Understanding “Requests for Compromise” at the Pa. Board of Appeals

One important tool that can be of use to CPAs in the appeal of taxes, rebates, or refunds is the Pennsylvania Board of Appeals' Request for Compromise. This blog explains the process and how a Request for Compromise could help you better serve your clients.

By Ryan M. Froman, JD, MBA

By Ryan M. Froman, JD, MBA

The Department of Revenue Board of Appeals is the first formal level in adjudication of tax, rebate, and refund appeals in Pennsylvania. It is on track to receive about 35,000 appeals this year that stem from all the different Pennsylvania taxes and rebates that the Department of Revenue is responsible for administering.

One important tool that can be of use to CPAs in the appeals process is the Request for Compromise. Over the past 10 years (2013-2023), the board has granted more than $1 billion in relief through the compromise process. I’ve written this blog to help CPAs learn about the process and how it could help you serve your clients by pursuing a compromise on their behalf.

Overview of Compromise Requests

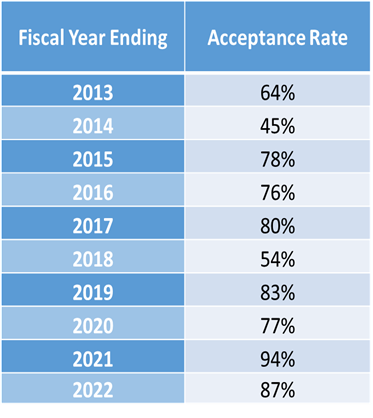

Pursuant to 72 P.S. Section 9707, upon request from a taxpayer the Board of Appeals has the statutory authority to consent to a compromise of the amount of liability for tax, interest, penalty, or additions administered by the Department of Revenue. In situations where a taxpayer proposes a compromise request, the board reaches an agreeable compromise with a high percentage of cases, particularly in recent years (see Table).

Pursuant to 72 P.S. Section 9707, upon request from a taxpayer the Board of Appeals has the statutory authority to consent to a compromise of the amount of liability for tax, interest, penalty, or additions administered by the Department of Revenue. In situations where a taxpayer proposes a compromise request, the board reaches an agreeable compromise with a high percentage of cases, particularly in recent years (see Table).

There are two bases used by the board to agree to a compromise:

- Doubt as to liability.

- The promotion of effective tax administration.

To submit a compromise request, a taxpayer should submit the DBA-10 form available on the board’s website with their appeal.

What Does “Doubt as to Liability” Mean?

While the Board of Appeals will review the facts and circumstances for each individual taxpayer, “doubt as to liability” generally includes situations where there are varying interpretations of the law, where the Department of Revenue failed to consider all the evidence presented, and where new evidence is available to support a change.

An example of doubt as to liability might include the following situation with a small business or individual taxpayer:

You or your business suffered a disaster (such as books and records were destroyed in a fire, flood, or other natural disaster). You did your best to accurately file your return, but the Department of Revenue reviewed the return and issued an assessment disallowing claimed expenses due to lack of supporting records. You are unable to reconstruct your books and records, but you can provide an explanation that justifies or approximates a reasonable reduction to a portion of your assessment.

Beyond Compromise

Even with the high compromise rates, there are situations when a compromise is not possible. Pursuant to the law, the Board of Appeals is not able to compromise on the following:

- Denials of property tax/rent rebate claims.

- Denials of charitable exemptions.

- Revocation of sales tax licenses.

- Appeals of taxes covered under the Gaming Control Act.

Additionally, certain personal situations are not eligible for compromise:

- Compromise requests demanding 100% relief.

- “Hardship” request based exclusively on a taxpayer’s financial situation or inability to pay. (This is a collections matter.)

- When the taxpayer has not filed any Pennsylvania tax returns.

- When a criminal prosecution is pending.

Compromise Tips

The compromise request process at the Board of Appeals is not a “tennis match” style of negotiation. The board expects and assumes the taxpayer is putting forth the best compromise offer.

If the board is unable to accept the offer presented by the taxpayer, but feels the matter is not too far away from reaching a compromise, the board may respond in some situations with a counterproposal. This should be viewed as the best and final proposal. Failure to accept such a proposal will likely terminate the compromise request review, and the board will move forward with a decision on the merits of the issues in the appeal.

Clearly stating your compromise offer (including proposed relief on tax, penalties, and interest) on the compromise request form (DBA-10), as well as prompt responses to any clarifying questions from the hearing officer assigned to your appeal, will assist in the compromise process.

Please be advised that the hearing officer will not advise you or your clients on the appropriate percentage relief on your initial compromise request.

If you have already filed an appeal and you have questions about the process at the board, contact the hearing officer assigned to your appeal.

Ryan M. Froman, JD, MBA, is chair of the Pennsylvania Department of Revenue Board of Appeals. He has been with the Board of Appeals for more than 17 years. He can be reached at rfroman@pa.gov.

Sign up for PICPA's weekly professional and technical updates by completing this form.

Statements of fact and opinion are the authors’ responsibility alone and do not imply an opinion on the part of the PICPA's officers or members. The information contained herein does not constitute accounting, legal, or professional advice. For actionable advice, you must engage or consult with a qualified professional.

PICPA Staff Contributors

Disclaimer

Statements of fact and opinion are the authors’ responsibility alone and do not imply an opinion on the part of PICPA officers or members. The information contained in herein does not constitute accounting, legal, or professional advice. For professional advice, please engage or consult a qualified professional.