic intensified this ongoing shift in the labor market.

To help meet business goals, accounting and financial services firms need a forward-thinking marketing strategy that fully embraces technology and brand identity.

What Firms Can Do Now

Accounting and financial services firms are at a crossroads. Firms should embrace the tools and techniques that faster-growing industries are already using to engage today’s professional services prospects and the talent needed to serve those clients.

Here are some recommendations on the marketing and business development side:

- Firms need to be proactive with data analytics. Data quality was a top challenge in the Marketing & Business Development Report. Analytics from technology, including customer relationship management (CRM) platforms, can help create targeted growth and business strategies.

- Strategic marketing must be a primary focus. Bring marketing to the forefront as a vital part of overall brand strategy, which includes having the budget and talent to compete with high-growth firms.

- Prioritize building automation into current systems. Leveraging automation can help build more efficient processes, reducing redundancy and busywork.

- Email marketing is a primary source of lead generation for financial services and accounting firms. Use it to reach and nurture more prospects while optimizing engagement with current clients to boost sales and retain business.

- Focus on areas to be proactive instead of reactive – data and insights from digital tools can help firms anticipate and respond quickly to evolving needs.

Here are a few recommendations for the talent side:

- Focusing on reputation and company culture is a good start – many job-seekers value culture as high as salary. Highlight key points of firm culture on marketing channels, including social media and the website.

- Survey current employees to determine areas of improvement.

- A Hinge Research Institute employer branding study found reputation to be a top selection criteria for job seekers. Avoiding firms with bad reputations is particularly critical to mid-career professionals, who make up the majority of those moving on in "The Great Resignation."

- Tap into digital marketing and public relations to manage online perception. A quick Google search can highlight what employees and candidates see about the firm online.

- Current employees and alumni can make some of the best advocates through brand promotion and new talent engagement.

Although COVID-19 was a once-in-a-lifetime phenomenon, the pandemic has brought several unusual challenges to the forefront. As a result, accounting and financial services firms can no longer be passive and hope things return to normal. Instead, it’s time to develop a strategy that invests in and embraces talent, marketing, and technology moving forward.

Lindsay Ashcraft is an account executive with LexisNexis InterAction in Raleigh, NC. She has 10-plus years of working in the accounting, legal, and professional services industries, and can be reached at lindsay.ashcraft@lexisnexis.com.

Lee W. Frederiksen, PhD, is managing partner at Hinge, a research-based branding and marketing firm in Reston, VA. He can be reached at lfrederiksen@hingemarketing.com.

Sign up for weekly professional and technical updates from PICPA's blogs, podcasts, and discussion board topics by completing this form.

Accounting & Auditing

Winning New Business, Acquiring Talent: COVID's Impact on Accounting Firms

By Lindsay Ashcraft and Lee W. Frederiksen, PhD

By Lindsay Ashcraft and Lee W. Frederiksen, PhD

Today, accounting and finance firms face a multipronged challenge: find ways to grow in the coming years and take advantage of the opportunities in this rapidly changing environment. The ripple effects from the COVID-19 pandemic, however, continue to cause uncertainty and delays around growth for these firms. A LexisNexis and Hinge Research Institute study, 2021 Marketing & Business Development Report: Accounting & Financial Services, reveals that 64% of firms found business development and sales difficult due to the pandemic, but these aren't the only areas feeling the impact. Over 50% of firms found hiring and maintaining staff to be challenging. "The Great Resignation" is dramatically shifting the workforce, with, according to the Bureau of Labor Statistics, over 4 million people having quit their jobs in September 2021 alone. These shifts in the labor force, especially among mid-career professionals, are leaving financial services and accounting firms hard hit.

A Tale of Two Firms

The Marketing & Business Development Report shows that 51% of firms point to COVID-19 as negatively affecting marketing and business development efforts. However, when you look deeper, a different story emerges.

For high growth firms (those seeing at least a 15% annual revenue increase between 2019 and 2020), fewer than half of the respondents claimed the pandemic had a negative impact, and nearly 40% reported a positive effect for business development. However, three-quarters of low-growth firms (those who saw negative growth year-over-year), reported that their business development was hurt by the pandemic. Just under 7% claimed a positive impact. It may not come as a surprise that high-growth firms spent nearly triple the amount of revenue on marketing than other firms during the pandemic.

Talent plays a significant role in marketing and business development success, too. For example, when high-growth firms in the Marketing & Business Development Report made changes, it was more often to add talent to their respective marketing and business development departments. Low-growth firms tended to reduce headcounts more significantly than their high-growth counterparts.

Talent plays a significant role in marketing and business development success, too. For example, when high-growth firms in the Marketing & Business Development Report made changes, it was more often to add talent to their respective marketing and business development departments. Low-growth firms tended to reduce headcounts more significantly than their high-growth counterparts.

Understanding the Risks

A digital transformation has been underway at firms for years, but the pandemic accelerated the need to embrace it. Now, firms are leveraging technology to connect with prospects and nurture current clients to sustain long-term growth.

Retaining talent is critical as well. Firms need to take a holistic look at how company culture impacts employees. Dissatisfaction with how former employers handled the pandemic is nearly universal among those who left jobs and are on the hunt in the COVID-19 era.

