Regulation Crowdfunding: A Securities Law Exemption Four Years Later

The Jumpstart Our Business Startups Act (JOBS Act) of 2012 Title III (Regulation Crowdfunding) and Title IV (Regulation A+) represented significant changes to U.S. securities laws. This blog looks at the crowdfunding environment after the JOBS Act implementation, and highlights its implications for CPAs, financial planners, and managers.

By Kreag Danvers, CPA, PhD, CMA, CFM

By Kreag Danvers, CPA, PhD, CMA, CFM

The Jumpstart Our Business Startups Act (JOBS Act) of 2012 was intended to promote capital formation for emerging-growth companies by easing the financial reporting requirements and regulatory obstacles for public offerings of small businesses. Effective in 2016, the JOBS Act contains six titles with different provisions for companies at different stages.

The JOBS Act’s Title III (Regulation Crowdfunding) and Title IV (Regulation A+) represent significant changes to U.S. securities laws. Regulation Crowdfunding (Regulation CF) provides for “equity” crowdfunding without SEC registration and may include many small investments from qualified investors for debt, equity, or other securities. Prior to Regulation CF, “affinity” crowdfunding could only offer merchandise or other perks to investors or rewards for nonprofits and charitable fundraising. While Regulation CF eased securities regulations and reduced barriers to small-business financing, it also permitted “nonqualified” individual investors to participate in entrepreneurial securities offerings. This blog takes a closer look at the crowdfunding environment four years after the JOBS Act implementation, and highlights some of the implications for CPAs, financial planners, and managers.

The JOBS Act’s Title III (Regulation Crowdfunding) and Title IV (Regulation A+) represent significant changes to U.S. securities laws. Regulation Crowdfunding (Regulation CF) provides for “equity” crowdfunding without SEC registration and may include many small investments from qualified investors for debt, equity, or other securities. Prior to Regulation CF, “affinity” crowdfunding could only offer merchandise or other perks to investors or rewards for nonprofits and charitable fundraising. While Regulation CF eased securities regulations and reduced barriers to small-business financing, it also permitted “nonqualified” individual investors to participate in entrepreneurial securities offerings. This blog takes a closer look at the crowdfunding environment four years after the JOBS Act implementation, and highlights some of the implications for CPAs, financial planners, and managers.

Regulation CF Exemption

The Securities Act of 1933 requires registration for the offer and sale of securities. Title III of the JOBS Act provides exemptions for certain crowdfunding transactions and permits eligible businesses to fundraise. To obtain the Regulation CF exemption, the following requirements must be met:

- The sale of securities to investors must be through an online platform or intermediary. The intermediary must be a broker-dealer or a funding portal registered with the Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA).

- A company can raise as much as $1.07 million annually from individual investors. To exceed this limit, a business needs an exemption under another regulation.

- Individual investors who have net worth or annual income of less than $107,000 can invest a maximum of $2,200 or 5% of the lessor of annual income or net worth.

- If both annual income and net worth are more than $107,000, the limit is 10% of the lesser of annual income or net worth.

- The aggregate amount of securities sold through all Regulation CF offerings cannot exceed $107,000 during a 12-month period, regardless of income or net worth.

- Investors must hold securities for a minimum of one year.

Thus, businesses can raise a maximum of $1.07 million annually under Regulation CF from unaccredited investors and maintain the SEC registration exemption. Companies seeking to raise $107,000 or less do not need reviews or audits of financial statements, only certification by the CEO of the issuer. For offerings greater than $107,000, but not more than $535,000, financial statements must be reviewed by an independent CPA. For issuers offering more than $535,000, financial statements must be reviewed (first-time issuers) or audited (prior issuers) by an independent CPA.

Regulation CF firms must electronically file Form C on the SEC’s EDGAR system to commence an offering, which includes the following information: officers, directors and owners of 20% or more of the issuer; description of the business and use of offering proceeds; price of the securities, target offering amount, and deadline to reach the target; whether the issuer will exceed the target offering amount; certain related-party transactions; and a discussion of the issuer’s financial condition and financial statements.

