Historic CNIT Reductions and Small-Business Tax Reform

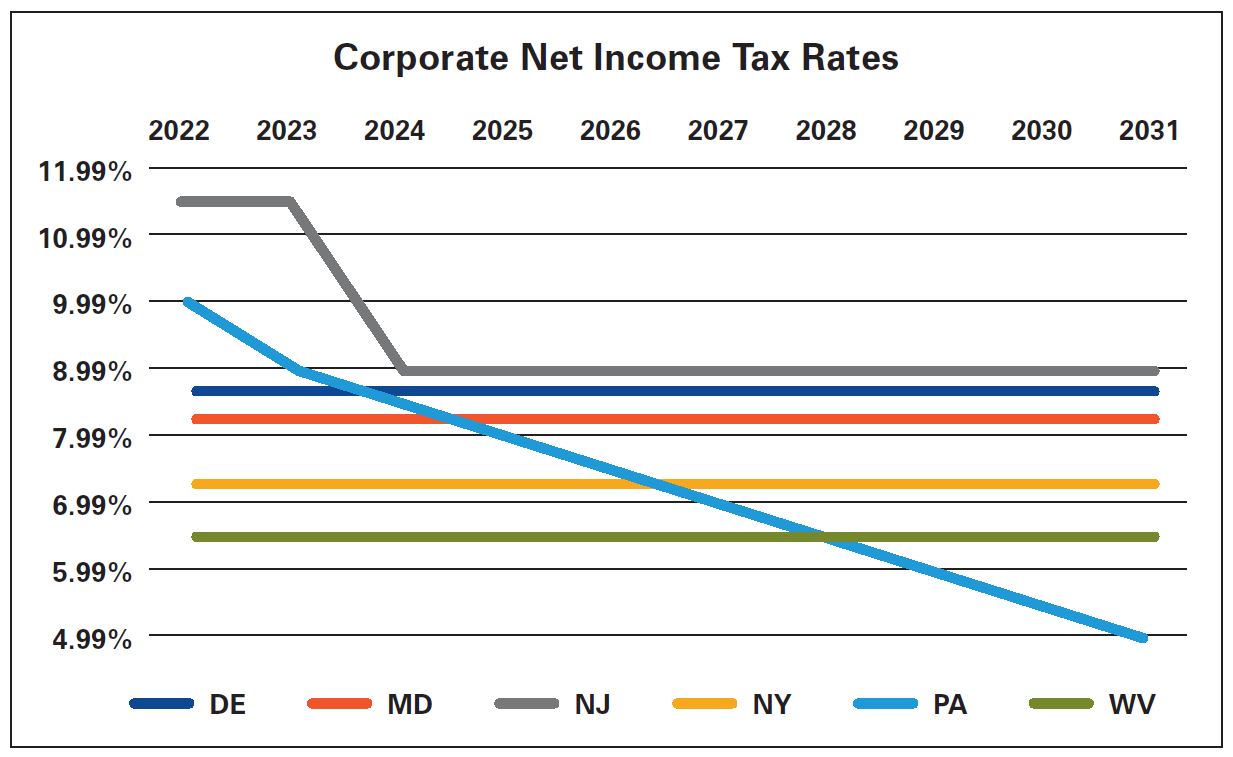

Gov. Tom Wolf signed House Bill 1342 into law as Act 53 of 2022 marking the first change in Pennsylvania’s corporate net income tax (CNIT) rate since 1995, reducing it by more than 50% over the next nine years: from 9.99% in 2022 down to 4.99% in 2031.

by Drew VandenBrul, CPA, and Michael Semes, JD Dec 15, 2022, 07:00 AM

On July 8, 2022, Pennsylvania Gov. Tom Wolf signed House Bill 1342 into law as Act 53 of 2022, culminating month’s-long bipartisan negotiations. The law marks the first change in Pennsylvania’s

corporate net income tax (CNIT) rate since 1995, reducing it by more than 50% over the next nine years: from 9.99% in 2022 down to 4.99% in 2031.

On July 8, 2022, Pennsylvania Gov. Tom Wolf signed House Bill 1342 into law as Act 53 of 2022, culminating month’s-long bipartisan negotiations. The law marks the first change in Pennsylvania’s

corporate net income tax (CNIT) rate since 1995, reducing it by more than 50% over the next nine years: from 9.99% in 2022 down to 4.99% in 2031.

