The True Cost of Income-Driven Student Loan Repayment Plans

About 42 million borrowers owe $1.4 trillion in federal student loans under the William D. Ford Direct Loan program. Many of these borrowers have opted to participate in income-driven repayment plans because they provide the lowest initial monthly payment and forgive any balance due at the end of the repayment period. However, the short-term benefits of IDR plans can produce long-term burdens.

by Keith Donnelly, CPA (inactive), JD Mar 2, 2020, 16:44 PM

About 42 million borrowers owe $1.4 trillion in federal student loans under the William D. Ford Direct Loan program.1 Many of these borrowers have opted to participate in income-driven repayment (IDR) plans because they provide the lowest initial monthly payment and forgive any balance due at the end of the repayment period. However, the short-term benefits of IDR plans can produce long-term burdens.

IDR is an umbrella term for four different repayment plans that base the monthly student loan repayment schedule on the borrower’s income. These include income-contingent repayment (ICR); income-based repayment (IBR), which bases the payment terms on borrowing history (pre- and post-July 1, 2014); pay as you earn (PAYE); and revised pay as you earn (REPAYE). Each maintains its own terms and conditions. For this reason, monthly payments, the total amount paid over the repayment period, and the total amount potentially forgiven can vary under each IDR plan.

Borrowers seeking the lowest monthly payment may be tempted to enroll in an IDR plan. However, they may not realize that monthly payments can increase over time (resulting in the highest monthly payment) or that IDR plans have the longest repayment period.

With regard to the loan forgiveness perk, many borrowers do not understand that loan forgiveness constitutes federal taxable income (unless an exception applies, such as a borrower’s 10 years of qualified public service work under the Public Service Loan Forgiveness program). Thus, absent proper financial planning, borrowers may be subject to an unexpectedly large federal tax liability in the year of forgiveness.

The combination of these factors – the potential increase in monthly payments, a longer repayment period, and a tax liability resulting from forgiveness – can make IDR plans the repayment option with the greatest overall cost. The outcomes, however, are contingent on the situation of the borrower.

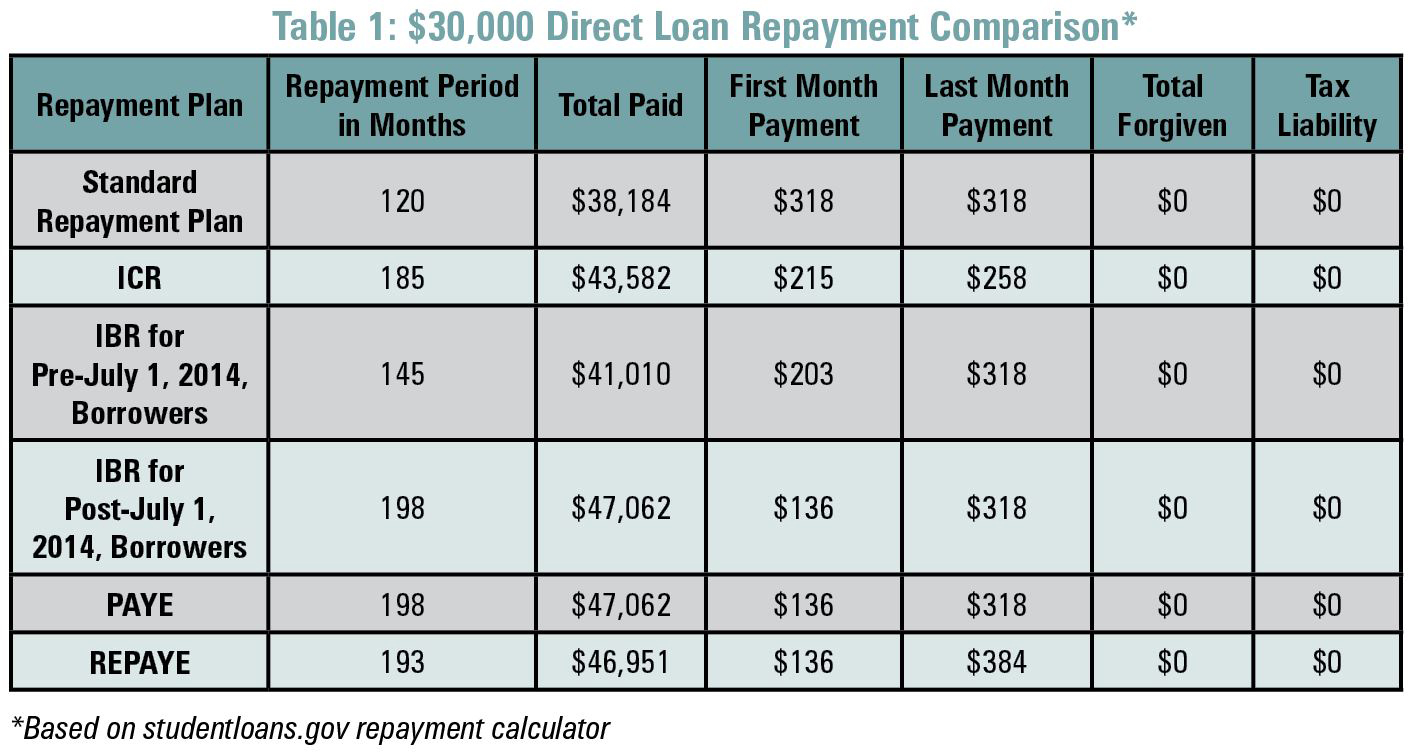

Borrowers with average federal direct loan balances and income levels generally repay the entire loan over the IDR repayment period and do not experience loan forgiveness. For example, assume a single Pennsylvania borrower has $30,000 of federal direct loans ($20,000 direct subsidized loans and $10,000 direct unsubsidized loans) with a 5% interest rate. Further, assume the borrower has an adjusted gross income (AGI) of $35,000 that is expected to grow by 5% each year.

