Spring 2025

How Is the New CPA Exam Holding Up?

A new version of the CPA Exam launched last year that incorporated three core exams and a choice of one of three discipline tests. This feature looks at the results for the majority of 2024 to see how the new exam is faring compared to the previous version.

by Ning Zhou, CPA, and Heather Demshock, CPA, CMA

Mar 21, 2025, 00:00 AM

In January 2024, the CPA Exam transitioned to a new “Core + Discipline” structure that consists of three foundational sections – Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), and Taxation and Regulation (REG) – along with the candidate’s choice of one section chosen from three disciplines – Business Analysis and Reporting, Information Systems and Controls, and Tax Compliance and Planning. Given the significance of this reform, this feature looks at exam performances one year into the new format.

In addition to the pass rates in the first three quarters of 2024, we will provide a content analysis using the CPA Exam Blueprint and the Evolution Model Curriculum (EMC) released by the AICPA and National Association of State Boards of Accountancy (NASBA) to assist future CPA candidates in understanding the new exam structure and content. Lastly, we provide a brief review of new updates in the latest CPA Exam Blueprint.

2024 CPA Exam Pass Rates Trends

The CPA Exam is widely regarded as one of the most challenging professional exams, with an average pass rate hovering around 50%, but for each section the actual pass rates varies. For instance, the FAR section often has the lowest pass rate due to its complexity, while the Business Environment and Concepts (BEC) section historically has had the highest pass rates. AICPA’s and NASBA’s CPA Evolution process, which began in 2017, officially replaced the traditional BEC exam in 2024 with a choice of discipline exams: Business Analysis and Reporting (BAR), Information Systems and Controls (ISC), and Tax Compliance and Planning (TCP). Candidates are required to select one of the discipline exams in addition to the three core exams to complete the CPA Exam. The most recent 2024 pass rates published by the AICPA and its board of examiners are particularly noteworthy since this is the first year of the new CPA Exam model in practice.1

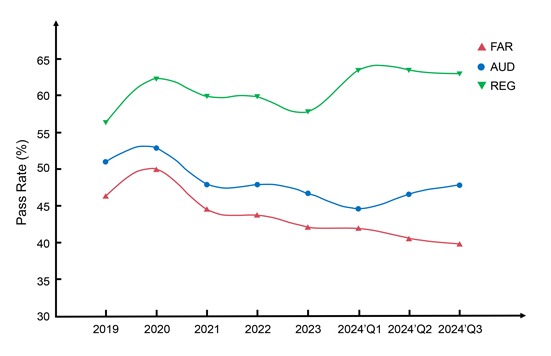

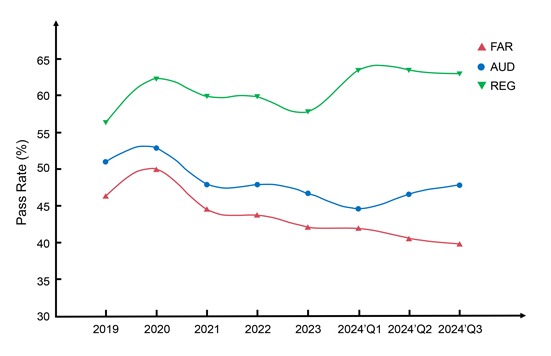

Regarding the three core exams, the pass rates are generally consistent with historical data. The average pass rate for FAR decreased slightly from 42.12% in 2023 to 40.59% in the first three quarters of 2024. The average pass rate for AUD remained stable, with 46.75% in 2023 and 46.53% in 2024. The REG section, which historically had higher pass rates, achieved the best performance by candidates among the three core sections in 2024, with an average pass rate of 63.26% compared to 57.82% in 2023.