Marketing and Business Development Risks

Firms today compete on a global stage for business. Financial services and accounting firms must dedicate time and investment to make the most of the opportunities that technologies bring. That means more than simply adding new tools and resources. Time, training, and process development all need to be part of the strategic shift.

According to the Marketing & Business Development Report, firms understand this shift. More than 75% said strategies to win new business changed significantly last year, while another two-thirds reported business development and sales as more difficult than 2019. Looking at the marketing techniques financial services and accounting firms use, relying on a website, email marketing, and social media are common. Yet, email marketing, which typically generates more brand awareness and leads, is still not used by nearly 35% of firms.

Here is something else to consider: while 83% of firms cite marketing as a vital part of overall brand strategy, only 33% found their efforts highly successful. Many low-growth firms struggle with marketing challenges, including a lack of access to good data, content creation, and generating awareness compared with their high-growth counterparts. A lack of technology may play a role, too.

Talent Risks

Business development and talent go hand in hand. Without the right talent in place, it becomes harder to execute strategic visions and be proactive with opportunities. Over half of firms cited difficulties in managing and hiring new talent over the past year.

Struggling to recruit and develop new talent can hamper the ability to adapt and leverage new technologies, impacting strategic goals and plans. Something accounting and financial services firms also need to face directly is the shortage of CPAs. With a shrinking pool of professionals over the past decade, the pandemic intensified this ongoing shift in the labor market.

To help meet business goals, accounting and financial services firms need a forward-thinking marketing strategy that fully embraces technology and brand identity.

What Firms Can Do Now

Accounting and financial services firms are at a crossroads. Firms should embrace the tools and techniques that faster-growing industries are already using to engage today’s professional services prospects and the talent needed to serve those clients.

Here are some recommendations on the marketing and business development side:

- Firms need to be proactive with data analytics. Data quality was a top challenge in the Marketing & Business Development Report. Analytics from technology, including customer relationship management (CRM) platforms, can help create targeted growth and business strategies.

- Strategic marketing must be a primary focus. Bring marketing to the forefront as a vital part of overall brand strategy, which includes having the budget and talent to compete with high-growth firms.

- Prioritize building automation into current systems. Leveraging automation can help build more efficient processes, reducing redundancy and busywork.

- Email marketing is a primary source of lead generation for financial services and accounting firms. Use it to reach and nurture more prospects while optimizing engagement with current clients to boost sales and retain business.

- Focus on areas to be proactive instead of reactive – data and insights from digital tools can help firms anticipate and respond quickly to evolving needs.

Here are a few recommendations for the talent side:

- Focusing on reputation and company culture is a good start – many job-seekers value culture as high as salary. Highlight key points of firm culture on marketing channels, including social media and the website.

- Survey current employees to determine areas of improvement.

- A Hinge Research Institute employer branding study found reputation to be a top selection criteria for job seekers. Avoiding firms with bad reputations is particularly critical to mid-career professionals, who make up the majority of those moving on in "The Great Resignation."

- Tap into digital marketing and public relations to manage online perception. A quick Google search can highlight what employees and candidates see about the firm online.

- Current employees and alumni can make some of the best advocates through brand promotion and new talent engagement.

Although COVID-19 was a once-in-a-lifetime phenomenon, the pandemic has brought several unusual challenges to the forefront. As a result, accounting and financial services firms can no longer be passive and hope things return to normal. Instead, it’s time to develop a strategy that invests in and embraces talent, marketing, and technology moving forward.

Lindsay Ashcraft is an account executive with LexisNexis InterAction in Raleigh, NC. She has 10-plus years of working in the accounting, legal, and professional services industries, and can be reached at lindsay.ashcraft@lexisnexis.com.

Lee W. Frederiksen, PhD, is managing partner at Hinge, a research-based branding and marketing firm in Reston, VA. He can be reached at lfrederiksen@hingemarketing.com.

Sign up for weekly professional and technical updates from PICPA's blogs, podcasts, and discussion board topics by completing this form.

Ethics

Winning New Business, Acquiring Talent: COVID's Impact on Accounting Firms

By Lindsay Ashcraft and Lee W. Frederiksen, PhD

By Lindsay Ashcraft and Lee W. Frederiksen, PhD

Today, accounting and finance firms face a multipronged challenge: find ways to grow in the coming years and take advantage of the opportunities in this rapidly changing environment. The ripple effects from the COVID-19 pandemic, however, continue to cause uncertainty and delays around growth for these firms. A LexisNexis and Hinge Research Institute study, 2021 Marketing & Business Development Report: Accounting & Financial Services, reveals that 64% of firms found business development and sales difficult due to the pandemic, but these aren't the only areas feeling the impact. Over 50% of firms found hiring and maintaining staff to be challenging. "The Great Resignation" is dramatically shifting the workforce, with, according to the Bureau of Labor Statistics, over 4 million people having quit their jobs in September 2021 alone. These shifts in the labor force, especially among mid-career professionals, are leaving financial services and accounting firms hard hit.

A Tale of Two Firms

The Marketing & Business Development Report shows that 51% of firms point to COVID-19 as negatively affecting marketing and business development efforts. However, when you look deeper, a different story emerges.

