Subscribe for Weekly Updates

CPA License Renewal: What Do You Do if CPE Falls Short or You Face an Audit?

By Lori Braden, vice president – marketing and communications

This blog was originally posted in the last reporting period and has been updated for the 2020-2021 cycle.

Pennsylvania CPAs’ biennial license renewal and reporting period ended Dec. 31, 2021. If you fulfilled your CPE requirements, submitted your renewal, and received your renewed license, congratulations! If you fell short of your education requirements, forgot to renew, or got selected for an audit, I’ve provided some helpful instructions on what to do next.

What happens if I didn’t meet the 20-credit-hour CPE minimum per year?

While Pennsylvania CPAs are required to earn 80 hours total over the two-year licensing period, they also must earn a minimum of 20 hours of CPE each year. Failure to complete 20 hours of acceptable CPE each year comes with disciplinary action: for the first offense there is a fine of $300, and for second or subsequent offenses there is formal action.

The State Board of Accountancy has a schedule of civil penalties for CPAs who fail to meet their CPE requirements. For first offenses, the fines are as follows:

- 1-20 hour deficiency - $300

- 21-40 hour deficiency - $600

- 41-60 hour deficiency - $800

- 61-80 hour deficiency - $1,000

If audited, what do I need to send to the Pennsylvania State Board of Accountancy?

After each renewal deadline, the State Board of Accountancy selects a random number of renewals for an audit. The audit will require you to provide documentation of individual CPE hours. You will need to send copies of your signed certificates of completion for the reporting period totaling a minimum of 80 credit hours. Certificates of completion must contain the information found in the State Board of Accountancy’s regulations, including the signature of the CPE sponsor.

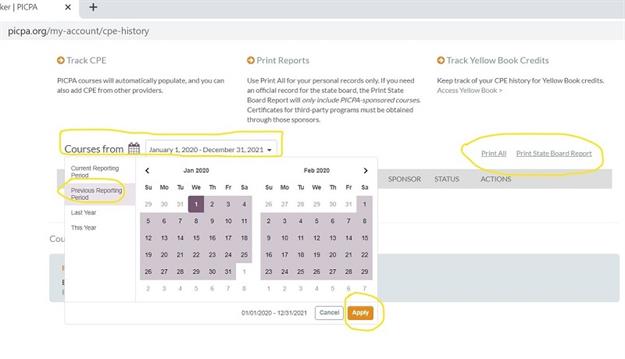

If you take CPE with the PICPA, you can print signed certificates for individual courses as well as a signed summary transcript at www.picpa.org. Just follow these steps:

• Visit the My Account section of PICPA’s site.

• Select “CPE History.”

• Use the calendar to select the timeframe for the last reporting period.

• Select “Print State Board Report” for a signed transcript of the courses and credits you’ve taken with the PICPA. You can also print certificates for individual courses.

When should I receive my license in the mail?

The State Board will verify that your renewal application has been accurately completed and then reissue permits to practice. Allow seven to 10 business days for the printing and mailing of your license; however, this may take longer during peak renewal times. You will receive an email confirmation when your license is renewed. You can also visit the State Board's PALS site to check the status of your license.

The PICPA does not issue licenses, but we can provide guidance and support during the renewal process. Should you communicate with the State Board during your renewal, we suggest that you maintain a copy of any correspondence with the State Board.

You can call the Board at 1-833-DOS-BPOA or submit a help desk ticket through the PALS website at www.pals.pa.gov. You can also email the State Board of Accountancy. If you have questions for the PICPA, email or call (215) 496-9272.

Sign up for weekly professional and technical updates in PICPA's blogs, podcasts, and discussion board topics by completing this form.

Leave a commentOrder by

Newest on top Oldest on top