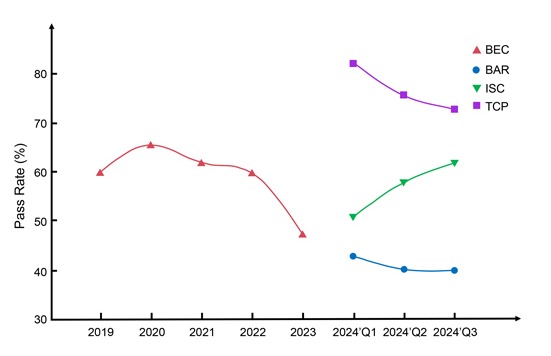

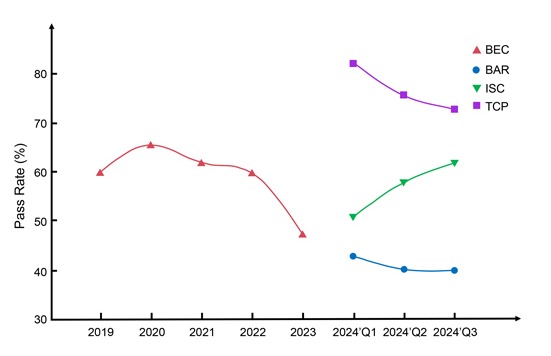

The pass rates for the new discipline exams showed significant disparity. The BAR section recorded a pass rate of 40.59%, aligning closely with the core FAR section. In comparison, the TCP section achieved the highest pass rate of 82.36% in the first quarter of 2024, with an overall cumulative pass rate of 75.42% across three quarters. The ISC section had an average pass rate of 59.14%.2

The two figures below compare the 2024 CPA Exam pass rates with those from the previous five years.3 Figure 1 displays the three core sections; Figure 2 compares the retired BEC section with the new disciplines. The clear outlier among these results is the unusually high pass rates for the TCP exam. This might suggest that adjustments to that content may need to be made to ensure the exam is appropriately rigorous. Alternatively, it could imply that colleges and preparation providers were better equipped to elevate students for that particular discipline exam.

Fig 1. Pass Rates of Core Exams FAR, AUD, and REG (2019 - Q3 2024)

Fig 2. Pass Rates of BEC and the BAR, ISC, and TCP Discipline Exams (2019 - Q3 2024)

Discipline Content Analysis

The revised CPA Exam model kept three of the core sections, with some material rearranged.4 FAR now encompasses financial reporting, selected balance sheet accounts, and specific transactions, with the financial reporting of state and local governments having been moved into BAR. Additionally, some of the more complex financial reporting items were moved from FAR to BAR (i.e., lessor accounting).5 AUD continues to cover all audit-related topics, and REG addresses ethics and professional responsibilities concerning taxation, business law, and property transactions for individuals and entities. The retired BEC exam covered a wide range of subjects, including enterprise risk management, internal controls, business processes, economics, financial management, information technology, and operations management. Its content has been redistributed across the FAR and AUD core sections and the new ISC and BAR sections.

CPA candidates now must select one discipline exam from BAR, ISC, or TCP. This approach allows candidates to demonstrate advanced knowledge and skills in a specific area of accounting practice, enabling them to tie licensure to a career path that aligns with their interests. While selecting a discipline indicates a particular focus, it does not restrict a CPA’s practice area. All individuals who pass can still engage in a variety of roles, regardless of their chosen discipline exam. Candidates may also use their discipline selection to signal potential career interests to employers during the job search.

As can be seen in the figures, there is a significant difference of the 2024 pass rates among the three new disciplines. Drawing on available information from the EMC and the CPA Exam Blueprint, along with our personal teaching experience, we provide a discussion here on the content of the three new discipline exams, their overlap with the core exams, and the ideal candidates for each discipline. It should be noted that any overlapping content is, in theory, tested at a more advanced level on the discipline exam.