For high growth firms (those seeing at least a 15% annual revenue increase between 2019 and 2020), fewer than half of the respondents claimed the pandemic had a negative impact, and nearly 40% reported a positive effect for business development. However, three-quarters of low-growth firms (those who saw negative growth year-over-year), reported that their business development was hurt by the pandemic. Just under 7% claimed a positive impact. It may not come as a surprise that high-growth firms spent nearly triple the amount of revenue on marketing than other firms during the pandemic.

Talent plays a significant role in marketing and business development success, too. For example, when high-growth firms in the Marketing & Business Development Report made changes, it was more often to add talent to their respective marketing and business development departments. Low-growth firms tended to reduce headcounts more significantly than their high-growth counterparts.

Talent plays a significant role in marketing and business development success, too. For example, when high-growth firms in the Marketing & Business Development Report made changes, it was more often to add talent to their respective marketing and business development departments. Low-growth firms tended to reduce headcounts more significantly than their high-growth counterparts.

Understanding the Risks

A digital transformation has been underway at firms for years, but the pandemic accelerated the need to embrace it. Now, firms are leveraging technology to connect with prospects and nurture current clients to sustain long-term growth.

Retaining talent is critical as well. Firms need to take a holistic look at how company culture impacts employees. Dissatisfaction with how former employers handled the pandemic is nearly universal among those who left jobs and are on the hunt in the COVID-19 era.

Marketing and Business Development Risks

Firms today compete on a global stage for business. Financial services and accounting firms must dedicate time and investment to make the most of the opportunities that technologies bring. That means more than simply adding new tools and resources. Time, training, and process development all need to be part of the strategic shift.

According to the Marketing & Business Development Report, firms understand this shift. More than 75% said strategies to win new business changed significantly last year, while another two-thirds reported business development and sales as more difficult than 2019. Looking at the marketing techniques financial services and accounting firms use, relying on a website, email marketing, and social media are common. Yet, email marketing, which typically generates more brand awareness and leads, is still not used by nearly 35% of firms.

Here is something else to consider: while 83% of firms cite marketing as a vital part of overall brand strategy, only 33% found their efforts highly successful. Many low-growth firms struggle with marketing challenges, including a lack of access to good data, content creation, and generating awareness compared with their high-growth counterparts. A lack of technology may play a role, too.

Talent Risks

Business development and talent go hand in hand. Without the right talent in place, it becomes harder to execute strategic visions and be proactive with opportunities. Over half of firms cited difficulties in managing and hiring new talent over the past year.

Struggling to recruit and develop new talent can hamper the ability to adapt and leverage new technologies, impacting strategic goals and plans. Something accounting and financial services firms also need to face directly is the shortage of CPAs. With a shrinking pool of professionals over the past decade, the pandemic intensified this ongoing shift in the labor market.

To help meet business goals, accounting and financial services firms need a forward-thinking marketing strategy that fully embraces technology and brand identity.

What Firms Can Do Now

Accounting and financial services firms are at a crossroads. Firms should embrace the tools and techniques that faster-growing industries are already using to engage today’s professional services prospects and the talent needed to serve those clients.

Here are some recommendations on the marketing and business development side:

- Firms need to be proactive with data analytics. Data quality was a top challenge in the Marketing & Business Development Report. Analytics from technology, including customer relationship management (CRM) platforms, can help create targeted growth and business strategies.

- Strategic marketing must be a primary focus. Bring marketing to the forefront as a vital part of overall brand strategy, which includes having the budget and talent to compete with high-growth firms.

- Prioritize building automation into current systems. Leveraging automation can help build more efficient processes, reducing redundancy and busywork.

- Email marketing is a primary source of lead generation for financial services and accounting firms. Use it to reach and nurture more prospects while optimizing engagement with current clients to boost sales and retain business.

- Focus on areas to be proactive instead of reactive – data and insights from digital tools can help firms anticipate and respond quickly to evolving needs.

Here are a few recommendations for the talent side:

- Focusing on reputation and company culture is a good start – many job-seekers value culture as high as salary. Highlight key points of firm culture on marketing channels, including social media and the website.

- Survey current employees to determine areas of improvement.

- A Hinge Research Institute employer branding study found reputation to be a top selection criteria for job seekers. Avoiding firms with bad reputations is particularly critical to mid-career professionals, who make up the majority of those moving on in "The Great Resignation."

- Tap into digital marketing and public relations to manage online perception. A quick Google search can highlight what employees and candidates see about the firm online.

- Current employees and alumni can make some of the best advocates through brand promotion and new talent engagement.

Although COVID-19 was a once-in-a-lifetime phenomenon, the pandemic has brought several unusual challenges to the forefront. As a result, accounting and financial services firms can no longer be passive and hope things return to normal. Instead, it’s time to develop a strategy that invests in and embraces talent, marketing, and technology moving forward.

Lindsay Ashcraft is an account executive with LexisNexis InterAction in Raleigh, NC. She has 10-plus years of working in the accounting, legal, and professional services industries, and can be reached at lindsay.ashcraft@lexisnexis.com.

Lee W. Frederiksen, PhD, is managing partner at Hinge, a research-based branding and marketing firm in Reston, VA. He can be reached at lfrederiksen@hingemarketing.com.

Sign up for weekly professional and technical updates from PICPA's blogs, podcasts, and discussion board topics by completing this form.

