This is the archive of CPA Now blogs posted on the PICPA website through April 30, 2025. Want more recent blogs?

Affordable Care Act Part Deux: Income Taxes

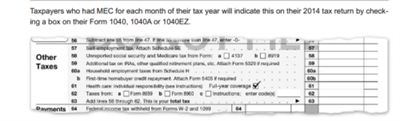

Affordable Care Act provisions will debut on your tax return for the first time this year. You will have to deal with it in some form, but for most people, the good news is all that’s involved on the tax side is a check mark.

Nov 5, 2014, 09:08 AM

By Guest Blogger Judy Herron, CPA

If you check the “full-year coverage” option under “Other Taxes,” it means you have health insurance that qualifies as minimum essential coverage. If you got this coverage through a health care exchange and got a tax credit, you have more work to do.

If you are an individual without health insurance coverage, you have a lot more work to do. If you don’t fit either of those descriptions, you can move on to the 5 Steps to Survive a Zombie Apocalypse. (Accountants always try to offer tips to get out of tricky situations.)

Adults who received coverage through a health care exchange must file a federal tax return this year, regardless of income level. If you claimed a health premium tax credit, the amount of that credit has to be reconciled on this year’s tax return, using a new form that had not yet been approved as of Nov. 1. Drafts of the document can be found on IRS.gov.

Taxpayers who used an advance credit to reduce their premium payments must report any change in family circumstance to the exchange. This is important, because if your income is higher than expected, the exchange can make adjustments in the subsidies now. If they don’t take action, you can end up owing tax you weren’t expecting.

People who didn’t purchase health insurance will receive a penalty tax unless they can prove they have a legitimate exemption. Most of these exemptions will be claimed on Form 8965. This form will also be used to calculate tax owed as a penalty for not having coverage. There are a number of ways to calculate the penalty, but in no case can the tax exceed the average cost of a bronze-level plan for the taxpayer and family members. For 2014, that monthly cost is $204 per person and $1,020 for a family of five. It’s worth noting that the IRS has limited ability to collect this tax. If you don’t pay it, the main collection tool is to reduce your tax refund. In addition, there is no interest added to this tax penalty.

More information will follow in the months ahead, but now at least you’ve seen the coming attractions.

For more help with this issue, visit PICPA’s Health Insurance page, ask a CPA your question, or find a CPA near you.

Judith Herron, CPA, works at Markovitz Dugan & Associates, a CPAs & Business Consultants firm in Pittsburgh. Her areas of expertise include business consulting, corporate income tax preparation and planning, financial statement reporting, personal income tax preparation and planning, and tax compliance. She is a PICPA member and serves on the CPA Image Enhancement committee.