Crowdfunding issuers set minimum as well as a maximum target offering levels. The minimum level must be achieved for the fundraising effort to be deemed successful and for the firm to receive investment proceeds. Issuers provide progress updates via Form C-U upon reaching 50% and 100% of target offering amounts. Form C/A (filing amendments) are required for material changes, additions, or updates. Firms that withdraw their offerings file Form C-W (offering withdrawal) to indicate that the crowdfunding effort has been terminated. Finally, Form C-AR (annual report) is filed on EDGAR and the issuer’s website within 120 days after fiscal year-end.

Crowdfunding issuers set minimum as well as a maximum target offering levels. The minimum level must be achieved for the fundraising effort to be deemed successful and for the firm to receive investment proceeds. Issuers provide progress updates via Form C-U upon reaching 50% and 100% of target offering amounts. Form C/A (filing amendments) are required for material changes, additions, or updates. Firms that withdraw their offerings file Form C-W (offering withdrawal) to indicate that the crowdfunding effort has been terminated. Finally, Form C-AR (annual report) is filed on EDGAR and the issuer’s website within 120 days after fiscal year-end.

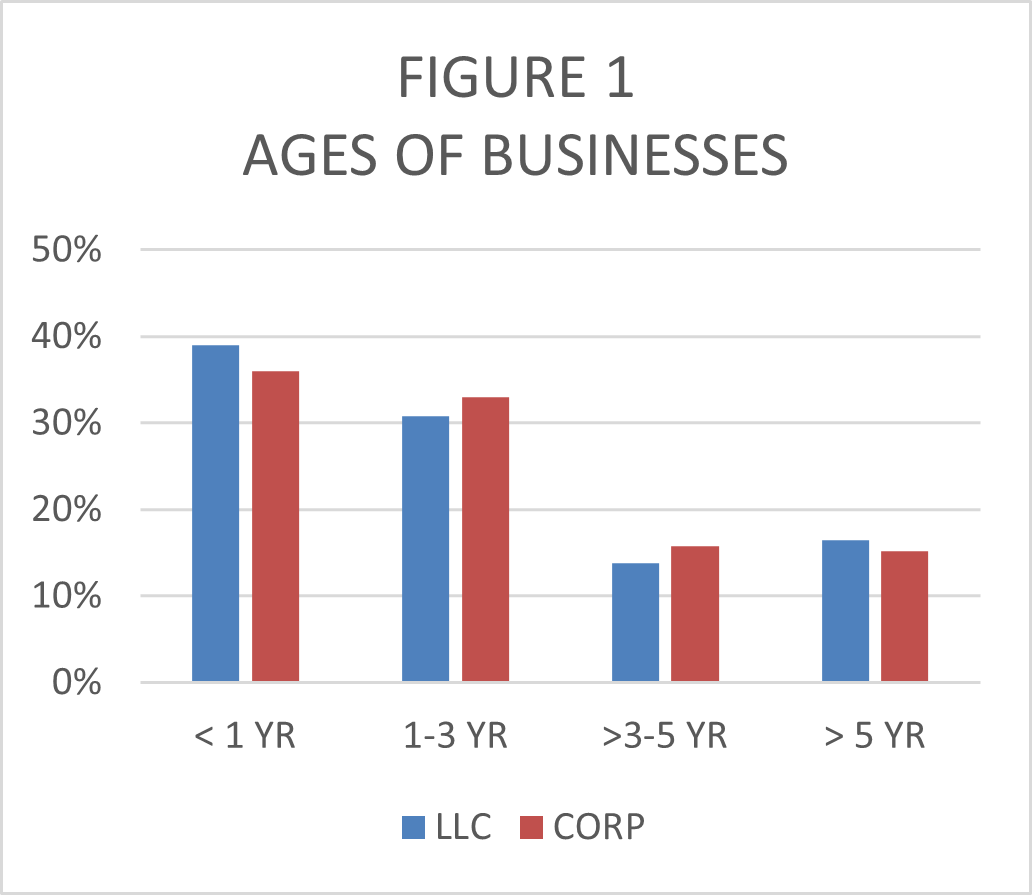