Leadership

Winning New Business, Acquiring Talent: COVID's Impact on Accounting Firms

By Lindsay Ashcraft and Lee W. Frederiksen, PhD

By Lindsay Ashcraft and Lee W. Frederiksen, PhD

Today, accounting and finance firms face a multipronged challenge: find ways to grow in the coming years and take advantage of the opportunities in this rapidly changing environment. The ripple effects from the COVID-19 pandemic, however, continue to cause uncertainty and delays around growth for these firms. A LexisNexis and Hinge Research Institute study, 2021 Marketing & Business Development Report: Accounting & Financial Services, reveals that 64% of firms found business development and sales difficult due to the pandemic, but these aren't the only areas feeling the impact. Over 50% of firms found hiring and maintaining staff to be challenging. "The Great Resignation" is dramatically shifting the workforce, with, according to the Bureau of Labor Statistics, over 4 million people having quit their jobs in September 2021 alone. These shifts in the labor force, especially among mid-career professionals, are leaving financial services and accounting firms hard hit.

A Tale of Two Firms

The Marketing & Business Development Report shows that 51% of firms point to COVID-19 as negatively affecting marketing and business development efforts. However, when you look deeper, a different story emerges.

For high growth firms (those seeing at least a 15% annual revenue increase between 2019 and 2020), fewer than half of the respondents claimed the pandemic had a negative impact, and nearly 40% reported a positive effect for business development. However, three-quarters of low-growth firms (those who saw negative growth year-over-year), reported that their business development was hurt by the pandemic. Just under 7% claimed a positive impact. It may not come as a surprise that high-growth firms spent nearly triple the amount of revenue on marketing than other firms during the pandemic.

Talent plays a significant role in marketing and business development success, too. For example, when high-growth firms in the Marketing & Business Development Report made changes, it was more often to add talent to their respective marketing and business development departments. Low-growth firms tended to reduce headcounts more significantly than their high-growth counterparts.

Talent plays a significant role in marketing and business development success, too. For example, when high-growth firms in the Marketing & Business Development Report made changes, it was more often to add talent to their respective marketing and business development departments. Low-growth firms tended to reduce headcounts more significantly than their high-growth counterparts.

Understanding the Risks

A digital transformation has been underway at firms for years, but the pandemic accelerated the need to embrace it. Now, firms are leveraging technology to connect with prospects and nurture current clients to sustain long-term growth.

Retaining talent is critical as well. Firms need to take a holistic look at how company culture impacts employees. Dissatisfaction with how former employers handled the pandemic is nearly universal among those who left jobs and are on the hunt in the COVID-19 era.

Marketing and Business Development Risks

Firms today compete on a global stage for business. Financial services and accounting firms must dedicate time and investment to make the most of the opportunities that technologies bring. That means more than simply adding new tools and resources. Time, training, and process development all need to be part of the strategic shift.

According to the Marketing & Business Development Report, firms understand this shift. More than 75% said strategies to win new business changed significantly last year, while another two-thirds reported business development and sales as more difficult than 2019. Looking at the marketing techniques financial services and accounting firms use, relying on a website, email marketing, and social media are common. Yet, email marketing, which typically generates more brand awareness and leads, is still not used by nearly 35% of firms.

Here is something else to consider: while 83% of firms cite marketing as a vital part of overall brand strategy, only 33% found their efforts highly successful. Many low-growth firms struggle with marketing challenges, including a lack of access to good data, content creation, and generating awareness compared with their high-growth counterparts. A lack of technology may play a role, too.

Talent Risks

Business development and talent go hand in hand. Without the right talent in place, it becomes harder to execute strategic visions and be proactive with opportunities. Over half of firms cited difficulties in managing and hiring new talent over the past year.

Struggling to recruit and develop new talent can hamper the ability to adapt and leverage new technologies, impacting strategic goals and plans. Something accounting and financial services firms also need to face directly is the shortage of CPAs. With a shrinking pool of professionals over the past decade, the pandemic intensified this ongoing shift in the labor market.

To help meet business goals, accounting and financial services firms need a forward-thinking marketing strategy that fully embraces technology and brand identity.

What Firms Can Do Now

Accounting and financial services firms are at a crossroads. Firms should embrace the tools and techniques that faster-growing industries are already using to engage today’s professional services prospects and the talent needed to serve those clients.

Here are some recommendations on the marketing and business development side:

- Firms need to be proactive with data analytics. Data quality was a top challenge in the Marketing & Business Development Report. Analytics from technology, including customer relationship management (CRM) platforms, can help create targeted growth and business strategies.

- Strategic marketing must be a primary focus. Bring marketing to the forefront as a vital part of overall brand strategy, which includes having the budget and talent to compete with high-growth firms.

- Prioritize building automation into current systems. Leveraging automation can help build more efficient processes, reducing redundancy and busywork.

- Email marketing is a primary source of lead generation for financial services and accounting firms. Use it to reach and nurture more prospects while optimizing engagement with current clients to boost sales and retain business.

- Focus on areas to be proactive instead of reactive – data and insights from digital tools can help firms anticipate and respond quickly to evolving needs.

Here are a few recommendations for the talent side:

- Focusing on reputation and company culture is a good start – many job-seekers value culture as high as salary. Highlight key points of firm culture on marketing channels, including social media and the website.

