Pennsylvania Tax Credits Add Extra Value During Economic Downturns

When recessions come, the impulse among businesses is to keep a watchful eye on resources. One way to do this is to see if a business is eligible for one of several Pennsylvania business tax credits.

By Daria D. Palaschak, CPA

By Daria D. Palaschak, CPA

With recessions come the impulse among businesses to keep a watchful eye on resources. One way to do this is to see if a business is eligible for one of several Pennsylvania business tax credits. In this blog I highlight three of the options: the Pennsylvania research and development tax credit, the Keystone Innovation Zone tax credit, and the Pennsylvania job creation tax credit.

Pennsylvania Research and Development Tax Credit

If a business is doing any type of research and development, it may qualify for the Pennsylvania research and development credit. It would first have to had incurred qualified research and development expenses – the same expenses that qualify for the federal R&D credit under IRC Section 41. A company could hit a home run if it qualifies for both credits.

R&D expenditures generally consist of wages of employees doing research and development, supplies consumed in the R&D process, rental or lease of computers (only if used in the R&D process – not to sell the product or for other uses), as well as 65% of the expense for contractors performing outsourced R&D. It is important to have documentation by employee and by project. Keeping time records to track R&D wages is the best support, but estimates will be accepted.

The company must have both a technical risk and an economic risk while performing R&D. A company’s ability to claim the R&D tax credit is based on the risk of technical failure. The R&D tax credit rewards companies based on their attempt at designing or manufacturing a new product, not building on their success. A company must also bear the economic risk of their product or process development to claim the R&D tax credit. In other words, a company must get paid based on its success, not its attempts. If a company is paid on a fixed-price basis, this usually signifies they bear the economic risk. Funded research generally does not qualify.

As companies grow and its operations grow more complex with employees doing a myriad of things, including R&D, it becomes increasingly difficult to determine what its R&D costs are. In those cases, it may be advisable to have the company engage someone to do an R&D study.

To apply for the Pennsylvania R&D credits a business must conduct research and development within Pennsylvania. Out-of-state employees do not qualify. The company must have at least two years of R&D expenditures since the Pennsylvania credit is based on an increase in R&D expenditures year over year.

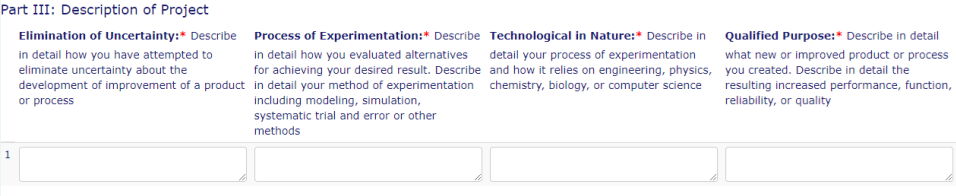

Pennsylvania recently added some additional questions to its R&D credit application that make the process a bit more time consuming. (See sample below.)

Remember, good documentation is key!

Application for this credit is done online and is due Sept. 15. The credit is normally awarded in mid-December. It can be used by the business or, if a pass-through entity, can be transferred to its owners. There is a 15-year carryforward period.

This credit can also be sold. Companies can usually get around 90 cents on the dollar. There are various brokers throughout the state that buy and sell these credits.

The Commonwealth of Pennsylvania website explains more about this credit and the application process.

Keystone Innovation Zone Tax Credit

This credit program was created for designated geographical areas to foster innovation and create entrepreneurial opportunities. The Keystone Innovation Zone (KIZ) credit primarily benefits start-ups since the business must be in operations less than eight years. Pennsylvania has KIZ coordinators based in various regions across the state who can help companies determine if they are operating within a zone or where nearby zones are.

The credit calculation is based off an increase in revenue year over year. The revenue must be earned within the zone. Prize money and grants are considered revenue, which can be important for startups. The company also needs to incur some payroll or rent within the zone.

Before the end of the tax year for which they want to apply, a company needs to contact one of the KIZ coordinators to determine if the company is situated within in a zone. The credit application is due on or before Sept. 15 following the end of the tax year in which the expenses were incurred. A filed version of all state and federal tax returns must be submitted with the application. The credit is awarded no later than Dec. 15 of each year. The maximum credit that can be awarded is $100,000.

The credit is available for use in the tax year in which credit is awarded and can be carried forward for five years. Like the Pennsylvania R&D credit, this credit can be either used by the company, its owners (if a pass-through), or sold.

The state checks the entity’s and owner’s tax compliance, so make sure all filings are current.

You can learn more about this credit on Pennsylvania’s website.

Job Creation Tax Credit

The job creation tax credit (JCTC) was established to secure job-creating economic development opportunities by expanding existing businesses and attracting prospects to Pennsylvania. Credits are awarded to businesses that create full-time jobs in Pennsylvania within three years. A business must create at least 25 new jobs or expand the existing workforce by at least 20%.

A company can receive $1,000 for each new job created up to a specified amount approved. These credits can be used by business after jobs are actually created.

Businesses need to apply for the credit before they do the hiring; once a business has done the hiring, it’s too late. A good time for a company to apply for this credit is when it is about to expand or after an equity infusion.

A business may apply the tax credit to its own Pennsylvania tax liability or the personal income tax of shareholders (if a Pennsylvania S corporation), or any combination thereof. Unused credits cannot be sold, but they can be carried forward five years.

The downside of applying for this credit is that there is a lot of paperwork associated with the application: budget information, project narrative, and description of milestones to name a few. Because of this, it is usually an application that needs to be completed by the company rather than its tax adviser.

The eligibility criteria can be found online.

Daria D. Palaschak, CPA, is a tax partner with Sisterson & Co. LLP in Pittsburgh. She can be reached at ddpalaschak@sisterson.com.

Sign up for weekly professional and technical updates in PICPA's blogs, podcasts, and discussion board topics by completing this form.

PICPA Staff Contributors

Disclaimer

Statements of fact and opinion are the authors’ responsibility alone and do not imply an opinion on the part of PICPA officers or members. The information contained in herein does not constitute accounting, legal, or professional advice. For professional advice, please engage or consult a qualified professional.