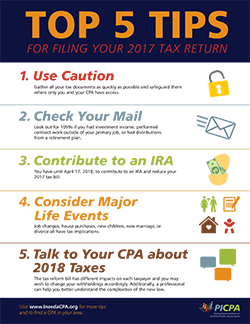

Top 5 Tax Filing Tips from a CPA

When was the last time you talked with a CPA about taxes? If it’s been a while, here are the top tax-filing tips that CPAs wants you to know.

By Judith Herron, CPA

By Judith Herron, CPA

Are you in tip-top shape for your 2017 taxes? When was the last time you talked with your CPA? If it’s been a while, let’s get started with the Top 5 Tax Filing Tips your CPA wants you to know.

Are you in tip-top shape for your 2017 taxes? When was the last time you talked with your CPA? If it’s been a while, let’s get started with the Top 5 Tax Filing Tips your CPA wants you to know.

1. Be Careful Out There

In all the hubbub surrounding the new tax law passed in December 2017, you may have forgotten about the Equifax data breech. Pat yourself of the back if you took steps to safeguard your credit as a result. Unfortunately, your efforts won’t prevent someone from filing a fraudulent tax return in your name. The IRS is taking steps to reduce fake filers’ success rate, like slowing down the process for returns with refunds to double check. In addition, the IRS is requiring more verification data on your W-2. Gather all your tax documents as quickly as you can, and make sure they are in a safe place where only you and your CPA have access. Speaking of documents …

2. Check Your Mail for Tax Related Forms

If you have income from any source other than your employer, then you should get a Form 1099 in the mail by the end of January. This can be connected to investment income, contract work, or distributions from a retirement plan. These 1099s are sent to the IRS and, in Pennsylvania, the Department of Revenue. If the numbers the taxing authorities have don’t match what’s on your tax return, they will ask you to explain why. To avoid this, get those 1099s to your CPA.

While you are required to report all your income on the tax return, you also want to make sure you get credit for all your deductible expenses. This means checking for even more forms. If you have a mortgage, your bank gives you a form with potential deductions. Tuition, student loan interest, and day care expenses all need documentation to take advantage of deductions and credits. Finally, you’ll need letters and receipts to back up your charitable donations.

3. It’s Not Too Late to Contribute to an IRA

3. It’s Not Too Late to Contribute to an IRA

If you are already contributing to a retirement plan at work, this may not be an option for you. Still, it is worth asking your CPA about your specific situation. An IRA contribution can be made up until the tax filing deadline in April. It’s one of the few things you can do to reduce 2017 taxes even though it’s 2018.

4. Be Sure to Mention Big Life Events to Your CPA

Job changes, house purchases and sales, new children, or children who graduate from higher education are all events that have tax implications. The sooner your talk with your CPA about this, the more they have the opportunity to help.

5. Talk with Your CPA about 2018 Taxes

Recent changes to the tax law may influence how you want to handle withholding from your paycheck or making estimated tax payments. While your tax rate may be lower, your tax owed may go up because of discontinued deductions. The many changes in the tax law will have a different impact on each tax payer. Not only that, but many of the details on how the IRS will enforce the law are still evolving. When you finalize your 2017 tax return, review with your CPA what might be different for you going forward. Be prepared for more conversation as the year goes on to consider possible course corrections.

Judith Herron, CPA, works at Markovitz Dugan & Associates, a CPA and business consulting firm in Pittsburgh. Her areas of expertise include business consulting, corporate income tax preparation and planning, financial statement reporting, personal income tax preparation and planning, and tax compliance. She is a PICPA member and chair of the CPA Image Enhancement Committee.

PICPA Staff Contributors

Disclaimer

Statements of fact and opinion are the authors’ responsibility alone and do not imply an opinion on the part of PICPA officers or members. The information contained in herein does not constitute accounting, legal, or professional advice. For professional advice, please engage or consult a qualified professional.