To achieve this rate reduction, Act 53 modifies certain CNIT receipt apportionment sourcing

provisions and codifies new economic nexus thresholds. From a small-business perspective, Act 53 conforms personal income tax (PIT) provisions to the Internal Revenue Code treatment of Section 1031 deferrals on like-kind exchanges and Section 179

first-year expensing. Act 53 also expands many tax credit provisions, but none of these changes is retroactive.1

The CNIT rate reductions incrementally occur over a nine-year period and move Pennsylvania from the second

highest CNIT rate in the nation to eighth lowest. The graph on this page illustrates the annual rate reductions and a comparison to neighboring states (assuming no changes among neighboring states).

The sourcing provisions create

some uncertainty, but nonetheless provide helpful guidance for sourcing receipts in the modern economy. The small business and tax credit changes will ease compliance and tax burdens on numerous businesses.

In 2014, Pennsylvania moved

to market-based sourcing of services (previously was costs of performance sourcing).2 Act 53 changes the sourcing method for receipts derived from certain types of financial transactions and intangible property. Act 53 does have many interpretive

gaps, but it states that the “Department [of Revenue] shall promulgate the rules and regulations necessary to implement” the CNIT sourcing provisions.

Intangible Property Sourcing

Financial Transactions Sourcing

Act 53 mirrors the market sourcing provisions of the Bank Shares Tax for certain types of financial transactions. Specifically, Act 53 sources gross receipts from the following:5

- Sale, redemption, maturity, or exchange of securities to the location of the customer

- Interest, fees, and penalties imposed in connection with loans secured by real property to the location of the borrower

- Loans related to the sale of tangible personal property to the delivery location of the purchaser

- Loans not otherwise specifically described to the location of the borrower

- Interest, fees, and penalties in the nature of interest from credit card receivables to the billing address of the cardholder

Note that Act 53 specifically states that the loan sourcing provisions described above apply only to a taxpayer that regularly lends funds to unaffiliated entities.6

Act 53 also includes two “catch all” provisions:7 interest described in the paragraph is sourced to the lender’s commercial domicile, and receipts from intangible property not otherwise described are excluded from the sales factor.

Economic Nexus

Act 53 modifies the CNIT nexus thresholds, generally speaking, to require a corporation with at least $500,000 of receipts (as determined by applying the new sourcing rules) to be subject to CNIT.8 Also, these new nexus rules do not apply to

affiliated foreign entities that are subject to treaty protection.9 Therefore, a foreign licensor with treaty protection that limits its contact with Pennsylvania may not be subject to CNIT.

Pass-Through Entities

While many of the CNIT rules continue to evolve regarding nexus, apportionment, and tax rates, the PIT rules applicable to pass-through entities (partnerships, S corporations, and certain limited liability companies) have remained constant. This includes the absence of a statutory economic nexus standard, three-factor apportionment with cost of performance sourcing of sales of other than tangible personal property, and a 3.07% tax rate. These differences factor into the tax reporting requirements and choice of entity issues.Credits