Business Analysis and Reporting (BAR) – The BAR section consists of three major content areas: business analysis, technical accounting and reporting, and state and local governments. Although there are only three primary content areas, the BAR exam includes a diverse array of advanced accounting topics. Unlike the other two discipline exams, BAR content does not focus on a single aspect of accounting. It covers areas such as state and governmental accounting, which was previously in the FAR section and typically represents higher-level elective courses in accounting programs. Additionally, it includes not only cost and managerial accounting (generally taught in cost accounting classes) but also advanced financial accounting content (usually covered in advanced accounting courses). Some topics, such as hedging and foreign currency transactions and translations, are typically explored in graduate-level accounting programs due to their complexity. Data analysis is also included, often addressed in accounting information systems courses. Overall, the BAR section offers a comprehensive and multifaceted exploration of advanced accounting topics. BAR had the lowest pass rate through three quarters in 2024, at just 40.59%. It is comparable to the FAR core section, which historically has been regarded as one of the most challenging sections of the exam. Due to a significant amount of complex financial reporting topics being moved from FAR to BAR, we expected to potentially see an increase in FAR pass rates in 2024. However, that has not been the case through Q3; in fact, the pass rate declined slightly.

Ideal Candidates: Candidates who have completed advanced accounting and state and governmental accounting courses will have an advantage in passing the BAR section. Additionally, if the candidate works in the financial accounting field, the BAR content will closely align with topics encountered at work. Since governmental accounting adheres to specific standards, acquiring specialized knowledge in this area is crucial for those planning to work in the public sector. Potential career paths in the BAR discipline include governmental accountants, external auditors, corporate accountants, controllers, chief accountants, and CEOs/CFOs.6

Overlapping Core Exam Section: The BAR exam assesses advanced financial accounting topics that are similar to those in the FAR exam. The current BAR section includes many topics restructured from the previous FAR exam, such as consolidated financial statements, revenue recognition, governmentwide financial statements, employee benefit plan accounting, among others. Additionally, the BAR section incorporates topics from the former BEC exam, such as cost accounting concepts, variance analysis, and financial risk management. Beyond these shifted topics, the BAR section has new content, including accounting research and advanced data analytics. The table below illustrates overlapping and nonoverlapping topics outlined in the EMC between the BAR and FAR exam sections.

| BAR Content Analysis | |

|---|---|

| FAR Only Select financial statement accounts; financial statement analysis and metrics; financial statements and select transactions for not-for-profit entities; critical thinking; digital acumen | BAR Only Accounting research; for-profit entity financial statements; select financial statement accounts; cost accounting; employee benefit plan accounting; planning techniques; advanced data analytics |

| Similar in FAR & BAR | |

| Select financial statement transactions and events; financial statements and select transactions for state and local governments; financial data analytics | Select transactions; state and local governments; financial statement analysis |

Source: AICPA and NASBA Model Curriculum.

Tax Compliance and Planning (TCP) – Based on the first three quarters of 2024, the TCP section had a significantly higher pass rate than the other two discipline exams, with 82.36%, 75.67%, and 72.91% from Q1 to Q3 respectively, and a cumulative pass rate of 75.42%. The ISC and BAR cumulative pass rates are 59.14% and 40.59% respectively. Many candidates might have chosen TCP as their discipline section due to a familiarity with tax concepts or because they are active in the tax field. Another contribution to the high pass rate is that the content in TCP is closely align with the core REG section (explained below).

Ideal Candidates: The TCP exam focuses on various topics within the tax field, including personal financial planning, advanced entity tax compliance and planning, property transactions, and advanced individual tax compliance. Candidates with a background in tax and solid foundational knowledge or experience in the tax field will have a competitive advantage on this exam. For those candidates who performed well on REG, taking the TCP exam is advisable. We also recommend completing this discipline exam soon after preparation for REG, as the tax content studied for the REG exam will still be fresh in your mind. Potential career paths for TCP candidates include tax accountant, tax analyst, tax compliance officer, and corporate tax manager.7

Overlapping Core Exam Section: As mentioned previously, the TCP exam covers topics that closely align with those of REG, with both focusing on taxation. Many subjects included in TCP had been in the previous REG exam, such as C corporations, S corporations, gifts, and trusts. Several new topics have been incorporated into the TCP exam to reflect contemporary career paths and job requirements. The TCP and REG exams have the highest degree of overlapping content, as illustrated in the table below.

| TCP Content Analysis | |||||

|---|---|---|---|---|---|

| REG Only Responsibilities in tax practice; legal duties and responsibilities; limited liability companies | Same in REG & TCP C corporations, S corporations; partnerships; tax-exempt organizations | TCP Only Tax planning for entities; trusts; multijurisdictional tax basics; tax research; personal financial advisory services | |||

| Similar in REG & TCP | |||||

| Methods of taxation; federal tax procedures; acquisition and disposition of assets; federal taxation of individuals; technology and digital acumen | Tax accounting methods; federal taxation of entities; acquisition, use, and disposition of assets; individual tax fundamentals and tax planning; technology | ||||

Source: AICPA and NASBA Model Curriculum.