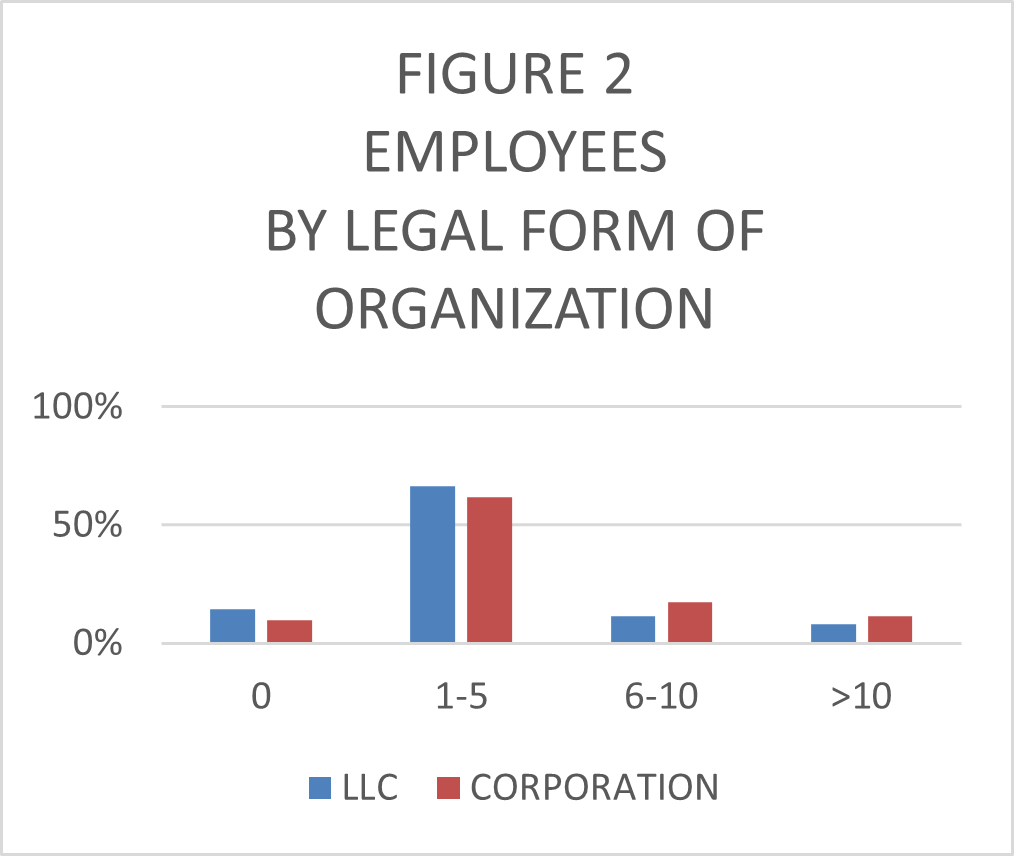

Crowdfunding firms tend to be relatively young, and many could be classified as “development stage enterprises.” As shown in Figure 1, almost 40% of crowdfunders have been organized for less than one year prior to filing an offering and fewer than 20% have been in business for more than five years. The high degree of early-stage businesses seeking financing should alert CPAs to going-concern issues for reviews and audits. In addition, over 10% of crowdfunders have no employees, while almost 80% have five or fewer employees, as shown in Figure 2.

Crowdfunding firms tend to be relatively young, and many could be classified as “development stage enterprises.” As shown in Figure 1, almost 40% of crowdfunders have been organized for less than one year prior to filing an offering and fewer than 20% have been in business for more than five years. The high degree of early-stage businesses seeking financing should alert CPAs to going-concern issues for reviews and audits. In addition, over 10% of crowdfunders have no employees, while almost 80% have five or fewer employees, as shown in Figure 2.

While dozens of intermediaries participate in crowdfunding, two -- StartEngine and Wefunder -- had a combined 48% of all crowdfunding offerings from 2016 to 2020.

Are Offerings Successful?

