Subscribe for Weekly Updates

CPA Exam Evolution: Several Pathways for Success

This blog was provided by UWorld Roger CPA Review, an Ambassador Level sponsor of the Pennsylvania CPA Foundation.

By Jennifer Boyd, CPA

By Jennifer Boyd, CPA

The CPA Exam is undergoing what the American Institute of CPAs (AICPA) and National Association of State Boards of Accountancy (NASBA) call the CPA Evolution initiative. In short, the exam is being restructured into a new model that accounts for the critical thinking skills required of modern CPAs while also incorporating more technology and data-related knowledge. The new format deviates from the traditional menu of four established and required subjects for all, and instead embraces three core tests for all followed by a choice of one of three discipline tests. Naturally, test-takers will have a few questions:

- How will the CPA Evolution impact my career?

- How will these changes impact my journey to licensure?

- Should I take the exam now or wait? What if I’m caught in the middle of the change?

I'll do my best to clarify these common concerns from my perspective as a CPA content developer at UWorld.

CPA Exam Transition Policy

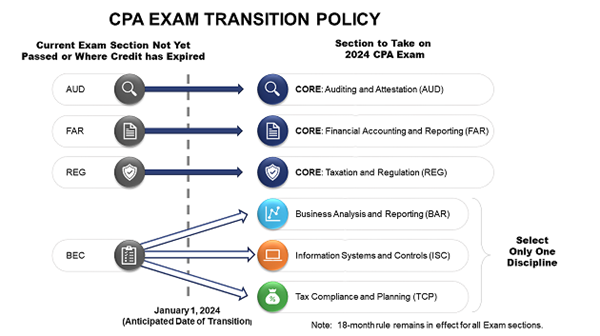

Many candidates are having difficulty wrapping their arms around the new exam format because, let’s be honest, change is uncomfortable. I’m here to let you know that the AICPA and NASBA want to simplify the process and minimize disruptions. They’ve developed a plan, outlined below, to make the transition as seamless as possible, no matter when you plan to sit for the CPA Exam.

Source: https://nasba.org/wp-content/uploads/2022/02/policy.png

Once 2024 rolls around, any existing auditing and attestation (AUD), financial accounting and reporting (FAR), or taxation and regulation (REG) pass credit will be applied to the updated core version, one for one. If you have credit for passing the business environment and concepts (BEC) section, the credit will be applied to one of the new discipline sections. This means candidates who pass BEC before 2024 and complete the other three sections in the 18-month window do not need to take one of the new discipline tests. So, if you plan to take any exam sections before January 2024, it pays to plan ahead and personalize your test-taking strategy.

Here are a few pathways to consider.

Option 1: Complete the CPA Exam Before the 2024 Changes – If you are an eligible candidate who is ready to take all four sections of the exam before January 2024, I say go for it! You’ve worked hard to get to this point and don’t need to let these changes distract you from your goals. This path allows you to put your head down and focus. You will also receive your CPA license sooner, and who doesn’t want that? With that said, do not rush your preparation or schedule an exam prematurely just to avoid new exam sections. Jumping in before you are ready is a recipe for disaster.

Option 2: Complete the CPA Exam Before and After the 2024 Changes – The CPA Exam transition policy was developed with flexibility in mind. Instead of enforcing a rigid switch to the new exam format, the AICPA and NASBA wanted to ensure that they were being fair to candidates. If you have concerns about the new AUD section (the section we anticipate candidates to struggle with the most), plan to take the current AUD exam. If you struggle with general business concepts but are stronger in technology, plan to take the new ISC discipline exam and forego the current BEC. There are a number of combinations to choose from that you should certainly explore to tailor the exam to your experience and preferences.

Option 3: Complete the CPA Exam After the 2024 Changes – The final option would be to take all four CPA Exam sections once the new format is available. Candidates who choose this path will have to demonstrate a better understanding of the technology used in the CPA profession. Learning new technologies may be intimidating for some, but don’t let it deter you. Any good CPA review course will make certain you have the requisite knowledge to succeed in all of the new exam sections. Furthermore, we’ve heard that many candidates are excited to choose a discipline and focus their study efforts on an area in which they intend to specialize or just have an interest.

What’s the Best Order to Take the 2024 CPA Exam?

While the order you take the CPA Exam largely comes down to preference, the new exam is designed in a way that encourages an intuitive order based on your chosen discipline. We recommend taking your chosen discipline section at some point after its related core section:

- If you plan on BAR, your order could be AUD, FAR, BAR, and REG.

- If you plan on ISC, your order could be AUD, REG, ISC, and FAR.

- If you plan on TCP, your order could be AUD, REG, TCP, and FAR.

You may have noticed that we suggest you sit for AUD first, no matter what. This is because we anticipate it to be the most difficult exam section and recommend you get over that hurdle as soon as possible. Keep in mind that the new CPA Exam will keep the 18-month rule, so you will still have an 18-month window to complete all four exam sections. This is a rolling window that begins on the date that you sat for your first exam section passed.

Other Tips for Pennsylvania CPA Candidates

Despite such major changes to the CPA Exam, much of your preparation strategy should remain the same:

- Make a realistic study plan that gives you enough time to learn the material outlined in the AICPA blueprints.

- Identify your strengths and weaknesses to eliminate surprises on exam day.

- Learn the why behind each practice problem you complete.

- Ensure you know Pennsylvania’s CPA Exam and licensure requirements.

Last, but certainly not least, keep a positive attitude. The journey to CPA licensure is a marathon, not a sprint. Every current CPA was once a candidate putting in the time to master critical accounting principles. Enjoy the journey and get support from your fellow PICPA members as needed.

Jennifer Boyd, CPA, is a CPA content developer for UWorld. She can be reached at jboyd@uworld.com.

Sign up for weekly professional and technical updates from PICPA's blogs, podcasts, and discussion board topics by completing this form.

Leave a commentOrder by

Newest on top Oldest on top