Information Systems and Controls (ISC) – There are four skill levels based on Bloom’s Taxonomy: remembering and understanding, application, analysis, and evaluation. Evaluation represents the highest skill level. In the ISC section, the allocation for remembering and understanding skills accounts for 55% to 65%, while application constitutes 20% to 30% and analysis makes up 10% to 20%. The focus of ISC is on remembering and understanding foundational knowledge related to standards, regulations, and procedures.8

Ideal Candidates: The ISC section covers information systems, information security, business processes, IT audits, service organization control (SOC) engagements, and cybersecurity. If a candidate is currently involved in these areas, the ISC exam is a great match. Candidates who have completed courses in information systems, advanced auditing, or IT will have solid foundational knowledge that can aid in passing the exam. Potential career paths in this field include IT audit, data management, and data engineering.9

Overlapping Core Exam Section: The ISC exam consists of topics that closely align with the AUD exam. Several subjects previously covered in the old AUD section are now in the ISC section. These include business processes, IT internal control design, and IT change management. New topics incorporated into ISC include IT control frameworks, SOC engagements, business continuity, and others. The table below illustrates the overlapping and nonoverlapping topics between the ISC and AUD sections.

| ISC Content Analysis | |

|---|---|

| AUD Only Audit environment; engagement planning and considerations; understanding an entity and its environment; risk assessment of fraud and noncompliance; materiality; audit evidence; audit procedures; special considerations; audit conclusion; audit reports; subsequent events and subsequently discovered facts; digital acumen | ISC Only Performing procedures; tests of internal controls; use and management of data |

| Similar in AUD & ISC | |

| Information technology; assessing risk of material misstatement; other engagements | Information security and protection of information assets; IT governance and risk assessment; SOC engagements |

Source: AICPA and NASBA Model Curriculum.

Revisions to the CPA Exam Blueprint

The latest CPA Exam Blueprint became effective Jan. 1, 2025.10 Its updates aim to refine the exam content without significantly altering its nature or scope. Here are some of the key changes:

- General Revisions – A table has been introduced that details the number and type of questions per testlet across all sections and clarifies the scope of references used in the exam.

- AUD – Examples were added in tasks related to professional conduct, internal factors, and data reliability.

- FAR – Direct method references were removed in cash flow statements for nongovernmental, not-for-profit entities, and clarification was added on income tax basis financial statements preparation.

- REG – Minor technical corrections were made.

- BAR – Revisions were added based on recent standard-setting activities, particularly in indefinite-lived intangible assets, and examples were added for capital assets and infrastructure assets.

- ISC – Updates were made to reflect new document versions, outdated cybersecurity references were removed, technical corrections were made, and a task on change management was added.

- TCP – Minor technical corrections were made, along with removal of net operating loss carrybacks in certain tax planning considerations.

Conclusion

After analyzing the initial CPA Exam pass rates on the 2024 revised testing, it is clear that the pass rates of the core sections have remained stable, while those of the three new discipline exams show a significant disparity, with TCP on the high end of pass rates and BAR on the low end. As we analyze the content of the three discipline exams, it may be helpful for candidates to understand each core section counterpart and be aware of the differences as well as overlapping content. Finally, we offered our opinion on candidate types for each of the three disciplines, and we hope this helps potential candidates or their mentors identify an exam that fits their background to ease success toward achieving the CPA credential.

