Get Ready: The CPA Exam Is Changing

The 2024 CPA Exam will feature a brand new format. The overhaul is designed to focus more on the technological aspects of accounting while still testing the knowledge base that newly licensed CPAs are expected to know.

This blog was provided by UWorld Roger CPA Review, an Ambassador-level sponsor of the Pennsylvania CPA Foundation.

By Jennifer Boyd, CPA

By Jennifer Boyd, CPA

The 2024 CPA Exam will feature a brand new format in which candidates will sit for three core sections (Auditing and Attestation – AUD, Financial Accounting and Reporting – FAR, and Regulation – REG) and one discipline section (Information Systems and Controls – ISC, Business Analysis and Reporting – BAR, or Tax Compliance and Planning – TCP) of the test-takers choice. The overhaul is designed to focus more on the technological aspects of accounting while still testing the knowledge base that newly licensed CPAs are expected to know. In this blog, I’ll break down how the content in the new exam sections relates to the content covered on the traditional sections (AUD, Business Environment and Concepts – BEC, FAR, and REG) to give you an idea of what to expect in 2024.

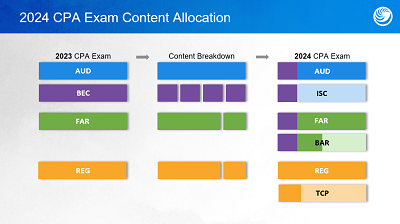

Below is a representation of how the content from the current CPA Exam will be rearranged for the new version of the exam.

(Image is for representation only and component divisions are not to scale.)

Breaking BEC

The biggest structural change candidates can expect in 2024 is the elimination of the BEC component in favor of three discipline options. Much of the BEC material will be redistributed and tested in the updated exam sections.

Certain economic topics, for example, are moving from BEC to AUD. Primarily, this would include content covering internal and external factors related to understanding an entity and its environment (e.g., supply and demand and business cycles). Some business process and internal control content has also been added to the AUD CPA Exam. Roughly 30% of the new ISC discipline will come from BEC. This includes aspects of business processes and internal controls, risks associated with IT and controls that respond to those risks, and data management and relationships. A couple of content areas are moving from BEC to the FAR CPA Exam. Among them are concepts related to understanding and applying financial statement ratios and performance metrics.

Roughly 50% of the new BAR CPA Exam will come from BEC. This includes nonfinancial measures of performance; budgeting, forecasting, and projection techniques; managerial and cost accounting concepts and the use of variance analysis techniques; factors that influence an entity’s capital structure, such as leverage, cost of capital, liquidity, and loan covenants; risk management topics including the COSO Enterprise Risk Management framework; financial valuation decision models used to compare investment alternatives; and the effect of changes in economic conditions and market influences on an entity’s business.

It's All Relative

How ISC Is Related to AUD – The new ISC CPA Exam option is designed to build off the AUD core. For this reason, we suggest candidates who select ISC as their discipline exam should sit for this section sometime after taking AUD. When taken in this manner, AUD will test your knowledge of auditing engagements, while ISC will assess your understanding and skills related to data management (including data collection, storage, and consumption across the data life cycle). Think about it this way: AUD reviews the controls and systems in place at companies to analyze whether they are sufficient. ISC determines which controls and systems should be put into place at companies in the first place.

How BAR Is Related to FAR – The BAR discipline exam is an extension of the FAR core, meaning candidates who select BAR as their discipline should plan to take it sometime after FAR. BAR includes new analysis and reporting topics and assesses your knowledge of revenue recognition, leases, business combinations, derivatives, hedge accounting, employee benefit plan financial statements, and other technical accounting matters. Essentially, FAR covers the foundational aspects of financial reporting and BAR gets into more complex and specialized knowledge areas.

How TCP Is Related to REG – The TCP CPA Exam is an extension of the REG CPA Exam, meaning candidates who select the TCP option should plan to take it sometime after REG. Thus, REG will test your general understanding of taxation and regulations, while TCP will assess tax situations at a more granular level. REG tests routine and recurring tasks for individuals and entities, while TCP tests tax and financial planning along with nonroutine and complex tax issues.

Time to Prepare

The best way to prepare for the 2024 CPA Exam changes is to create a plan now. If you complete BEC before the end of 2023, for example, you will not need to take one of the new discipline sections. It’s also to your benefit to begin studying early and develop a test-taking strategy. This might involve AICPA practice exams or a CPA Exam prep service. While the 2024 CPA Exam changes may look intimidating at first glance, there is nothing there you can’t handle with a little preparation.

Jennifer Boyd, CPA, is a CPA content developer for UWorld. She can be reached at jboyd@uworld.com.

Sign up for PICPA's weekly professional and technical updates by completing this form.

Statements of fact and opinion are the authors’ responsibility alone and do not imply an opinion on the part of the PICPA's officers or members. The information contained herein does not constitute accounting, legal, or professional advice. For actionable advice, you must engage or consult with a qualified professional.

PICPA Staff Contributors

Disclaimer

Statements of fact and opinion are the authors’ responsibility alone and do not imply an opinion on the part of PICPA officers or members. The information contained in herein does not constitute accounting, legal, or professional advice. For professional advice, please engage or consult a qualified professional.