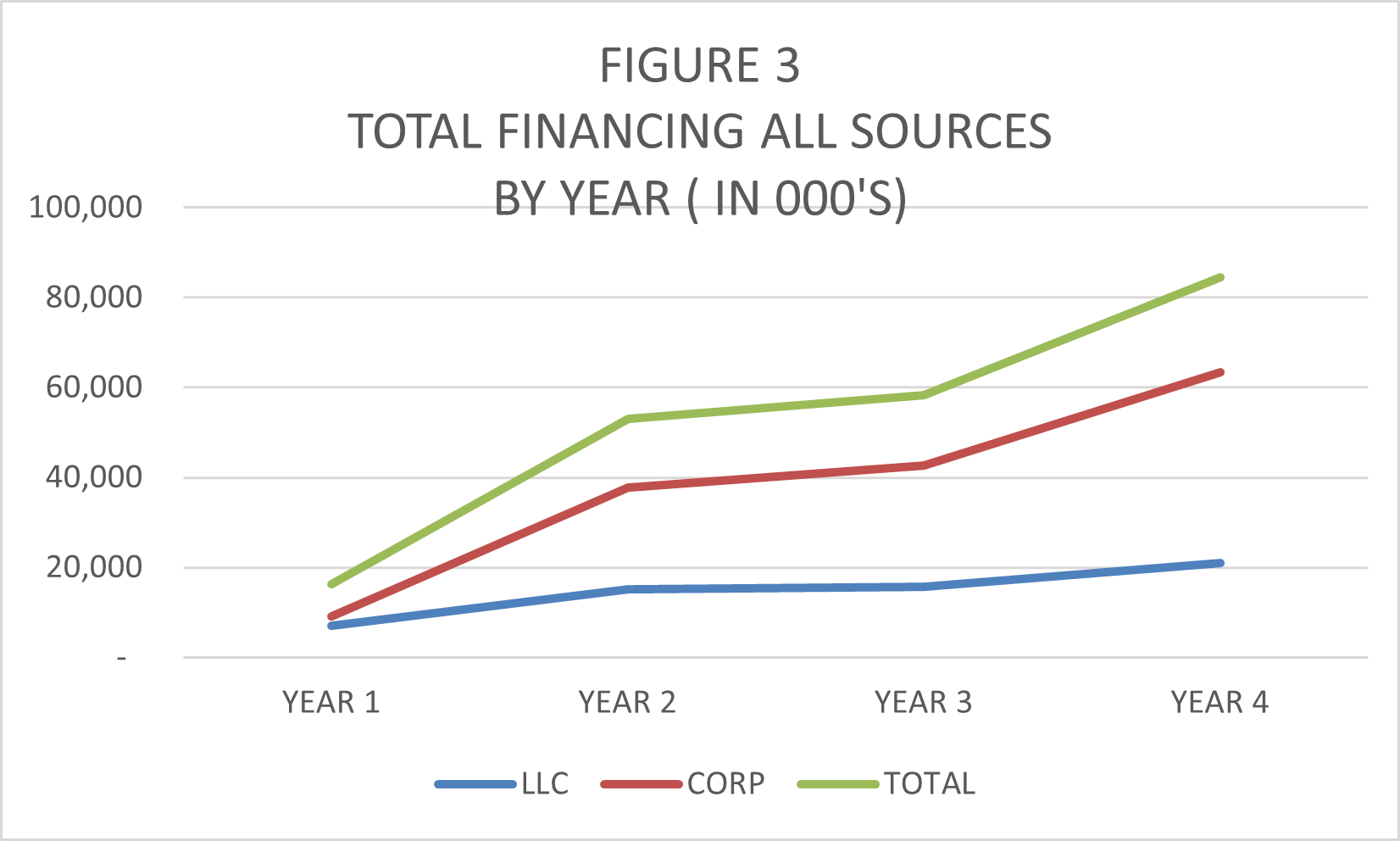

While a total of 1,017 firms filed Form C-U progress updates, 72 are duplicates or provide insufficient information about offerings progress. Figure 3 shows successful financings by year (2016-2020) from all securities broken down by LLCs and corporations. Successful offerings increase year over year, particularly for corporations, which tend to drive total financing raised.

While a total of 1,017 firms filed Form C-U progress updates, 72 are duplicates or provide insufficient information about offerings progress. Figure 3 shows successful financings by year (2016-2020) from all securities broken down by LLCs and corporations. Successful offerings increase year over year, particularly for corporations, which tend to drive total financing raised.

In the aggregate, $212 million in financing has been obtained under Regulation CF thus far, with common stock offerings by corporations providing 30% of the total. Simple Agreements for Future Equity (SAFE) security offerings constitute almost 23% of total financing.