1 www.aicpa-cima.com/resources/article/learn-more-about-cpa-exam-scoring-and-pass-rates

2 www.aicpa-cima.com/resources/article/learn-more-about-cpa-exam-scoring-and-pass-rates

3 www.another71.com/cpa-exam-pass-rates

4 Heather Demshock and Robert Duquette, “The New & Improved CPA Exam: A Look Inside the CPA Evolution Updates,” the Pennsylvania CPA Journal (Winter 2021).

5 Demshock and Duquette, “The New and Improved CPA Exam” (2021).

6 “How to Choose Your CPA Exam Discipline,” Gleim Exam Prep.

7 “How to Choose Your CPA Exam Discipline,” ” Gleim Exam Prep.

8 www.aicpa-cima.com/resources/article/learn-what-is-tested-on-the-cpa-exam

9 “How to Choose Your CPA Exam Discipline,” Gleim Exam Prep.

10 www.aicpa-cima.com/resources/article/learn-what-is-tested-on-the-cpa-exam

Ning Zhou, CPA, is a PhD student at the University of Scranton and an instructor in accounting at the University of Virginia’s College at Wise. She can be reached at ning.zhou@scranton.edu or nz7g@uvawise.edu.

Heather Demshock, CPA, CMA, is an associate professor of accounting at Lycoming College in Williamsport and a member of the Pennsylvania CPA Journal Editorial Board. She can be reached at demshock@lycoming.edu.

How Is the New CPA Exam Holding Up?

A new version of the CPA Exam launched last year that incorporated three core exams and a choice of one of three discipline tests. This feature looks at the results for the majority of 2024 to see how the new exam is faring compared to the previous version.

by Ning Zhou, CPA, and Heather Demshock, CPA, CMA

Mar 21, 2025, 00:00 AM

In January 2024, the CPA Exam transitioned to a new “Core + Discipline” structure that consists of three foundational sections – Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), and Taxation and Regulation (REG) – along with the candidate’s choice of one section chosen from three disciplines – Business Analysis and Reporting, Information Systems and Controls, and Tax Compliance and Planning. Given the significance of this reform, this feature looks at exam performances one year into the new format.

In addition to the pass rates in the first three quarters of 2024, we will provide a content analysis using the CPA Exam Blueprint and the Evolution Model Curriculum (EMC) released by the AICPA and National Association of State Boards of Accountancy (NASBA) to assist future CPA candidates in understanding the new exam structure and content. Lastly, we provide a brief review of new updates in the latest CPA Exam Blueprint.

2024 CPA Exam Pass Rates Trends

The CPA Exam is widely regarded as one of the most challenging professional exams, with an average pass rate hovering around 50%, but for each section the actual pass rates varies. For instance, the FAR section often has the lowest pass rate due to its complexity, while the Business Environment and Concepts (BEC) section historically has had the highest pass rates. AICPA’s and NASBA’s CPA Evolution process, which began in 2017, officially replaced the traditional BEC exam in 2024 with a choice of discipline exams: Business Analysis and Reporting (BAR), Information Systems and Controls (ISC), and Tax Compliance and Planning (TCP). Candidates are required to select one of the discipline exams in addition to the three core exams to complete the CPA Exam. The most recent 2024 pass rates published by the AICPA and its board of examiners are particularly noteworthy since this is the first year of the new CPA Exam model in practice.1

Regarding the three core exams, the pass rates are generally consistent with historical data. The average pass rate for FAR decreased slightly from 42.12% in 2023 to 40.59% in the first three quarters of 2024. The average pass rate for AUD remained stable, with 46.75% in 2023 and 46.53% in 2024. The REG section, which historically had higher pass rates, achieved the best performance by candidates among the three core sections in 2024, with an average pass rate of 63.26% compared to 57.82% in 2023.

