The New Credit Loss Standard and the CECL Model

After almost a decade of study, the Financial Accounting Standards Board (FASB) released an accounting standard on the credit losses on financial instruments. In rethinking how credit losses should be recognized and measured, however, FASB created a standard that affects the accounting for a wide variety of financial instruments and a wide variety of entities.

By William G. Engelbret, CPA, PhD | Pennsylvania State University - Altoona

By William G. Engelbret, CPA, PhD | Pennsylvania State University - Altoona

After almost a decade of study, the Financial Accounting Standards Board (FASB) released an accounting standard on the credit losses on financial instruments. FASB developed the new standard principally because of concerns about the way financial institutions (banks, credit unions, investment companies, and so forth) recognized and measured losses on loans. In rethinking how credit losses should be recognized and measured, however, FASB created a standard that affects the accounting for a wide variety of financial instruments and a wide variety of entities.

This blog provides FASB’s motivation for developing a new credit loss standard and briefly describes the new primary model for dealing with credit losses and the different kinds of financial instruments that the standard addresses. It will also describe the effective dates and transition to the new standard.

Motivation for the New Standard

In 2005, many lending institutions held an unusually large amount of impaired loans on their balance sheets because of their lending practices at the time, including no document loans and teaser rates on adjustable rate mortgages. In February 2016, Lawrence W. Smith, a FASB member who has been with the board in a variety of positions since 2002, told a group of representatives from community banks and credit unions that about 15 midsize banks approached FASB in 2005 reporting that the credit loss impairment model they used, called the incurred loss model, did not allow them to accurately report the true level of impaired loans. The financial crisis of 2008 and the recession that followed caused FASB and the International Accounting Standards Board (IASB) to create the Financial Crisis Advisory Group (FCAG). In a report issued in July 2009, FCAG recommended the following:

The Boards should give highest priority to their project to simplify and improve their standards on financial instruments, moving forward as a matter of urgency but with wide consultation. … In the financial instruments project, the Boards should explore alternatives to the incurred loss model for loan loss provisioning that use more forward-looking information. These alternatives include an expected loss model and a fair value model.

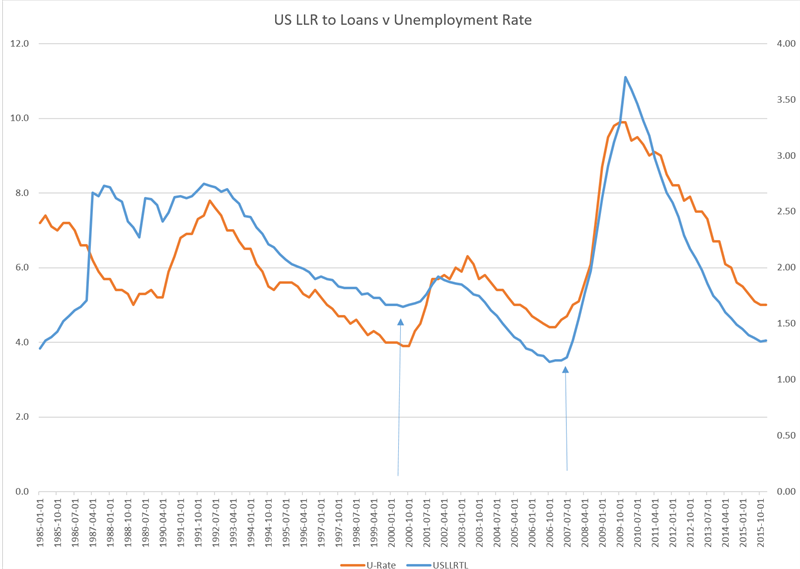

The following chart indicates some of the problems with the incurred loss model. The blue line represents the ratio of loan loss reserves to loans (LLR2L) over a 30-year period based on data from the Federal Reserve. Note the two arrows indicating that the ratio bottoms out in 2001 and 2006, just around the time that the two most recent recessions began. Also, note the orange line representing the unemployment rate, based on data from the bureau of labor statistics. There is a high degree of correlation between the LLR2L and the unemployment rate, but the LLR2L does not lead. If anything it lags. Comparisons with LLR2L with the Dow Jones Industrial Average (DJIA) and U.S. gross domestic product (GDP) leads to similar conclusions. Changes in economic measures occur at the same time or just ahead of changes in the LLR2L. One might also note, for general interest, that the LLR2L is now reaching very low levels.

So, there is evidence that the incurred loss model lacks predictive value. On occasion, investors have been surprised by the true level of loan losses.

Applicable Financial Instruments

The centerpiece of the new standard is the Current Expected Credit Loss (CECL) model (ASU 326-20). FASB created the CECL model to measure loan loss reserves, but it applies to a much wider array of financial instruments. Entities are to apply the CECL model to most financial instruments measured at amortized cost and certain other financial instruments.

The CECL model applies to financing receivables, including loans, trade accounts receivable, notes receivable, credit cards, and lease receivables (now a component of net investment in leases). It also applies to held-to-maturity (HTM) debt securities, receivables that result from revenue transactions under the new revenue standard, reinsurance receivables that result from insurance transactions, receivables that relate to repurchase agreements and securities lending agreements, and off-balance-sheet credit exposures not accounted for as insurance, such as off-balance-sheet loan commitments, standby letters of credit, and financial guarantees. The CECL model does not apply to financial assets measured at fair value through net income, available-for-sale (AFS) debt securities, loans made to participants by defined contribution employee benefit plans, policy loan receivables of an insurance entity, promises to give (pledges receivable) of a not-for-profit entity, and loans and receivables between entities under common control.

