Coronavirus Impact on Business Detailed in New Survey

The PICPA recently partnered with Avenue M to conduct a survey to determine how COVID-19 is impacting accounting firms and other companies nationwide and at the state level. Find out what Pennsylvania's 1,050 respondents had to say.

By Sara Albert, PICPA member relations manager

By Sara Albert, PICPA member relations manager

Accounting firms, companies, and organizations across the state are starting to analyze the impact that COVID-19 will have on their business, both from a revenue and personnel perspective. The full extent of the impact is still being determined, but we can reasonably assume that the pandemic’s effects will be felt for many months, if not longer.

The PICPA recently partnered with Avenue M to conduct a survey to determine how COVID-19 is impacting accounting firms and other companies nationwide and at the state level. Pennsylvania had 1,050 respondents, contributing about 7.3% to the nationwide total of 14,443 responses. In this blog I want to share a few highlights, but I encourage you to check out the full report to see the responses of your peers in Pennsylvania, as well as the responses and demographics from the nationwide results.

Most firms and companies are experiencing moderate to extreme disruption in their business due to the pandemic. At a national level, 40% of firms, organizations, and companies say they have moderate disruption while 27% note extreme disruption. Pennsylvania-specific results show that 36% are feeling moderate disruption and 30% are experiencing extreme disruption. Of the national respondents, 50% expect the financial impact to last from four to 12 months. In Pennsylvania, respondents are treading a bit more cautiously, thinking the impact will extend out anywhere from 13 to 24 months (Pennsylvania recorded 18% in this category while 16% of national respondents think the impact will extend 13-24 months).

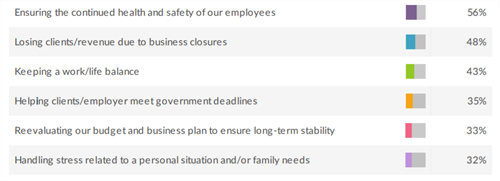

Disruption to revenue and client management is only one aspect companies are dealing with; there is also personnel disruption that is changing the way business is being conducted. Most respondents on both a national and state level indicated that they have reduced staff at the physical office, with most employees telecommuting (43% both in national and Pennsylvania results). Pennsylvania businesses trend higher in allowing all employees to work remotely (27% versus 21% nationally). When it comes to staff cuts, on a national level 25% of respondents reported reductions in staff or furloughs. Of the respondents in Pennsylvania, the number is 31%. One reassuring measurement in this survey shows that at both a national and state level, the top answer to the question “What are your most pressing concerns related to your work and professional success?” was “Ensuring the continued health and safety of our employees” (over 55% nationally and in Pennsylvania). In a strong second place was the response “Losing clients/revenue due to business closures.”

|

|

Top six responses to the survey question "What are your most pressing concerns related to your work and professional success?" |

The survey also touched on resources that firms and companies would find valuable and useful during this time, and how their state CPA society can be the most helpful over the next six months. As one would expect, top responses included updates on accounting and financial reporting considerations related to COVID-19, guidance for advising clients on small business loans or other federal business relief programs, and guidance for managing a remote workforce on a long-term basis. These responses are a good segue to noting some of the things that the PICPA is doing to support the accounting profession during this time of turmoil.

The PICPA is committed to providing our members and the accounting professionals across the state with timely information, complementary education and resources, and continuous advocacy work on their behalf.

We are continuously updating our COVID-19 resource page to provide access to the waves of information coming in daily and weekly. We have conducted Q&A webinars with the Pennsylvania Department of Revenue and Department of Labor, both of which are recorded and available for both members and nonmembers. Our government relations team is working tirelessly to address issues facing our members and the accounting profession. And to help address long-term disruption, the PICPA is working to connect our members virtually via our Connect discussion boards, virtual round table events, and chapter town hall meetings.

The PICPA will continue to gather feedback from our members and will continue to create programming and services to help address the needs of our members.

Sign up for weekly professional and technical updates in PICPA's blogs, podcasts, and discussion board topics by completing this form.

PICPA Staff Contributors

Disclaimer

Statements of fact and opinion are the authors’ responsibility alone and do not imply an opinion on the part of PICPA officers or members. The information contained in herein does not constitute accounting, legal, or professional advice. For professional advice, please engage or consult a qualified professional.