Reminder: This is a reporting year! Meet your CPE requirements and make the most of your budget with PICPA’s discounted CPE bundles.

This is the archive of CPA Now blogs posted on the PICPA website through April 30, 2025. Want more recent blogs?

IT Hot Topics for the Insurance Industry

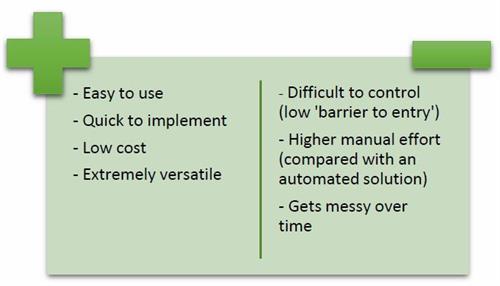

Michael Flagiello, partner at WeiserMazars LLP, asks, “Is Excel the greatest application ever or a liability?” This graph shows the potential strengths and weaknesses of Excel.

By Guest Blogger Ashley Dennon, PICPA, Strategic Marketing Coordinator

The rapid growth in the insurance industry over the past decade has left many insurance companies with multiple data systems that complicate reporting. Excel has become the go-to tool of almost every financial professional, but indicators link overuse of Excel spreadsheets to poor financial performance in insurance companies. Lack of infrastructure investments have left staff with few tools to review and correctly analyze data.

PICPA Insurance Conference speaker Michael Flagiello, partner at WeiserMazars LLP, recounted that during a request for proposal (RFP) process, one global financial services company found that it used 650,000 spreadsheets in their quarterly SEC reporting. Using Excel often means doing work that isn’t fully automated and has room for improvement. This potential lack of controls and IT support means more risk.

Flagiello asks, “Is Excel the greatest application ever or a liability?” This graph shows the potential strengths and weaknesses of Excel.

Excel is not optimum for processes that include critical paths for reporting or for customer-facing activities. It is better suited for processes that have fewer internal and external time dependencies. Keeping up with the trends in technology will keep your company ahead of the game in the transformation of finance and tax.

Finance Transformation

Typical finance performance improvement opportunities include strategic planning, business unit and departmental alignment, business intelligence and decision support, and changes to management or training. According to Flagiello, transformation leaders have learned these lessons:

- Assess current state of performance

- Develop a future state blueprint

- Build a business case everyone can understand

- Develop a realistic plan

- Obtain executive support and have an active, visible project sponsor

- Staff the project with high-performing resources

- Actively manage the change

Tax Transformation

Tax transformation is especially challenging for the insurance industry. Large and mid-sized companies are reporting increased audit activity by tax authorities and an increased need for auditable data. Tax executives are being called upon to take on broader roles, and new hires and consultants are being brought in. Close process deadlines and high resource turnover have become a norm. In the past five years, tax issues have caused over 10 percent of all restatements. Check out how tax provisioning causes a restatement that you can avoid all together: Income tax disclosures

- Deferred taxes, assets, and realizability

- Valuation allowances, NOLs, and UTPs

- Foreign tax liabilities

- Intra-period general accounting errors

- Intercompany transactions

- State and local tax accounting

Commercial tools exist that can help achieve a fully integrated tax environment, and data is readily available in

a fully auditable fashion. Over 80 percent provision automation can be reached with simple out-of-the-box

configurations. These calculation engines and algorithms ensure correct and complete tax accounting

information.

Integrated and up-to-date systems will bring value to everything your company produces, such as improved

effective tax rate, reduced tax defense costs, improved cash flow, greater opportunity to realize the benefits of

all adjustment items, and increased monetization of deferred tax assets.