Name, Image, and Likeness Income for Students: Not Amateur Hour When It Comes to Taxes

The U.S. Supreme Court ruled in 2021 that college and high school athletes should reap the benefits of the marketing of their name, image, and likeness (NIL). But as these young men and women will soon learn, there is no such thing as freebees in the world of sports marketing. They will soon confront a difficult, and often murky, Pennsylvania tax situation.

By Edward R. Jenkins, CPA, CGMA

By Edward R. Jenkins, CPA, CGMA

Remember those days of innocence when student athletes used to be called amateurs? Back then, perhaps the most brazen high schoolers might have asked a college recruiter, “How much will I get to play?” Today, the students are asking, “How much will I get paid?”

This evolution in 18-year-olds’ mercenary outlook is a byproduct of the 2021 U.S. Supreme Court decision in National Collegiate Athletic Association v. Alston. The court ruled that college and high school athletes should reap the benefits of the marketing of their name, image, and likeness (NIL). But as these young men and women will soon learn, there is no such thing as freebees in the world of sports marketing.

Enter the taxman.

Background

NIL income is generally paid by a collective or organization outside of the province of the universities themselves. Often, alumni donors are the creators of these collectives, soliciting donations and marketing arrangements for the benefit of the student athletes. The IRS has pretty much ruled out tax-exempt status for these collectives. (See IRS Chief Counsel Memorandum AM2023-004.) Students may also enjoy substantial affiliate marketing revenues from their social media accounts. But it doesn’t end there. Other sources of NIL income for student athletes seemingly arise daily.

NIL income is generally paid by a collective or organization outside of the province of the universities themselves. Often, alumni donors are the creators of these collectives, soliciting donations and marketing arrangements for the benefit of the student athletes. The IRS has pretty much ruled out tax-exempt status for these collectives. (See IRS Chief Counsel Memorandum AM2023-004.) Students may also enjoy substantial affiliate marketing revenues from their social media accounts. But it doesn’t end there. Other sources of NIL income for student athletes seemingly arise daily.

NIL income is generally reported to students and the IRS via Form 1099NEC. It is treated as self-employment income, subject to income tax and self-employment tax. That means student athletes earning NIL income will owe roughly 30 cents on every dollar they receive. Students often have few expenses to offset the income received, so most of the reported NIL income is fully taxable.

In addition to NIL income, some students have enjoyed an increase in scholarship funds. Recall that scholarships received are taxable income to the extent the scholarship exceeds qualified education expenses for tuition, required fees, supplies, and equipment. Some students are quite surprised when they find they owe tax on their scholarship.

If a student meets the qualified child dependent test, the student is a dependent – whether or not the parents claim the student as a dependent. At the federal level, there is some good news: the standard deduction of the student is the greater of the student’s standard deduction of $1,250 or $400 plus their earned income up to the single standard deduction. The taxable scholarship portion is included in the calculation of the earned income component. Therefore, a student with NIL income can often get the full $13,850 single-person standard deduction.

Pennsylvania Tax or Not?

When we get down to state-level taxation, there is a thorny issue: where (in which state) is the income taxable? An out-of-state student is construed as having only a temporary residence at the university, with the permanent abode being his or her family’s residence. So, does Pennsylvania have the right to tax NIL income received by an out-of-state student attending college in Pennsylvania?

Consider these scenarios for an out-of-state student athlete:

- The student receives NIL income solely for the use of their image in advertisements throughout different markets in the United States, their home state, or Pennsylvania. The student performs no service.

- The student receives NIL income, and they are expected to appear at unrelated charitable events five times during the tax year. Perhaps that’s a sports camp in New York state, a United Way event in the college town, etc. The paying organization does not specify which charitable events to attend.

- The student receives a royalty for the use of artwork containing the student’s image and the contract is clearly identified as a royalty with no service component whatsoever. (Potentially not self-employment income.)

- The student is required to appear at a photo shoot in Pennsylvania once during the taxable year.

- The student is required to appear at a photo shoot outside of Pennsylvania once during the taxable year.