The pass rates for the new discipline exams showed significant disparity. The BAR section recorded a pass rate of 40.59%, aligning closely with the core FAR section. In comparison, the TCP section achieved the highest pass rate of 82.36% in the first quarter of 2024, with an overall cumulative pass rate of 75.42% across three quarters. The ISC section had an average pass rate of 59.14%.2

The two figures below compare the 2024 CPA Exam pass rates with those from the previous five years.3 Figure 1 displays the three core sections; Figure 2 compares the retired BEC section with the new disciplines. The clear outlier among these results is the unusually high pass rates for the TCP exam. This might suggest that adjustments to that content may need to be made to ensure the exam is appropriately rigorous. Alternatively, it could imply that colleges and preparation providers were better equipped to elevate students for that particular discipline exam.

Fig 1. Pass Rates of Core Exams FAR, AUD, and REG (2019 - Q3 2024)

Fig 2. Pass Rates of BEC and the BAR, ISC, and TCP Discipline Exams (2019 - Q3 2024)

Discipline Content Analysis

The revised CPA Exam model kept three of the core sections, with some material rearranged.4 FAR now encompasses financial reporting, selected balance sheet accounts, and specific transactions, with the financial reporting of state and local governments having been moved into BAR. Additionally, some of the more complex financial reporting items were moved from FAR to BAR (i.e., lessor accounting).5 AUD continues to cover all audit-related topics, and REG addresses ethics and professional responsibilities concerning taxation, business law, and property transactions for individuals and entities. The retired BEC exam covered a wide range of subjects, including enterprise risk management, internal controls, business processes, economics, financial management, information technology, and operations management. Its content has been redistributed across the FAR and AUD core sections and the new ISC and BAR sections.

CPA candidates now must select one discipline exam from BAR, ISC, or TCP. This approach allows candidates to demonstrate advanced knowledge and skills in a specific area of accounting practice, enabling them to tie licensure to a career path that aligns with their interests. While selecting a discipline indicates a particular focus, it does not restrict a CPA’s practice area. All individuals who pass can still engage in a variety of roles, regardless of their chosen discipline exam. Candidates may also use their discipline selection to signal potential career interests to employers during the job search.

As can be seen in the figures, there is a significant difference of the 2024 pass rates among the three new disciplines. Drawing on available information from the EMC and the CPA Exam Blueprint, along with our personal teaching experience, we provide a discussion here on the content of the three new discipline exams, their overlap with the core exams, and the ideal candidates for each discipline. It should be noted that any overlapping content is, in theory, tested at a more advanced level on the discipline exam.

Business Analysis and Reporting (BAR) – The BAR section consists of three major content areas: business analysis, technical accounting and reporting, and state and local governments. Although there are only three primary content areas, the BAR exam includes a diverse array of advanced accounting topics. Unlike the other two discipline exams, BAR content does not focus on a single aspect of accounting. It covers areas such as state and governmental accounting, which was previously in the FAR section and typically represents higher-level elective courses in accounting programs. Additionally, it includes not only cost and managerial accounting (generally taught in cost accounting classes) but also advanced financial accounting content (usually covered in advanced accounting courses). Some topics, such as hedging and foreign currency transactions and translations, are typically explored in graduate-level accounting programs due to their complexity. Data analysis is also included, often addressed in accounting information systems courses. Overall, the BAR section offers a comprehensive and multifaceted exploration of advanced accounting topics. BAR had the lowest pass rate through three quarters in 2024, at just 40.59%. It is comparable to the FAR core section, which historically has been regarded as one of the most challenging sections of the exam. Due to a significant amount of complex financial reporting topics being moved from FAR to BAR, we expected to potentially see an increase in FAR pass rates in 2024. However, that has not been the case through Q3; in fact, the pass rate declined slightly.

Ideal Candidates: Candidates who have completed advanced accounting and state and governmental accounting courses will have an advantage in passing the BAR section. Additionally, if the candidate works in the financial accounting field, the BAR content will closely align with topics encountered at work. Since governmental accounting adheres to specific standards, acquiring specialized knowledge in this area is crucial for those planning to work in the public sector. Potential career paths in the BAR discipline include governmental accountants, external auditors, corporate accountants, controllers, chief accountants, and CEOs/CFOs.6