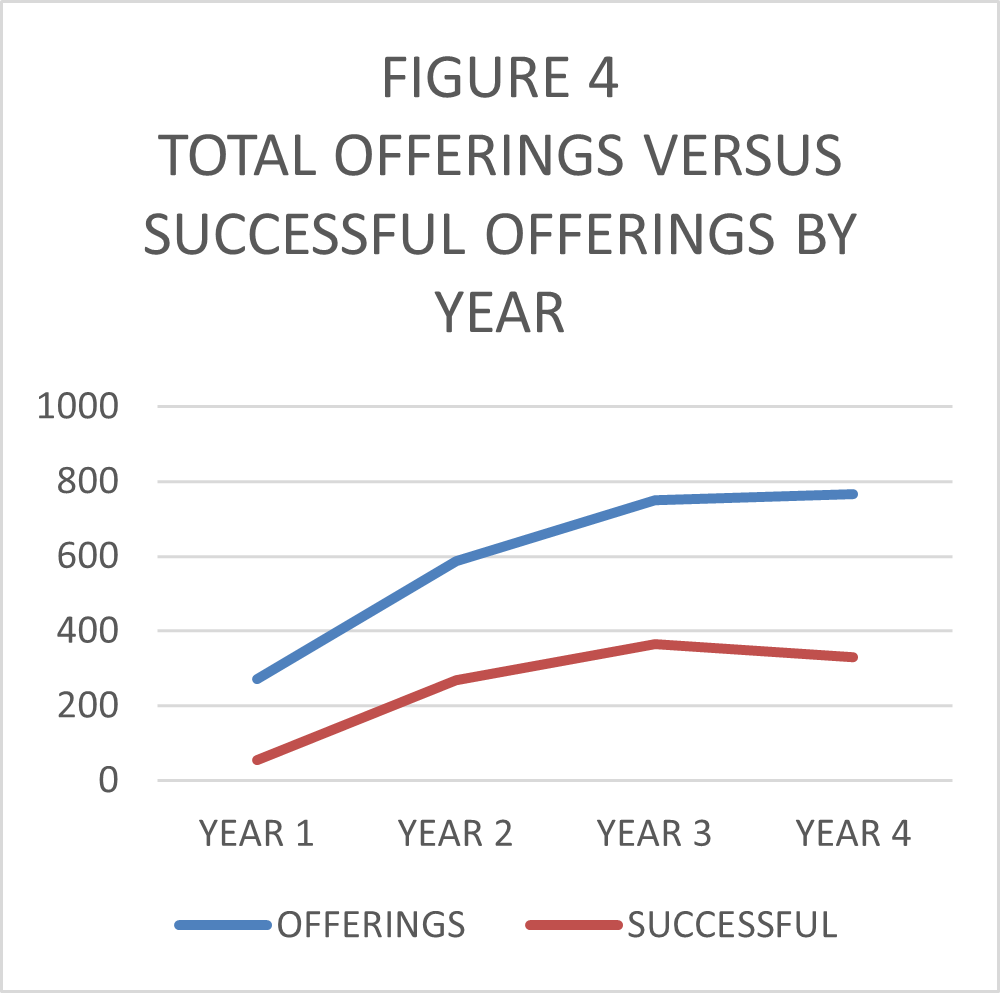

Figure 4 shows total Form C versus successful Form C-U offerings. Overall, 1,107 successful offerings were completed out of a total of 2,372, or almost 43% of offerings. While successful offerings reached a peak of 48% of total offerings in Year 3, a decline to 43% is noted in Year 4.

Figure 4 shows total Form C versus successful Form C-U offerings. Overall, 1,107 successful offerings were completed out of a total of 2,372, or almost 43% of offerings. While successful offerings reached a peak of 48% of total offerings in Year 3, a decline to 43% is noted in Year 4.

SAFE Securities

SAFE securities represent an agreement whereby the crowdfunding firm promises a future equity stake to investors contingent on one or more triggering events. Triggering events may include equity financing, change of control, completion of a project, or attaining certain sales volumes. It is critical to understand the triggering events and the likelihood of such events occurring.

SAFE investors have neither equity nor are they recognized as creditors. While SAFEs have similarities to convertible debt, they do not impose debt service obligations on the issuer.

