Subscribe for Weekly Updates

Mandatory Amortization of Research Expenses: What CPAs Must Know

This blog was provided by Capstan Tax Strategies, a premier sponsor of the PICPA.

By Jacob Wood, JD

By Jacob Wood, JD

Before the Tax Cuts and Jobs Act (TCJA) of 2018 was passed, taxpayers could choose to immediately deduct Section 174 expenses or capitalize and amortize them over a period of five years. Section 174 expenses are known as research and experimentation (R&E) expenses. The expenses that fall under Section 174 of the Internal Revenue Code can be divided into two categories, based on how essential each is to the activity being performed:

- Direct research expenses that qualify for the R&D tax credit under Section 41.

- Indirect research expenses that are generally more incidental costs.

Section 41 expenses, known as “direct research expenses,” are what usually come to mind when you imagine research and development. Wages, supplies/materials, cloud hosting, and fees paid to third-party contractors are expenses integral to the research process.

However, performing a research activity requires more than just those things. You need a facility to perform the research in. You probably need to pay rent on that facility and pay for utilities and phone lines. Maybe you need to travel as part of the research and have associated travel costs. If you are filing for a patent, you probably have legal fees to pay. All these additional costs are considered “indirect research expenses.”

However, performing a research activity requires more than just those things. You need a facility to perform the research in. You probably need to pay rent on that facility and pay for utilities and phone lines. Maybe you need to travel as part of the research and have associated travel costs. If you are filing for a patent, you probably have legal fees to pay. All these additional costs are considered “indirect research expenses.”

The TCJA contained a provision mandating that, beginning in tax year 2022, Section 174 expenses must be amortized over five years, or 15 years in the case of foreign R&E, and may no longer be immediately deducted.

There are several implications to this change:

- This mandatory change will result in a short-term increase in taxable income.

- Since previously there was no difference between Section 162 and Section 174 deductibility, many businesses may not realize they are now affected.

- Taxpayers have a limited time to take advantage of Revenue Procedure (Rev. Proc.) 2023-11 and avoid filing the complex Change of Accounting Form 3115.

- While an eventual change in the rules is generally expected, in the immediate term taxpayers will have to account for these changes on their tax returns.

- The Section 41 R&D tax credit is an excellent way to mitigate the effects of mandatory amortization under Section 174.

Section 41 expenses are a subset of Section 174 expenses. So, apart from the rare exception, virtually all Section 41 expenses are Section 174 expenses.

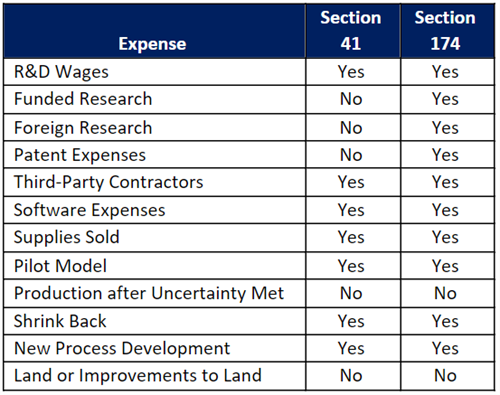

The table below summarizes some common expenses with their section designation. Note that expenses for foreign or funded research do not qualify as Section 41 expenses for the R&D tax credit, but are designated as Section 174 expenses.

The treatment of software development costs was given special mention in the TCJA. Software development expenses incurred in tax years starting after Dec. 31, 2021, are no longer deductible under Rev. Proc. 2000-50. Instead, they must be treated as R&E expenditures under Section 174 and, as such, amortized.

The delayed rollout of the amortization mandates in the TCJA had many hoping the provision would be repealed before it took effect. That was not the case. We may still see a retroactive repeal, but for the time being we must work with these rules as a new reality.

Rev. Proc. 2023-11

The IRS released Rev. Proc. 2023-11 on Dec. 29, 2022, to guide taxpayers as they file their taxes with this provision in place for the first time.

Most taxpayers will require a change in accounting method. For tax year 2022 only, in lieu of filing a Form 3115, the IRS is allowing taxpayers to include a notice with their original 2022 tax return indicating that the taxpayer is now amortizing Section 174 expenses.

The statement must include key pieces of information:

- Name and employer identification number or Social Security number (as applicable) of the applicant that has incurred Section 174 expenses after Dec. 31, 2021.

- Beginning and ending dates of the year of change (i.e., Jan. 1, 2022-Dec. 31, 2022).

- Designated automatic accounting method change number for this change (#265).

- Description of the type of expenditure included in the change.

- Amount of R&E expenditures paid or incurred by the applicant during the year of change.

- Declaration that the applicant is changing the method of accounting for specified research or experimental expenditures to capitalize such expenditures to a specified research or experimental capital account, and amortize such amount over either a five-year period for domestic research or 15-year period for foreign research (as applicable) beginning with the midpoint of the taxable year in which such expenditures are paid or incurred in accordance with the method permitted under Section 174 for the year of change.

- Declaration must also state that the applicant is making the change on a cut-off basis.