Overlapping Core Exam Section: The BAR exam assesses advanced financial accounting topics that are similar to those in the FAR exam. The current BAR section includes many topics restructured from the previous FAR exam, such as consolidated financial statements, revenue recognition, governmentwide financial statements, employee benefit plan accounting, among others. Additionally, the BAR section incorporates topics from the former BEC exam, such as cost accounting concepts, variance analysis, and financial risk management. Beyond these shifted topics, the BAR section has new content, including accounting research and advanced data analytics. The table below illustrates overlapping and nonoverlapping topics outlined in the EMC between the BAR and FAR exam sections.

| BAR Content Analysis | |

|---|---|

| FAR Only Select financial statement accounts; financial statement analysis and metrics; financial statements and select transactions for not-for-profit entities; critical thinking; digital acumen | BAR Only Accounting research; for-profit entity financial statements; select financial statement accounts; cost accounting; employee benefit plan accounting; planning techniques; advanced data analytics |

| Similar in FAR & BAR | |

| Select financial statement transactions and events; financial statements and select transactions for state and local governments; financial data analytics | Select transactions; state and local governments; financial statement analysis |

Source: AICPA and NASBA Model Curriculum.

Tax Compliance and Planning (TCP) – Based on the first three quarters of 2024, the TCP section had a significantly higher pass rate than the other two discipline exams, with 82.36%, 75.67%, and 72.91% from Q1 to Q3 respectively, and a cumulative pass rate of 75.42%. The ISC and BAR cumulative pass rates are 59.14% and 40.59% respectively. Many candidates might have chosen TCP as their discipline section due to a familiarity with tax concepts or because they are active in the tax field. Another contribution to the high pass rate is that the content in TCP is closely align with the core REG section (explained below).

Ideal Candidates: The TCP exam focuses on various topics within the tax field, including personal financial planning, advanced entity tax compliance and planning, property transactions, and advanced individual tax compliance. Candidates with a background in tax and solid foundational knowledge or experience in the tax field will have a competitive advantage on this exam. For those candidates who performed well on REG, taking the TCP exam is advisable. We also recommend completing this discipline exam soon after preparation for REG, as the tax content studied for the REG exam will still be fresh in your mind. Potential career paths for TCP candidates include tax accountant, tax analyst, tax compliance officer, and corporate tax manager.7

Overlapping Core Exam Section: As mentioned previously, the TCP exam covers topics that closely align with those of REG, with both focusing on taxation. Many subjects included in TCP had been in the previous REG exam, such as C corporations, S corporations, gifts, and trusts. Several new topics have been incorporated into the TCP exam to reflect contemporary career paths and job requirements. The TCP and REG exams have the highest degree of overlapping content, as illustrated in the table below.

| TCP Content Analysis | |||||

|---|---|---|---|---|---|

| REG Only Responsibilities in tax practice; legal duties and responsibilities; limited liability companies | Same in REG & TCP C corporations, S corporations; partnerships; tax-exempt organizations | TCP Only Tax planning for entities; trusts; multijurisdictional tax basics; tax research; personal financial advisory services | |||

| Similar in REG & TCP | |||||

| Methods of taxation; federal tax procedures; acquisition and disposition of assets; federal taxation of individuals; technology and digital acumen | Tax accounting methods; federal taxation of entities; acquisition, use, and disposition of assets; individual tax fundamentals and tax planning; technology | ||||

Source: AICPA and NASBA Model Curriculum.

Information Systems and Controls (ISC) – There are four skill levels based on Bloom’s Taxonomy: remembering and understanding, application, analysis, and evaluation. Evaluation represents the highest skill level. In the ISC section, the allocation for remembering and understanding skills accounts for 55% to 65%, while application constitutes 20% to 30% and analysis makes up 10% to 20%. The focus of ISC is on remembering and understanding foundational knowledge related to standards, regulations, and procedures.8

Ideal Candidates: The ISC section covers information systems, information security, business processes, IT audits, service organization control (SOC) engagements, and cybersecurity. If a candidate is currently involved in these areas, the ISC exam is a great match. Candidates who have completed courses in information systems, advanced auditing, or IT will have solid foundational knowledge that can aid in passing the exam. Potential career paths in this field include IT audit, data management, and data engineering.9