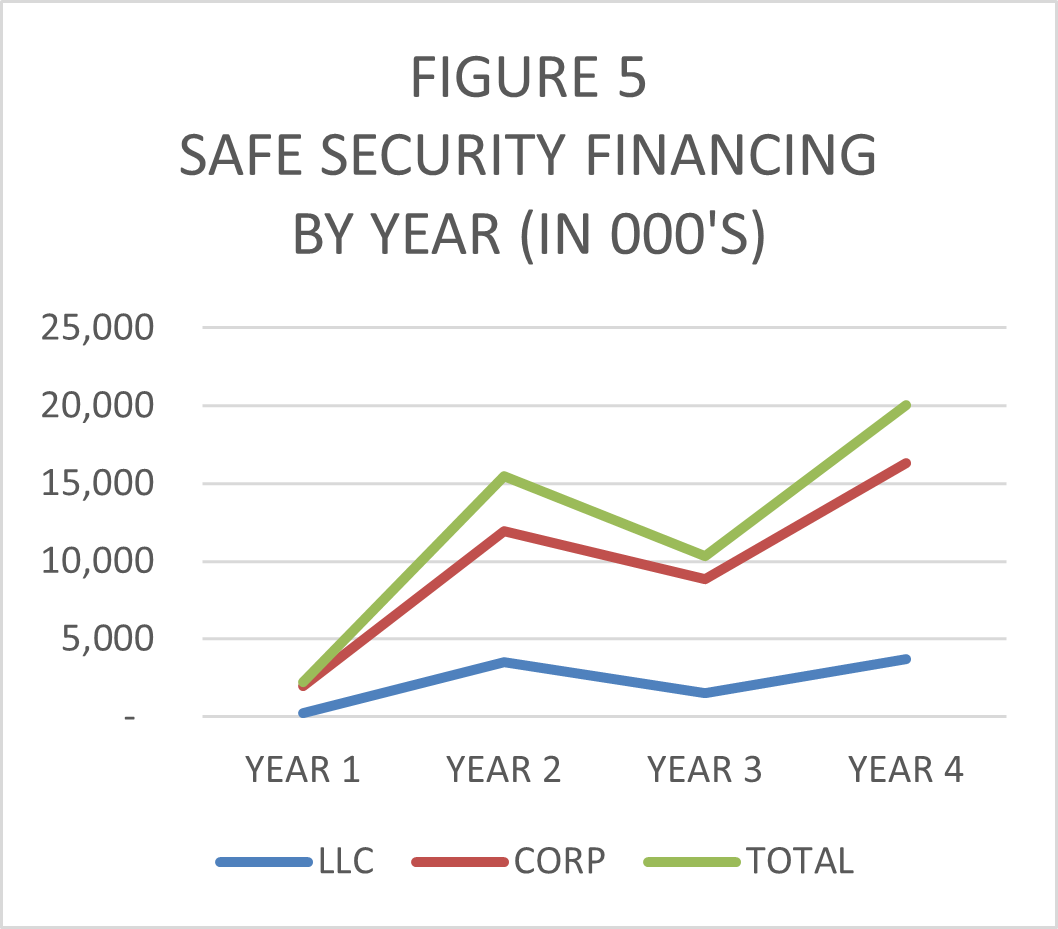

Thus, investors generally have no legal claims in the event of bankruptcy or liquidation, and take substantial risks on little upside potential. In other words, there appears to be a risk-reward imbalance for investments in SAFE securities. This is alarming because SAFE security financing has exploded recently, exceeding $20 million, as shown in Figure 5.

Thus, investors generally have no legal claims in the event of bankruptcy or liquidation, and take substantial risks on little upside potential. In other words, there appears to be a risk-reward imbalance for investments in SAFE securities. This is alarming because SAFE security financing has exploded recently, exceeding $20 million, as shown in Figure 5.

More than $48 million in crowdfunding has been raised via SAFE securities from 2016 to 2020. Corporations have issued over $39 million of SAFEs and LLCs have issued a bit less than $9 million. While 18% of LLC offerings were SAFE securities, only 14% were successful. Corporations’ SAFE offerings were 25%, with 22% successful. This analysis of crowdfunding data suggests generally positive, but mixed, results over the first four years of Regulation CF. However, concerns exist regarding the pervasiveness and recent increase of SAFE securities used by crowdfunders.