- Survey current employees to determine areas of improvement.

- A Hinge Research Institute employer branding study found reputation to be a top selection criteria for job seekers. Avoiding firms with bad reputations is particularly critical to mid-career professionals, who make up the majority of those moving on in "The Great Resignation."

- Tap into digital marketing and public relations to manage online perception. A quick Google search can highlight what employees and candidates see about the firm online.

- Current employees and alumni can make some of the best advocates through brand promotion and new talent engagement.

Although COVID-19 was a once-in-a-lifetime phenomenon, the pandemic has brought several unusual challenges to the forefront. As a result, accounting and financial services firms can no longer be passive and hope things return to normal. Instead, it’s time to develop a strategy that invests in and embraces talent, marketing, and technology moving forward.

Lindsay Ashcraft is an account executive with LexisNexis InterAction in Raleigh, NC. She has 10-plus years of working in the accounting, legal, and professional services industries, and can be reached at lindsay.ashcraft@lexisnexis.com.

Lee W. Frederiksen, PhD, is managing partner at Hinge, a research-based branding and marketing firm in Reston, VA. He can be reached at lfrederiksen@hingemarketing.com.

Sign up for weekly professional and technical updates from PICPA's blogs, podcasts, and discussion board topics by completing this form.

Practice Management

Winning New Business, Acquiring Talent: COVID's Impact on Accounting Firms

By Lindsay Ashcraft and Lee W. Frederiksen, PhD

By Lindsay Ashcraft and Lee W. Frederiksen, PhD

Today, accounting and finance firms face a multipronged challenge: find ways to grow in the coming years and take advantage of the opportunities in this rapidly changing environment. The ripple effects from the COVID-19 pandemic, however, continue to cause uncertainty and delays around growth for these firms. A LexisNexis and Hinge Research Institute study, 2021 Marketing & Business Development Report: Accounting & Financial Services, reveals that 64% of firms found business development and sales difficult due to the pandemic, but these aren't the only areas feeling the impact. Over 50% of firms found hiring and maintaining staff to be challenging. "The Great Resignation" is dramatically shifting the workforce, with, according to the Bureau of Labor Statistics, over 4 million people having quit their jobs in September 2021 alone. These shifts in the labor force, especially among mid-career professionals, are leaving financial services and accounting firms hard hit.

A Tale of Two Firms

The Marketing & Business Development Report shows that 51% of firms point to COVID-19 as negatively affecting marketing and business development efforts. However, when you look deeper, a different story emerges.

For high growth firms (those seeing at least a 15% annual revenue increase between 2019 and 2020), fewer than half of the respondents claimed the pandemic had a negative impact, and nearly 40% reported a positive effect for business development. However, three-quarters of low-growth firms (those who saw negative growth year-over-year), reported that their business development was hurt by the pandemic. Just under 7% claimed a positive impact. It may not come as a surprise that high-growth firms spent nearly triple the amount of revenue on marketing than other firms during the pandemic.

Talent plays a significant role in marketing and business development success, too. For example, when high-growth firms in the Marketing & Business Development Report made changes, it was more often to add talent to their respective marketing and business development departments. Low-growth firms tended to reduce headcounts more significantly than their high-growth counterparts.

Talent plays a significant role in marketing and business development success, too. For example, when high-growth firms in the Marketing & Business Development Report made changes, it was more often to add talent to their respective marketing and business development departments. Low-growth firms tended to reduce headcounts more significantly than their high-growth counterparts.

Understanding the Risks

A digital transformation has been underway at firms for years, but the pandemic accelerated the need to embrace it. Now, firms are leveraging technology to connect with prospects and nurture current clients to sustain long-term growth.

Retaining talent is critical as well. Firms need to take a holistic look at how company culture impacts employees. Dissatisfaction with how former employers handled the pandemic is nearly universal among those who left jobs and are on the hunt in the COVID-19 era.

Marketing and Business Development Risks

Firms today compete on a global stage for business. Financial services and accounting firms must dedicate time and investment to make the most of the opportunities that technologies bring. That means more than simply adding new tools and resources. Time, training, and process development all need to be part of the strategic shift.

According to the Marketing & Business Development Report, firms understand this shift. More than 75% said strategies to win new business changed significantly last year, while another two-thirds reported business development and sales as more difficult than 2019. Looking at the marketing techniques financial services and accounting firms use, relying on a website, email marketing, and social media are common. Yet, email marketing, which typically generates more brand awareness and leads, is still not used by nearly 35% of firms.

Here is something else to consider: while 83% of firms cite marketing as a vital part of overall brand strategy, only 33% found their efforts highly successful. Many low-growth firms struggle with marketing challenges, including a lack of access to good data, content creation, and generating awareness compared with their high-growth counterparts. A lack of technology may play a role, too.

Talent Risks

Business development and talent go hand in hand. Without the right talent in place, it becomes harder to execute strategic visions and be proactive with opportunities. Over half of firms cited difficulties in managing and hiring new talent over the past year.

Struggling to recruit and develop new talent can hamper the ability to adapt and leverage new technologies, impacting strategic goals and plans. Something accounting and financial services firms also need to face directly is the shortage of CPAs. With a shrinking pool of professionals over the past decade, the pandemic intensified this ongoing shift in the labor market.

