This is the archive of CPA Now blogs posted on the PICPA website through April 30, 2025. Want more recent blogs?

PICPA Poll Recap: Will the Corporate Tax Cut Affect Your Business?

During a two-week period from Feb. 19 to March 5 the PICPA conducted a poll asking members working in corporate finance if they planned to change how they invest in their business based on the cut in tax rates contained in the new tax reform law. Here are some of the results.

By Jim DeLuccia, PICPA communications manager

By Jim DeLuccia, PICPA communications manager

The Tax Cuts and Jobs Act, signed in late December 2017, reduced the corporate tax rate from 35 percent to 21 percent. During a two-week period from Feb. 19 to March 5 the PICPA conducted a quick and informal poll asking members working in corporate finance if they planned to change how they invest in their business based on this new rate. This is a recap of how 87 members responded.1

Just more than half – 51 percent – said they would not change how they invest in their business due to the tax reduction, 38 percent said it would change their approach, and 11 percent answered that they were unsure.

The common responses from those who said the rate reduction would not affect how they invest in their business were variations of the following:

- Tax cuts are not what inspire them to invest in the business. Opportunity and demand are the primary motivating factors.

- Many represented nonprofit organizations, and some felt the Tax Act could hurt their donation pool and create additional unrelated business income tax (UBIT) liability.

- Some said they represented a pass-through entity or were not part of a C corporation.

- Others had not had the time to analyze how the new tax law would affect their entity.

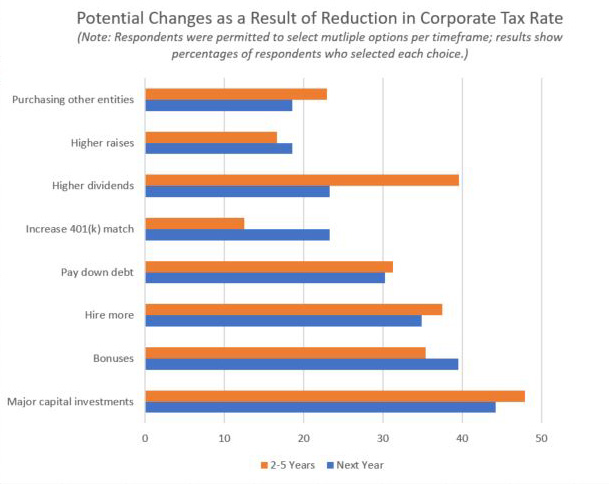

Those who said the new tax rate would affect how they invest in their business provided an outlook on the changes they plan to implement in the short term (up to one year) and in the long term (two to five years). Respondents were asked to pick all that applied from the following potential changes for the short and long term: make major capital investments, provide bonuses to existing employees, hire more employees, pay down debt, increase 401(k) match, give the extra money to shareholders via higher dividends, budget higher than average raises, and expand the business by purchasing other entities.

For the short term, the most popular answers provided were as follows:

- Make major capital investments

- Provide bonuses to existing employees

- Hire more employees

- Pay down debt

The option to “make major capital investments” was the top choice in the long-term category, while “hire more employees” and “provide bonuses to existing employees” also appeared on the list at three and four, respectively. However, respondents rated “give extra money to shareholders via higher dividends” as the No. 2 change they plan to make in the next two to five years. That option, by contrast, rated in the bottom half by respondents who addressed it in the short-term category.

One interesting discrepancy between the short and long-term strategies was how respondents addressed the 401(k) match. Companies were nearly two times more likely to increase the 401(k) match in the short term than they would be in the long term.

The Association of International Certified Professional Accountants conducted a similar survey two weeks prior to ours, and discovered that decision makers at small and midsize companies “are showing previously unseen levels of optimism.” Those who indicated the tax cut would influence how they invest in their businesses plan to make moves as those declared by PICPA members, including increasing capital expenditures, paying down debt, and hiring more full-time workers.

The PICPA will continue to provide education and resources to members in the coming months on the Tax Cuts and Jobs Act and what these changes mean for business and individuals. Check out www.picpa.org/taxreform for more information.

1 92 percent of respondents were CPAs with five years or more of experience in corporate accounting.