Opportunities for CPAs and Financial Managers

Crowdfunding presents opportunities for CPAs to assist with navigating the funding process as well as performing financial projections and forecasts. Virtually none of the SEC filings on EDGAR include formal prospective information with detailed assumptions, pursuant to the AICPA Guide to Prospective Financial Information. EDGAR filings that provide forward-looking information are mostly informal and lack detailed assumptions.

While aggregate 12-month offering amounts of up to $107,000 only require tax returns to be certified by the principal executive officer, higher offering amounts must be reviewed by an independent CPA. Reviews and audits can enhance the credibility of crowdfunding offerings, even for firms that are not required to obtain assurance services. Liquidity and solvency are issues that face crowdfunders and other nascent businesses that have tenuous cash situations. AU-C Section 570 requires auditors to assess substantial doubt of an entity’s ability to continue as a going concern and its ability to sustain operations. In addition, AU-C Section 315, Understanding the Entity and Its Environment and Assessing the Risks of Material Misstatement, requires auditors to obtain an understanding of the relevant industry as well as regulatory and other external factors, including entity structure and financing, which can be intertwined with crowdfunding activity.

Financial managers can help ensure -- in conjunction with legal counsel -- that crowdfunding clients select the appropriate state of organization and legal form. In addition, financial managers can ensure quality financial information on Form C to enhance the success of crowdfunding campaigns and advise on the appropriate target offerings, types of securities, and capital structure. Crowdfunding firms also require tax planning and compliance services. Certain types of crowdfunders that are underrepresented, such as minority-owned businesses within inner-cities, could particularly benefit from financial management expertise.

Financial planners should understand and apprise investors of the risk associated with investing in crowdfunding ventures. A legitimate question is whether businesses that have been operating for only one or two months with no employees are worthy of investment or should even be seeking public funding. Clearly, many early-stage businesses will go bankrupt, and even “accredited” investors are not fully cognizant of the risks. Crowdfunding rules also provide loopholes for criminals due to a lower disclosure level relative to traditional IPOs and documentation that can easily be fabricated. Finally, SAFEs carry relatively greater risk since they are neither a loan nor equity, and may never trigger equity conversion.

SEC Oversight

Although the compliance bar was set low for crowdfunders, the SEC may further relax offering requirements. It is critical to objectively evaluate the costs, such as fraud and going concern, versus the benefits of Title III. A recent argument set forth by the SEC is that the costs of internal control assessment exceed the benefits because small firms have less complex operating environments. However, internal control assessments must still be performed to ascertain the appropriate scope and testing procedures for audited financial statements. As Helen Munter, a former director of the division of registration and inspections at the PCAOB, noted: “When ICFR (internal control over financial reporting) is effective, it helps companies make sure that they produce reliable financial statements that investors can use to make investment decisions. When it is not, it can damage the integrity of financial reporting that is the very foundation of the capital markets.”

A partial review of EDGAR Form C submissions reveals that disclosures tend to be disjointed, incomplete, and not appropriately reviewed by crowdfunding portals or the SEC. The high, and increasing, volume of amended filings (Form C/A) should be scrutinized. Improved disclosures will better enable investors and financial planners to have more reliable and transparent information regarding prospects of crowdfunding firms. As Regulation CF continues to mature, offering amounts are increasing along with a wider range of security offerings and investments in SAFE securities. This is not the time to further relax oversight of issuers and internal controls. Enforcement must be a priority. Anything less will compromise the integrity of the financial markets.

Kreag Danvers, CPA, PhD, CMA, CFM, is a professor of accountancy at PennWest University in Clarion, Pa. He can be reached at kdanvers@pennwest.edu.

Sign up for PICPA's weekly professional and technical updates by completing this form.

Statements of fact and opinion are the authors’ responsibility alone and do not imply an opinion on the part of the PICPA's officers or members. The information contained herein does not constitute accounting, legal, or professional advice. For actionable advice, you must engage or consult with a qualified professional.

PICPA Staff Contributors

Disclaimer

Statements of fact and opinion are the authors’ responsibility alone and do not imply an opinion on the part of PICPA officers or members. The information contained in herein does not constitute accounting, legal, or professional advice. For professional advice, please engage or consult a qualified professional.