As part of the credit loss standard, FASB developed an updated version of the other-than-temporary impairment model for available-for-sale debt securities, which is for financial instruments measured at fair value with unrealized gains and losses recorded in other comprehensive income (ASC 326-30). That model will be discussed in a future article. FASB has also provided guidance on troubled debt restructurings (ASC 310-40), purchased credit impaired financial assets (ASC 310-30), and beneficial interests (ASC 325-40).

| CECL | |

| Applies to ... | Does not apply to ... |

| Trade receivables | Equity securities |

| Lease receivables | AFS debt securities |

| HTM debt securities | EBP loans receivable |

| Reinsurance receivables | Policy loans receivable |

| Repurchase agreements | Related-party loans |

| Financial guarantees | |

Applying the CECL Model

When acquiring a financial asset, estimate expected credit losses over the contractual term (lifetime) of that asset. Establish an allowance for credit losses, which is a valuation account that is deducted from the amortized cost basis of a financial asset to present the net amount expected to be collected from the financial asset. Measure expected credit losses of financial assets on a collective (pool) basis when similar risk characteristics exist, such as, but not limited to, credit ratings, financial asset type, collateral type, term, or geographic location. One may determine the allowance for credit losses using various methods, such as discounted-cash-flow methods, loss-rate methods, roll-rate methods, probability-of-default methods, or methods that utilize an aging schedule. A discounted-cash-flow approach is not required, but when a discounted-cash-flow method is applied, discount expected cash flows at the financial asset’s effective interest rate. The allowance for credit losses shall reflect the difference between the amortized cost basis and the present value of the expected cash flows.

Do not rely solely on past events to estimate expected credit losses. Include internal information, external information, or a combination of both relating to past events, current conditions, and reasonable and supportable forecasts. Consider relevant qualitative and quantitative factors.

Financial institutions, particularly smaller and less sophisticated financial institutions, had, and to some extent still have, concerns about the CECL model. They were concerned about having to incorporate data about the future. To reduce their concerns, FASB told them that that they should not make forecasts that were not reasonable and supportable. FASB does not require entities to forecast conditions over the life of the financial asset. For the period beyond which one can make reasonable and supportable forecasts, return to using to historical credit loss experience.

Financial institutions were also concerned that they would need to employ methods that were exceptionally expensive. FASB told them they were not required to use any particular model. In fact, FASB expected that the methods used to determine credit loss allowances would be scalable. Large complex organizations would employ highly quantitative and sophisticated models; smaller, less-sophisticated organizations would apply simpler methods often based on qualitative factors. This is true for all entities, not just financial institutions.

Here are a couple of points to consider:

First, financial institutions’ concerns extended beyond FASB. They were concerned about additional burdens regulators would impose on them. Few industries face as much regulatory pressure over credit losses as financial institutions. Most firms need only concern themselves with the requirements of auditors or reviewers, who in turn need to consider the responses of peer reviewers.

Second, credit losses are credit losses. Eventually there will be write-offs. Estimating expected lifetime credit losses when one acquires a financial instrument is likely to alter the timing of recognition and measurement. Most firms will likely accelerate the timing of credit losses. If the financial assets and conditions of those firms remain relatively constant, larger credit losses on newer financial assets may be offset by smaller losses on older assets after a few years of employing the new credit loss standard. After a few years, many firms are likely to find that the annual cost of credit losses will return to something approaching the levels they experienced in the past.

What if there is a very low chance of credit loss? CECL has no recognition threshold. FASB tells us the estimate of expected credit losses shall include a measure of the expected risk of credit loss, even if that risk is remote, but not if historical credit loss information adjusted for current conditions and reasonable and supportable forecasts results in an expectation that nonpayment of the amortized cost basis is zero. In other words, unless one is investing in something like U.S. Treasury bills, be sure to record some amount of expected loss.

Revise the expected credit loss each reporting period based on current conditions. The procedures for writing off and recovering financial assets will be consistent with those used today. The write-off or recovery will adjust the allowance. Recovery will be recognized when cash is received.

FASB requires SEC filers to adopt the new standard in 2020; others in 2021. Early adoption can begin in 2019. For the transition, apply a cumulative effects adjustment to the statement of financial position in the earliest period presented. Because adoption may require entities to adjust systems and controls, begin planning for adoption early. FASB expects that many transition issues will arise, so it is creating a Transition Resource Group to consider those issues and give advice about them.

William G. Engelbret, CPA, PhD, is an associate professor at Pennsylvania State University in Altoona, Pa.

Also, listen to PICPA's CPA Conversations podcast with Faye Miller, a partner with RSM US LLP, on the credit loss standard.

PICPA Staff Contributors

Disclaimer

Statements of fact and opinion are the authors’ responsibility alone and do not imply an opinion on the part of PICPA officers or members. The information contained in herein does not constitute accounting, legal, or professional advice. For professional advice, please engage or consult a qualified professional.