To help meet business goals, accounting and financial services firms need a forward-thinking marketing strategy that fully embraces technology and brand identity.

What Firms Can Do Now

Accounting and financial services firms are at a crossroads. Firms should embrace the tools and techniques that faster-growing industries are already using to engage today’s professional services prospects and the talent needed to serve those clients.

Here are some recommendations on the marketing and business development side:

- Firms need to be proactive with data analytics. Data quality was a top challenge in the Marketing & Business Development Report. Analytics from technology, including customer relationship management (CRM) platforms, can help create targeted growth and business strategies.

- Strategic marketing must be a primary focus. Bring marketing to the forefront as a vital part of overall brand strategy, which includes having the budget and talent to compete with high-growth firms.

- Prioritize building automation into current systems. Leveraging automation can help build more efficient processes, reducing redundancy and busywork.

- Email marketing is a primary source of lead generation for financial services and accounting firms. Use it to reach and nurture more prospects while optimizing engagement with current clients to boost sales and retain business.

- Focus on areas to be proactive instead of reactive – data and insights from digital tools can help firms anticipate and respond quickly to evolving needs.

Here are a few recommendations for the talent side:

- Focusing on reputation and company culture is a good start – many job-seekers value culture as high as salary. Highlight key points of firm culture on marketing channels, including social media and the website.

- Survey current employees to determine areas of improvement.

- A Hinge Research Institute employer branding study found reputation to be a top selection criteria for job seekers. Avoiding firms with bad reputations is particularly critical to mid-career professionals, who make up the majority of those moving on in "The Great Resignation."

- Tap into digital marketing and public relations to manage online perception. A quick Google search can highlight what employees and candidates see about the firm online.

- Current employees and alumni can make some of the best advocates through brand promotion and new talent engagement.

Although COVID-19 was a once-in-a-lifetime phenomenon, the pandemic has brought several unusual challenges to the forefront. As a result, accounting and financial services firms can no longer be passive and hope things return to normal. Instead, it’s time to develop a strategy that invests in and embraces talent, marketing, and technology moving forward.

Lindsay Ashcraft is an account executive with LexisNexis InterAction in Raleigh, NC. She has 10-plus years of working in the accounting, legal, and professional services industries, and can be reached at lindsay.ashcraft@lexisnexis.com.

Lee W. Frederiksen, PhD, is managing partner at Hinge, a research-based branding and marketing firm in Reston, VA. He can be reached at lfrederiksen@hingemarketing.com.

Sign up for weekly professional and technical updates from PICPA's blogs, podcasts, and discussion board topics by completing this form.

Technology

Winning New Business, Acquiring Talent: COVID's Impact on Accounting Firms

By Lindsay Ashcraft and Lee W. Frederiksen, PhD

By Lindsay Ashcraft and Lee W. Frederiksen, PhD

Today, accounting and finance firms face a multipronged challenge: find ways to grow in the coming years and take advantage of the opportunities in this rapidly changing environment. The ripple effects from the COVID-19 pandemic, however, continue to cause uncertainty and delays around growth for these firms. A LexisNexis and Hinge Research Institute study, 2021 Marketing & Business Development Report: Accounting & Financial Services, reveals that 64% of firms found business development and sales difficult due to the pandemic, but these aren't the only areas feeling the impact. Over 50% of firms found hiring and maintaining staff to be challenging. "The Great Resignation" is dramatically shifting the workforce, with, according to the Bureau of Labor Statistics, over 4 million people having quit their jobs in September 2021 alone. These shifts in the labor force, especially among mid-career professionals, are leaving financial services and accounting firms hard hit.

A Tale of Two Firms

The Marketing & Business Development Report shows that 51% of firms point to COVID-19 as negatively affecting marketing and business development efforts. However, when you look deeper, a different story emerges.

For high growth firms (those seeing at least a 15% annual revenue increase between 2019 and 2020), fewer than half of the respondents claimed the pandemic had a negative impact, and nearly 40% reported a positive effect for business development. However, three-quarters of low-growth firms (those who saw negative growth year-over-year), reported that their business development was hurt by the pandemic. Just under 7% claimed a positive impact. It may not come as a surprise that high-growth firms spent nearly triple the amount of revenue on marketing than other firms during the pandemic.

Talent plays a significant role in marketing and business development success, too. For example, when high-growth firms in the Marketing & Business Development Report made changes, it was more often to add talent to their respective marketing and business development departments. Low-growth firms tended to reduce headcounts more significantly than their high-growth counterparts.

Talent plays a significant role in marketing and business development success, too. For example, when high-growth firms in the Marketing & Business Development Report made changes, it was more often to add talent to their respective marketing and business development departments. Low-growth firms tended to reduce headcounts more significantly than their high-growth counterparts.

Understanding the Risks

A digital transformation has been underway at firms for years, but the pandemic accelerated the need to embrace it. Now, firms are leveraging technology to connect with prospects and nurture current clients to sustain long-term growth.

Retaining talent is critical as well. Firms need to take a holistic look at how company culture impacts employees. Dissatisfaction with how former employers handled the pandemic is nearly universal among those who left jobs and are on the hunt in the COVID-19 era.