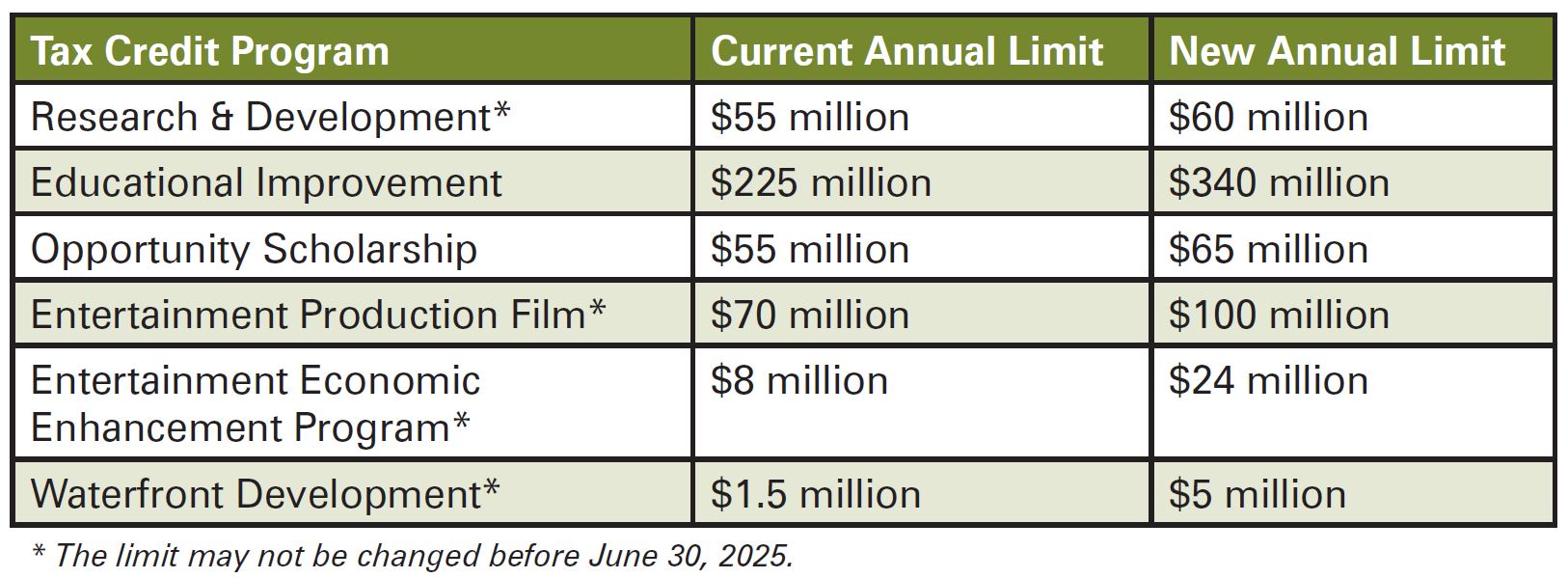

The annual limits for several existing tax credit programs were increased as well, as shown in the table below.

Tax Accounting Impact

As a result of the CNIT rate reductions and the changes to sourcing rules for sales of intangibles, there are important financial statement impacts for corporate taxpayers to consider beginning with the period of enactment of this legislation. The rate changes should impact deferred tax rates in 2022 and current tax rates beginning in 2023. This may result in changes to deferred tax assets and deferred tax liabilities, including potential impacts on net operating loss carryovers and valuation allowances. Care should be given to ensure that the rate, nexus, and sourcing provisions all are addressed.With Act 53 enacted in 2022, but not effective until 2023, taxpayers may see significantly different tax results between the two tax years. Corporate taxpayers and their advisers should consider the impact these changes will have on pending transactions, accounting methods, and business decisions impacting revenues and expenses between the periods.

Conclusion

Act 53’s CNIT rate reduction should make Pennsylvania more attractive to business investment, expansion, and retention. The favorable small-business and tax-credit enhancements should also increase capital investment in Pennsylvania. Finally, productive dialogue between taxpayers and the Department of Revenue will lead to the promulgation of meaningful regulations, create needed certainty, and make Pennsylvania an even more attractive place to do business.

Achieving the full benefits of these tax changes, however, will require Pennsylvania to stay the course and not slow or suspend these reductions.101 The CNIT provisions take effect for tax years beginning after Dec. 31, 2022, and the PIT provisions apply to transactions occurring after Dec. 31, 2022.

2 See “DOR vs. AG: Who Gets Final Say on Tax Statute Interpretation?” Pennsylvania CPA Journal (Winter 2021).

3 72 P.S. Section 7401(3)2.(A)(17)(C) and (D).

4 72 P.S. Section 7401(3)2.(A)(17)(L). It should be noted that the Department of Revenue has not yet published a draft regulation on the 2014 sourcing changes.

5 72 P.S. Section 7401(3)2.(A)(17)(E), (F), (G), (H), and (I).

6 72 P.S. Section 7401(3)2.(A)(17)(F), (G), and (H).

7 72 P.S. Section 7401(3)2.(A)(17)(J) and (K).

8 72 P.S. Section 7402(A)(5). Even though Act 53 does not express that any of its changes clarified existing law (as it has in other legislation) and does express that the CNIT nexus changes are effective prospectively, the Department of Revenue’s State Tax Legislative Summary – July 2022 nevertheless claims that Act 53 “codifies the Department of Revenue-issued Corporation Tax Bulletin 2019-04.” www.revenue.pa.gov/TaxLawPoliciesBulletinsNotices/TaxSummaries/Documents/2022_tax_summary_jul.pdf

9 72 P.S. Section 7402(A)(6).

10 See for example the phase-out of the capital stock/foreign franchise tax, which faced repeated delays before its eventual sunset after the 2015 tax year.

Drew VandenBrul, CPA, is a state and local tax managing director with Grant Thornton LLP in Philadelphia and an adjunct professor at the Villanova University graduate tax program. He can be reached at drew.vandenbrul@us.gt.com.

Michael Semes, JD, is professor of practice at the Villanova University graduate tax program and of counsel with BakerHostetler in Philadelphia. He can be reached at msemes@bakerlaw.com.

Leave a commentOrder by

Newest on top Oldest on top