This is the archive of CPA Now blogs posted on the PICPA website through April 30, 2025. Want more recent blogs?

Are You Optimizing the R&D Tax Credit for Your Clients?

Many companies that take advantage of the research and development (R&D) tax credit rarely go the distance to maximize the credit they can actually claim. EPSA USA has been able to help CPA firms and their clients optimize R&D tax credits.

This blog was provided by EPSA USA, a premier sponsor of the PICPA.

By Ashley Chikes

By Ashley Chikes

Many companies that take advantage of the research and development (R&D) tax credit rarely go the distance to maximize the credit they can actually claim. EPSA USA has been able to help CPA firms and their clients optimize R&D tax credits and, therefore, significantly reduce their tax liability. To substantiate R&D credit claims for our clients, we typically follow these steps:

- Investigate all relevant buckets of R&D expenses

- Evaluate both historic base methodologies for each year

- Determine eligible state credits in addition to the federal credit

- Conduct a statistical sample to consider all eligible projects and expenses

Investigate All Relevant Buckets of R&D Expenses

If a company is already claiming the R&D credit, wages and contractors are usually included in the calculation. However, manufacturers can sometimes include supply costs, which can substantially increase the credit. We typically see that supplies are understated, if included at all.

In addition to supply costs, companies often leave out relevant wage expenditures related to direct support and direct supervision of the R&D activities. This includes managers of those performing R&D, a secretary supporting someone performing R&D, and a variety of other roles and activities. Direct support and direct supervision activities are specifically permitted in the Internal Revenue Code and can increase the qualified research expenses significantly.

Evaluate Both Historic Base Methodologies for Each Year

Unbeknownst to most people, there are actually two base methodologies that can be used when calculating the R&D credit: the Alternative Simplified Credit (ASC) and the regular credit methodology. The ASC method is usually easier to calculate, so it is oftentimes the method chosen. In our experience, the regular base methodology can increase the credit if the information required is available.

Determine Eligible State Credits in Addition to the Federal Credit

A majority of states offer R&D credits. The calculation and requirements vary dramatically from state to state, but, if calculated correctly, the state credits can greatly benefit companies and can usually be claimed in addition to the federal credit. Even if a company operates in several states, or has employees across the country, state credits are usually based on the location of the activities, so a company may be eligible for multiple state credits.

Conduct Statistical Sample to Consider All Eligible Projects and Expenses

Instead of individually reviewing sometimes hundreds of projects companies undertake each year, Internal Revenue Procedure 2011-42 allows companies to conduct a statistical sample of all eligible projects to individually review a smaller subset of projects. Once the sample is complete, the company can follow the Revenue Procedure to capture all eligible expenses instead of just a subset of expenses.

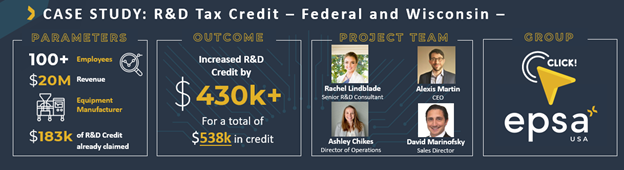

Below is an example of the results from an optimization study we conducted where we followed all of the steps listed above to maximize the credit for our client.

These are just a few of the ways to maximize the R&D credit. As R&D consultants, EPSA USA has worked with countless businesses and their CPAs to calculate an R&D tax credit. We partner with CPAs just like you to provide this valuable benefit to their clients.

If you are interested in learning more, please visit EPSA USA’s booth at one of the following PICPA online conferences this fall:

Or you can reach out to EPSA USA at info-usa@epsa.com.

Ashley Chikes is director of operations at EPSA USA. She can be reached at achikes@epsa.com.

Sign up for weekly professional and technical updates from PICPA's blogs, podcasts, and discussion board topics by completing this form.