Marketing and Business Development Risks

Firms today compete on a global stage for business. Financial services and accounting firms must dedicate time and investment to make the most of the opportunities that technologies bring. That means more than simply adding new tools and resources. Time, training, and process development all need to be part of the strategic shift.

According to the Marketing & Business Development Report, firms understand this shift. More than 75% said strategies to win new business changed significantly last year, while another two-thirds reported business development and sales as more difficult than 2019. Looking at the marketing techniques financial services and accounting firms use, relying on a website, email marketing, and social media are common. Yet, email marketing, which typically generates more brand awareness and leads, is still not used by nearly 35% of firms.

Here is something else to consider: while 83% of firms cite marketing as a vital part of overall brand strategy, only 33% found their efforts highly successful. Many low-growth firms struggle with marketing challenges, including a lack of access to good data, content creation, and generating awareness compared with their high-growth counterparts. A lack of technology may play a role, too.

Talent Risks

Business development and talent go hand in hand. Without the right talent in place, it becomes harder to execute strategic visions and be proactive with opportunities. Over half of firms cited difficulties in managing and hiring new talent over the past year.

Struggling to recruit and develop new talent can hamper the ability to adapt and leverage new technologies, impacting strategic goals and plans. Something accounting and financial services firms also need to face directly is the shortage of CPAs. With a shrinking pool of professionals over the past decade, the pandemic intensified this ongoing shift in the labor market.

To help meet business goals, accounting and financial services firms need a forward-thinking marketing strategy that fully embraces technology and brand identity.

What Firms Can Do Now

Accounting and financial services firms are at a crossroads. Firms should embrace the tools and techniques that faster-growing industries are already using to engage today’s professional services prospects and the talent needed to serve those clients.

Here are some recommendations on the marketing and business development side:

- Firms need to be proactive with data analytics. Data quality was a top challenge in the Marketing & Business Development Report. Analytics from technology, including customer relationship management (CRM) platforms, can help create targeted growth and business strategies.

- Strategic marketing must be a primary focus. Bring marketing to the forefront as a vital part of overall brand strategy, which includes having the budget and talent to compete with high-growth firms.

- Prioritize building automation into current systems. Leveraging automation can help build more efficient processes, reducing redundancy and busywork.

- Email marketing is a primary source of lead generation for financial services and accounting firms. Use it to reach and nurture more prospects while optimizing engagement with current clients to boost sales and retain business.

- Focus on areas to be proactive instead of reactive – data and insights from digital tools can help firms anticipate and respond quickly to evolving needs.

Here are a few recommendations for the talent side:

- Focusing on reputation and company culture is a good start – many job-seekers value culture as high as salary. Highlight key points of firm culture on marketing channels, including social media and the website.

- Survey current employees to determine areas of improvement.

- A Hinge Research Institute employer branding study found reputation to be a top selection criteria for job seekers. Avoiding firms with bad reputations is particularly critical to mid-career professionals, who make up the majority of those moving on in "The Great Resignation."

- Tap into digital marketing and public relations to manage online perception. A quick Google search can highlight what employees and candidates see about the firm online.

- Current employees and alumni can make some of the best advocates through brand promotion and new talent engagement.

Although COVID-19 was a once-in-a-lifetime phenomenon, the pandemic has brought several unusual challenges to the forefront. As a result, accounting and financial services firms can no longer be passive and hope things return to normal. Instead, it’s time to develop a strategy that invests in and embraces talent, marketing, and technology moving forward.

Lindsay Ashcraft is an account executive with LexisNexis InterAction in Raleigh, NC. She has 10-plus years of working in the accounting, legal, and professional services industries, and can be reached at lindsay.ashcraft@lexisnexis.com.

Lee W. Frederiksen, PhD, is managing partner at Hinge, a research-based branding and marketing firm in Reston, VA. He can be reached at lfrederiksen@hingemarketing.com.

Sign up for weekly professional and technical updates from PICPA's blogs, podcasts, and discussion board topics by completing this form.

Tax

Winning New Business, Acquiring Talent: COVID's Impact on Accounting Firms

By Lindsay Ashcraft and Lee W. Frederiksen, PhD

By Lindsay Ashcraft and Lee W. Frederiksen, PhD

Today, accounting and finance firms face a multipronged challenge: find ways to grow in the coming years and take advantage of the opportunities in this rapidly changing environment. The ripple effects from the COVID-19 pandemic, however, continue to cause uncertainty and delays around growth for these firms. A LexisNexis and Hinge Research Institute study, 2021 Marketing & Business Development Report: Accounting & Financial Services, reveals that 64% of firms found business development and sales difficult due to the pandemic, but these aren't the only areas feeling the impact. Over 50% of firms found hiring and maintaining staff to be challenging. "The Great Resignation" is dramatically shifting the workforce, with, according to the Bureau of Labor Statistics, over 4 million people having quit their jobs in September 2021 alone. These shifts in the labor force, especially among mid-career professionals, are leaving financial services and accounting firms hard hit.

A Tale of Two Firms

The Marketing & Business Development Report shows that 51% of firms point to COVID-19 as negatively affecting marketing and business development efforts. However, when you look deeper, a different story emerges.