Given these facts, Table 1 represents repayment scenarios using a standard repayment plan of 10 years and the IDR plans.

As shown in Table 1, the IDR plans for those with average federal direct loan balances have, comparatively, the lowest initial monthly payment but the greatest overall amount paid. These outcomes vary for those borrowers who have above average amounts of federal direct loans.

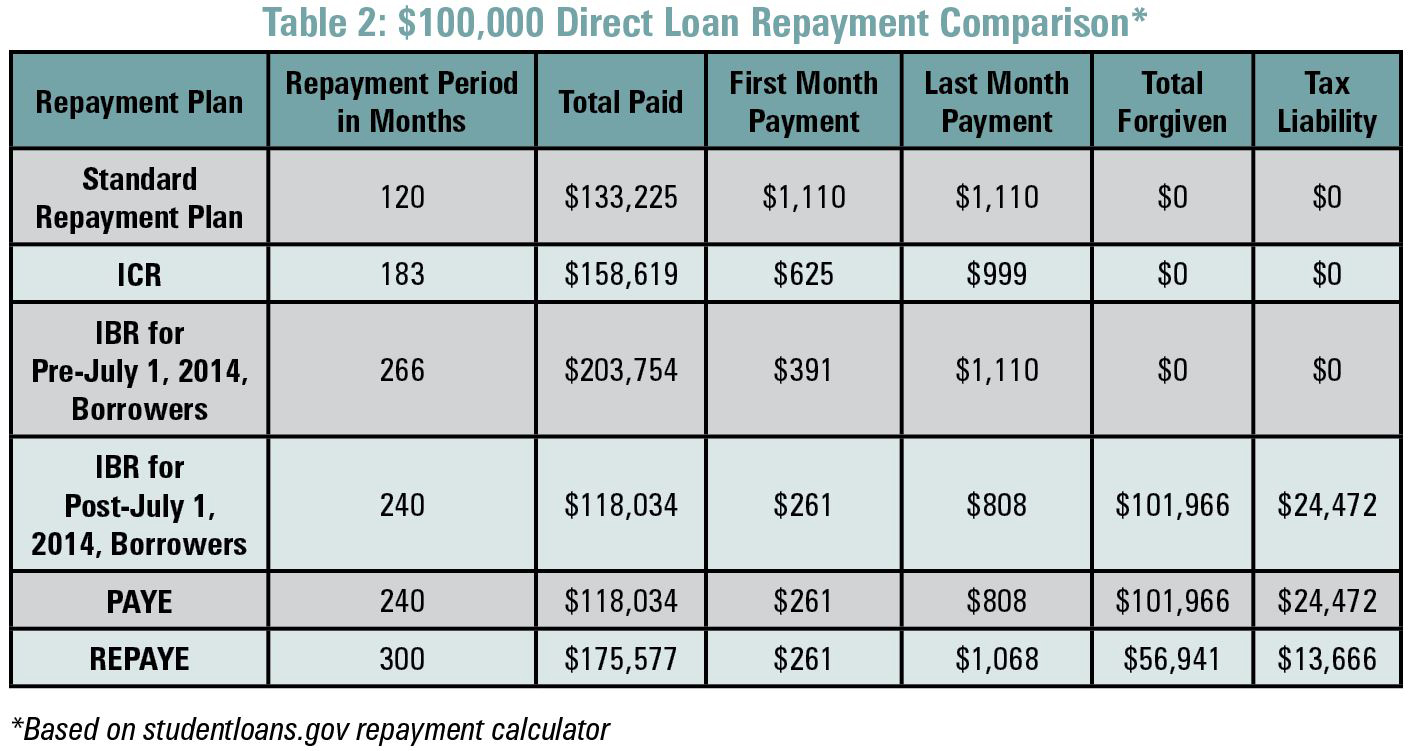

Assume a single Pennsylvania borrower has $100,000 of federal direct loans ($20,000 direct subsidized loans, $10,000 direct unsubsidized loans, and $70,000 of direct PLUS loans) with a 6% interest rate. Further, let’s say the borrower has an AGI of $50,000 that is expected to grow by 5% each year and that any loan forgiveness would be taxed at a 24% federal marginal tax rate.

Table 2 represents repayment scenarios on these facts using a standard repayment plan of 10 years and the IDR plans.

As shown in Table 2, borrowers with above-average federal direct loan balances who opt for the lowest monthly payment IDR plans will likely experience loan forgiveness in addition to escalating monthly payments. After considering both the future increase in the monthly payment and the associated tax liability with loan forgiveness, IDR plans in this scenario produce the greatest overall amount paid.

These are two of many possible scenarios. Careful financial planners should make recommendations based on the facts and circumstances of the borrower, considering both quantitative and qualitative factors. Enrollment in an IDR plan just because it has the lowest initial monthly payment is nearsighted. IDR plans can result in the longest repayment period, a tax liability, and the greatest overall amount paid.

Keith Donnelly, CPA (inactive), JD, is an assistant professor of accounting at the State University of New York, The College at Brockport. He can be reached at kdonnelly@brockport.edu.