Budget Negotiations during a Pandemic

COVID-19 has wreaked havoc on every aspect of our lives. There is no longer a routine anything. That uncertainty and trepidation is evident in Harrisburg as state lawmakers try to work through this unprecedented event.

by Peter N. Calcara, CAE Jun 2, 2020, 12:19 PM

COVID-19 has wreaked havoc on every aspect of our lives. There is no longer a routine anything. That uncertainty and trepidation is evident in Harrisburg as state lawmakers try to work through this unprecedented event. There is no playbook or script telling policymakers how to respond, what legislation to pass, or which regulations to advance. Notwithstanding the restrictions of the new normal, the General Assembly has been open for business and the legislative process is still functioning. Standing committees of the House and Senate are still considering and voting on legislation and convening public hearings.

Under normal circumstances, state lawmakers would be putting together a budget for the new fiscal year that begins July 1. A balanced budget is the only constitutionally mandated legislation required of Pennsylvania lawmakers in a given year. Prior to the statewide shutdown order on March 6, the process was moving along just like any other budget season. Budget hearings on Gov. Tom Wolf’s proposed $36 billion spending plan had commenced and low-level discussions were underway. Budget bills and supporting legislative vehicles were being maneuvered into place for future consideration.

There were two factors pointing to a relatively easy budget process this year: state elections and the economy. In addition to the national elections this year, all 203 state representatives and 25 of 50 state senators are up for election. Incumbents running for reelection want nothing more than to pass a responsible, on-time budget and get back home to their districts.

Pennsylvania also was enjoying one of its better fiscal years in recent memory. In February, fiscal year-to-date General Fund collections totaled $20.9 billion, which was $249.1 million above estimate. Through March 30, though, Pennsylvania’s General Fund collections totaled $25.3 billion, which was $45.6 million below estimate.

The novel coronavirus had hit, and there has since been great uncertainty as to how lawmakers will cobble together a budget.

New Difficulties

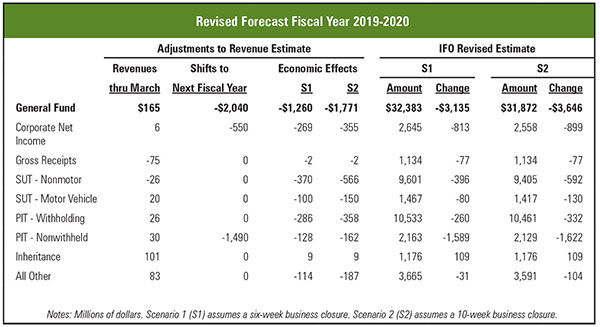

An Independent Fiscal Office (IFO) report released on April 8 points to a difficult path ahead for the Wolf administration and lawmakers. It presents potential outcomes based on the length of mandated business closures under two scenarios: S1 assumes a six-week closure; S2 assumes a 10-week closure. The IFO analysis (see the Revised Forecast chart below) assumes the following shifts to fiscal year 2020-2021:

- Two-thirds of the personal income tax final payment for tax year 2019 normally due in April

- 80% of the two estimated personal income tax payments for tax year 2020 normally received in April and June

- 90% of final corporate net income tax payments normally due in May

The third adjustment reflects the revenue impact under S1 and S2 due to lower economic activity.

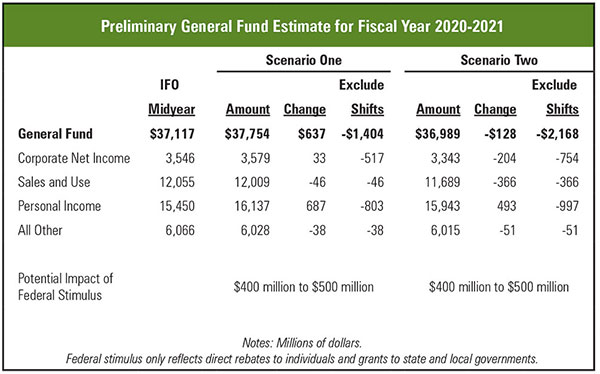

Further, IFO’s analysis has preliminary projections for fiscal year 2020-2021 based on two scenarios. The two scenarios, according to the IFO report, are compared to a preliminary revenue projection for fiscal year 2020-2021 made by the IFO for the midyear update in January 2020 that assumes “normal” economic growth. Compared to that forecast, excluding any revenue shifts into the fiscal year, IFO projects that total General Fund revenues will decline by $1.4 billion in S1 and $2.2 billion in S2, with combined fiscal year 2019-2020 and fiscal year 2020-2021 revenues falling by $2.7 billion in S1 and $3.9 billion in S2.

The budget picture in Pennsylvania is not pretty, but no state is immune to the impact of COVID-19. With so much uncertainty and the need for revenues to close the burgeoning budget gap, vigilance in our advocacy efforts against bad tax policy initiatives is paramount. As state lawmakers begin to roll up their sleeves on a 2020-2021 fiscal year budget, the PICPA Committee on State Taxation and government relations team will have boots on the ground and will be fully engaged on behalf of our membership.

CPA Law Changes

While COVID-19-related legislation and the state budget are top priorities for legislators, the PICPA and other groups continue to vie for room on state lawmakers’ agendas. In the lull between now and when a budget is possibly in place, our main legislative priority is seeking amendments to the CPA Law.

These proposed amendments will enable Pennsylvania CPAs to better meet the needs of taxpayers, consumers, and capital markets. House Bill 2288, sponsored by Rep. Mike Peifer (R-Pike), will codify a nationally recognized Code of Professional Conduct, expand the scope of education that can be applied toward an accounting degree, and strengthen the peer review requirements of CPA firms. The bill is pending in the House Finance Committee for consideration.

COVID-19 has changed our world, but it has not changed the need to be involved and engaged in the legislative process. Want to help? Visit www.picpa.org/cpa-pac today.

Peter N. Calcara, CAE, is PICPA vice president – government relations. He can be reached at pcalcara@picpa.org.