For high growth firms (those seeing at least a 15% annual revenue increase between 2019 and 2020), fewer than half of the respondents claimed the pandemic had a negative impact, and nearly 40% reported a positive effect for business development. However, three-quarters of low-growth firms (those who saw negative growth year-over-year), reported that their business development was hurt by the pandemic. Just under 7% claimed a positive impact. It may not come as a surprise that high-growth firms spent nearly triple the amount of revenue on marketing than other firms during the pandemic.

Talent plays a significant role in marketing and business development success, too. For example, when high-growth firms in the Marketing & Business Development Report made changes, it was more often to add talent to their respective marketing and business development departments. Low-growth firms tended to reduce headcounts more significantly than their high-growth counterparts.

Talent plays a significant role in marketing and business development success, too. For example, when high-growth firms in the Marketing & Business Development Report made changes, it was more often to add talent to their respective marketing and business development departments. Low-growth firms tended to reduce headcounts more significantly than their high-growth counterparts.

Understanding the Risks

A digital transformation has been underway at firms for years, but the pandemic accelerated the need to embrace it. Now, firms are leveraging technology to connect with prospects and nurture current clients to sustain long-term growth.

Retaining talent is critical as well. Firms need to take a holistic look at how company culture impacts employees. Dissatisfaction with how former employers handled the pandemic is nearly universal among those who left jobs and are on the hunt in the COVID-19 era.

Marketing and Business Development Risks

Firms today compete on a global stage for business. Financial services and accounting firms must dedicate time and investment to make the most of the opportunities that technologies bring. That means more than simply adding new tools and resources. Time, training, and process development all need to be part of the strategic shift.

According to the Marketing & Business Development Report, firms understand this shift. More than 75% said strategies to win new business changed significantly last year, while another two-thirds reported business development and sales as more difficult than 2019. Looking at the marketing techniques financial services and accounting firms use, relying on a website, email marketing, and social media are common. Yet, email marketing, which typically generates more brand awareness and leads, is still not used by nearly 35% of firms.

Here is something else to consider: while 83% of firms cite marketing as a vital part of overall brand strategy, only 33% found their efforts highly successful. Many low-growth firms struggle with marketing challenges, including a lack of access to good data, content creation, and generating awareness compared with their high-growth counterparts. A lack of technology may play a role, too.

Talent Risks

Business development and talent go hand in hand. Without the right talent in place, it becomes harder to execute strategic visions and be proactive with opportunities. Over half of firms cited difficulties in managing and hiring new talent over the past year.

Struggling to recruit and develop new talent can hamper the ability to adapt and leverage new technologies, impacting strategic goals and plans. Something accounting and financial services firms also need to face directly is the shortage of CPAs. With a shrinking pool of professionals over the past decade, the pandemic intensified this ongoing shift in the labor market.

To help meet business goals, accounting and financial services firms need a forward-thinking marketing strategy that fully embraces technology and brand identity.

What Firms Can Do Now

Accounting and financial services firms are at a crossroads. Firms should embrace the tools and techniques that faster-growing industries are already using to engage today’s professional services prospects and the talent needed to serve those clients.

Here are some recommendations on the marketing and business development side:

- Firms need to be proactive with data analytics. Data quality was a top challenge in the Marketing & Business Development Report. Analytics from technology, including customer relationship management (CRM) platforms, can help create targeted growth and business strategies.

- Strategic marketing must be a primary focus. Bring marketing to the forefront as a vital part of overall brand strategy, which includes having the budget and talent to compete with high-growth firms.

- Prioritize building automation into current systems. Leveraging automation can help build more efficient processes, reducing redundancy and busywork.

- Email marketing is a primary source of lead generation for financial services and accounting firms. Use it to reach and nurture more prospects while optimizing engagement with current clients to boost sales and retain business.

- Focus on areas to be proactive instead of reactive – data and insights from digital tools can help firms anticipate and respond quickly to evolving needs.

Here are a few recommendations for the talent side:

- Focusing on reputation and company culture is a good start – many job-seekers value culture as high as salary. Highlight key points of firm culture on marketing channels, including social media and the website.

- Survey current employees to determine areas of improvement.

- A Hinge Research Institute employer branding study found reputation to be a top selection criteria for job seekers. Avoiding firms with bad reputations is particularly critical to mid-career professionals, who make up the majority of those moving on in "The Great Resignation."

- Tap into digital marketing and public relations to manage online perception. A quick Google search can highlight what employees and candidates see about the firm online.

- Current employees and alumni can make some of the best advocates through brand promotion and new talent engagement.

Although COVID-19 was a once-in-a-lifetime phenomenon, the pandemic has brought several unusual challenges to the forefront. As a result, accounting and financial services firms can no longer be passive and hope things return to normal. Instead, it’s time to develop a strategy that invests in and embraces talent, marketing, and technology moving forward.

Lindsay Ashcraft is an account executive with LexisNexis InterAction in Raleigh, NC. She has 10-plus years of working in the accounting, legal, and professional services industries, and can be reached at lindsay.ashcraft@lexisnexis.com.

Lee W. Frederiksen, PhD, is managing partner at Hinge, a research-based branding and marketing firm in Reston, VA. He can be reached at lfrederiksen@hingemarketing.com.

Sign up for weekly professional and technical updates from PICPA's blogs, podcasts, and discussion board topics by completing this form.

Leave a commentOrder by

Newest on top Oldest on top