Overlapping Core Exam Section: The ISC exam consists of topics that closely align with the AUD exam. Several subjects previously covered in the old AUD section are now in the ISC section. These include business processes, IT internal control design, and IT change management. New topics incorporated into ISC include IT control frameworks, SOC engagements, business continuity, and others. The table below illustrates the overlapping and nonoverlapping topics between the ISC and AUD sections.

| ISC Content Analysis | |

|---|---|

| AUD Only Audit environment; engagement planning and considerations; understanding an entity and its environment; risk assessment of fraud and noncompliance; materiality; audit evidence; audit procedures; special considerations; audit conclusion; audit reports; subsequent events and subsequently discovered facts; digital acumen | ISC Only Performing procedures; tests of internal controls; use and management of data |

| Similar in AUD & ISC | |

| Information technology; assessing risk of material misstatement; other engagements | Information security and protection of information assets; IT governance and risk assessment; SOC engagements |

Source: AICPA and NASBA Model Curriculum.

Revisions to the CPA Exam Blueprint

The latest CPA Exam Blueprint became effective Jan. 1, 2025.10 Its updates aim to refine the exam content without significantly altering its nature or scope. Here are some of the key changes:

- General Revisions – A table has been introduced that details the number and type of questions per testlet across all sections and clarifies the scope of references used in the exam.

- AUD – Examples were added in tasks related to professional conduct, internal factors, and data reliability.

- FAR – Direct method references were removed in cash flow statements for nongovernmental, not-for-profit entities, and clarification was added on income tax basis financial statements preparation.

- REG – Minor technical corrections were made.

- BAR – Revisions were added based on recent standard-setting activities, particularly in indefinite-lived intangible assets, and examples were added for capital assets and infrastructure assets.

- ISC – Updates were made to reflect new document versions, outdated cybersecurity references were removed, technical corrections were made, and a task on change management was added.

- TCP – Minor technical corrections were made, along with removal of net operating loss carrybacks in certain tax planning considerations.

Conclusion

After analyzing the initial CPA Exam pass rates on the 2024 revised testing, it is clear that the pass rates of the core sections have remained stable, while those of the three new discipline exams show a significant disparity, with TCP on the high end of pass rates and BAR on the low end. As we analyze the content of the three discipline exams, it may be helpful for candidates to understand each core section counterpart and be aware of the differences as well as overlapping content. Finally, we offered our opinion on candidate types for each of the three disciplines, and we hope this helps potential candidates or their mentors identify an exam that fits their background to ease success toward achieving the CPA credential.

1 www.aicpa-cima.com/resources/article/learn-more-about-cpa-exam-scoring-and-pass-rates

2 www.aicpa-cima.com/resources/article/learn-more-about-cpa-exam-scoring-and-pass-rates

3 www.another71.com/cpa-exam-pass-rates

4 Heather Demshock and Robert Duquette, “The New & Improved CPA Exam: A Look Inside the CPA Evolution Updates,” the Pennsylvania CPA Journal (Winter 2021).

5 Demshock and Duquette, “The New and Improved CPA Exam” (2021).

6 “How to Choose Your CPA Exam Discipline,” Gleim Exam Prep.

7 “How to Choose Your CPA Exam Discipline,” ” Gleim Exam Prep.

8 www.aicpa-cima.com/resources/article/learn-what-is-tested-on-the-cpa-exam

9 “How to Choose Your CPA Exam Discipline,” Gleim Exam Prep.

10 www.aicpa-cima.com/resources/article/learn-what-is-tested-on-the-cpa-exam

Ning Zhou, CPA, is a PhD student at the University of Scranton and an instructor in accounting at the University of Virginia’s College at Wise. She can be reached at ning.zhou@scranton.edu or nz7g@uvawise.edu.

Heather Demshock, CPA, CMA, is an associate professor of accounting at Lycoming College in Williamsport and a member of the Pennsylvania CPA Journal Editorial Board. She can be reached at demshock@lycoming.edu.