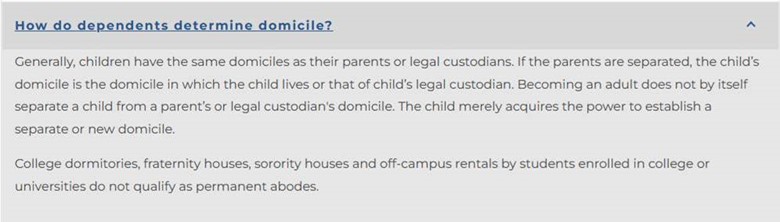

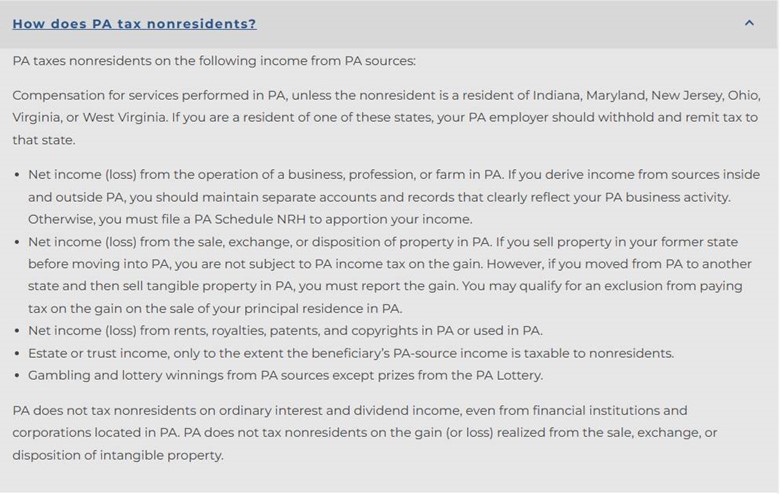

The Pennsylvania Department of Revenue provides the following guidance on its website (Determining Residency).

Source: Pennsylvania Department of Revenue

Source: Pennsylvania Department of Revenue

You can see how “Where is the NIL income taxed?” can be a bit confusing. Here is what I am looking at:

- Clearly, Pennsylvania recognizes that an out-of-state student is not domiciled in Pennsylvania.

- Employment compensation for services rendered in Pennsylvania is taxable in Pennsylvania, unless there is a reciprocity arrangement with another state. However, students earning NIL income are not employees, so that provision does not apply.

- Pennsylvania does not tax nonresidents on gain or loss realized on the sale of intangible property.

- Business income from operating a business in Pennsylvania is taxable in Pennsylvania when derived from sources in Pennsylvania.

Knowing all this, it remains uncertain whether or not Pennsylvania taxes NIL income of out-of-state students. The guidance existing today does not adequately answer the question of what happens when no services are performed, de minimis services are performed, or when a royalty is received. Does the sourcing construct refer to where the services (if any) are performed or the source of the payment? Are the royalties sourced to the student’s domicile outside of Pennsylvania?

The taxation of NIL income of student athletes will evolve as tax jurisdictions address the issues and while the NCAA and university representatives hammer out the new business model.

Edward R. Jenkins Jr., CPA, CGMA, is professor of practice in accounting for Pennsylvania State University in University Park, managing member of Jenkins & Co. LLC in Lemont, Pa., and a member of the Pennsylvania CPA Journal Editorial Board. He can be reached at erj2@psu.edu.

Sign up for PICPA's weekly professional and technical updates by completing this form.

Statements of fact and opinion are the authors’ responsibility alone and do not imply an opinion on the part of the PICPA's officers or members. The information contained herein does not constitute accounting, legal, or professional advice. For actionable advice, you must engage or consult with a qualified professional.

PICPA Staff Contributors

Disclaimer

Statements of fact and opinion are the authors’ responsibility alone and do not imply an opinion on the part of PICPA officers or members. The information contained in herein does not constitute accounting, legal, or professional advice. For professional advice, please engage or consult a qualified professional.