The Impact

Mandatory capitalization and amortization of Section 174 expenses will impact tax returns, but hopefully less than one might imagine.

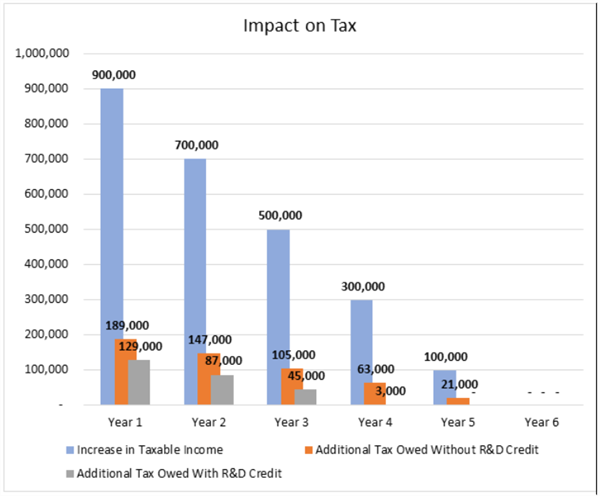

It may be a timing issue more than anything else. By amortizing the deduction over five years, taxpayers will see a higher net taxable income initially. Generally, taxpayers will pay more taxes in year one and year two, but not more overall. In fact, most taxpayers will “break even” by year three and pay little to no tax in that year and beyond. Smaller firms and start-ups will likely feel the impact of the increased tax liability more deeply, even if it is only short-term.

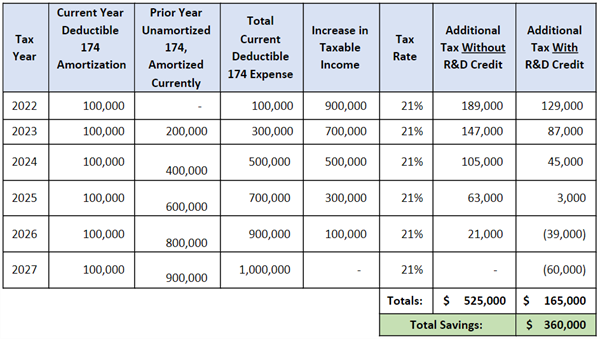

Consider a taxpayer that incurs $800,000 in Section 41 expenses, resulting in a net R&D tax credit of $60,000 annually. Based on a review of which Section 41 expenses are also considered Section 174 expenses, it is determined that the taxpayer has $1 million annually in Section 174 expenses.

Assuming the taxpayer claims the same expenses and credit annually, the table below demonstrates how the amortization of the Section 174 expenses will impact the amount of tax owed.

The chart below demonstrates how the amortized deduction of Section 174 expenses impact tax by year. Note the progressive decline in taxable income and tax owed.

When Section 174 Expenses Come as a Surprise

Mandatory amortization may be a harder pill to swallow for those taxpayers who didn’t realize their expenditures fell under Section 174. Many expenses people thought were Section 162 – and deductible – are actually Section 174 and must be amortized. We anticipate that the IRS will be looking out for 162/174 mismatches. If your activities indicate that you should have Section 174 expenses, the IRS will be closely reviewing your return to make sure they’ve been amortized appropriately.

Some industries that likely have Section 174 R&E expenses include the following:

- Manufacturing

- Software

- Engineering

- Architecture

- Product Development

- Breweries/Distilleries/Wineries

- Technology

If primary activity falls in one of the above categories, the IRS will expect to see Section 174 expenditures correctly amortized on your return.

Mitigating Options

Some have posited that if a taxpayer chose not to take the R&D tax credit, or to skip a year, they wouldn’t have to deal with Section 174. That is not the right way to view the situation. If a taxpayer has Section 174 activities, then they have Section174 expenses; taking the R&D tax credit doesn’t generate additional Section 174 expenses.

In fact, the opposite is true: the R&D tax credit is an excellent way to mitigate the impact of Section 174 amortization. The R&D tax credit can go a long way toward diminishing the unfavorable tax consequences of Section 174 amortization. (See charts above.)

The 199A qualified business income (QBI) deduction is another helpful option. Qualifying pass-through entity owners may deduct up to 20% of their QBI, which certainly would help offset the additional tax liability generated by Section 174 amortization.

Conclusion

While there is a possibility that Section 174 amortization may be repealed retroactively later this year, it is mandatory for current filings. The IRS will be looking for compliance this tax season. The short-term impact of mandatory Section 174 amortization will be felt, but may be mitigated by R&D tax credit studies and/or the 199A QBI deduction, as appropriate.

Jacob Wood, JD, is a regional director at Capstan Tax Strategies, where he works on cost segregation, R&D tax credits, and federal energy incentives. He can be reached at jwood@capstantax.com.

Sign up for PICPA's weekly professional and technical updates by completing this form.

Statements of fact and opinion are the authors’ responsibility alone and do not imply an opinion on the part of the PICPA's officers or members. The information contained herein does not constitute accounting, legal, or professional advice. For actionable advice, you must engage or consult with a qualified professional.

Leave a commentOrder by

Newest on top Oldest on top