Pennsylvania Department of Revenue Electronic Statement of Accounts: One Year Later

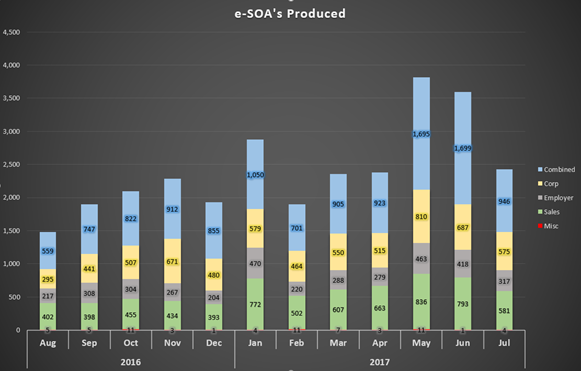

Since the Pennsylvania Department of Revenue implemented the electronic statement of accounts within its e-TIDES system last year, the department has produced almost 29,000 electronic account statements.

By John Kaschak, CPA | Pennsylvania Department of Revenue

By John Kaschak, CPA | Pennsylvania Department of Revenue

In August 2016, at the request of the business and tax practitioner community, the Pennsylvania Department of Revenue launched a new online feature in its business tax filing system. This feature provides an electronic avenue for business taxpayers and tax practitioners to receive a detailed electronic statement of account (e-SOA) in PDF format within the e-TIDES system. Upon making a request, the electronic statement is available the next business day.

Previously, taxpayers could obtain only a simple hard-copy summary after making a request in writing or by phone.

Each e-SOA includes the three most recently filed tax periods, nonfiled tax periods, and tax periods with open liabilities, payments, or credits grouped by tax type. Additional sections show tax periods under appeal, unused restricted credits, and W-2 annual reconciliation, if applicable.

Implementing this process gave businesses faster access to tax information, while reducing costs to the Department of Revenue.

Since implementation, 240 additional tax practitioners have registered online and requested statements of accounts. The department has produced almost 29,000 electronic account statements since its launch.

On Aug. 28, 2017, the department added another enhancement. Splash page functionality was launched in e-TIDES to heighten awareness of this new service and led to customers requesting 590 e-SOAs in one day. The department plans to provide even broader e-correspondence functionality this winter.

“We like this system very much, and it has definitely improved our ability to resolve our client’s payment on account issues quicker,” said Mike Eby, CPA, senior tax manager at McKonly & Asbury. “The ability to get a statement the next morning is the best feature.”

Todd Stonesifer, CPA, a partner with Rotz & Stonesifer PC, suggests that “this is an extremely useful service for clients that have balances due to determine what is owed.”

Watch this video for a quick overview of how to register and get the new e-SOA.

“While the mission of the Pennsylvania Department of Revenue is to administer the tax laws of the commonwealth in a fair and equitable manner, it is also the goal of the department to modernize the way we communicate and interact with all taxpayers,” said Revenue Secretary Dan Hassell. “We will continue to implement strategic initiatives to better serve individuals, businesses, and practitioners.”

John Kaschak, CPA, is deputy secretary for taxation with the Pennsylvania Department of Revenue.

PICPA Staff Contributors

Disclaimer

Statements of fact and opinion are the authors’ responsibility alone and do not imply an opinion on the part of PICPA officers or members. The information contained in herein does not constitute accounting, legal, or professional advice. For professional advice, please engage or consult a qualified professional.