Clarifying the TCJA, and Section 263A Regs Finally Official

The Office of Information and Regulatory Affairs operated with reduced staff during the partial government shutdown, but special funding last year ensured that reviews and other activities stemming from the Tax Cuts and Jobs Act would continue. Other tax updates issued in the latter part of 2018 include the recent release of the Joint Committee on Taxation’s General Explanation of Public Law 115-97, commonly referred to as the bluebook, and the long-awaited guidance on Section 263A negative additional costs.

by Brendan P. Cox, CPA Mar 4, 2019, 11:43 AM

The Office of Information and Regulatory Affairs (OIRA) operated with reduced staff during the partial government shutdown, but special funding last year ensured that reviews and other activities stemming from the Tax Cuts and Jobs Act (TCJA) would continue. Other tax updates issued in the latter part of 2018 include the recent release of the Joint Committee on Taxation’s (JCT) General Explanation of Public Law 115-97, commonly referred to as the bluebook, and the long-awaited guidance on Section 263A negative additional costs.

OIRA Guidance Projects

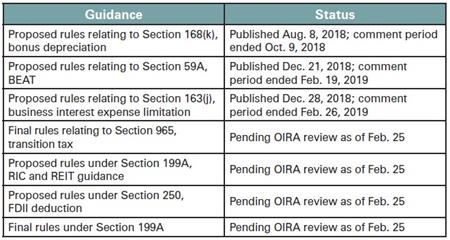

The U.S. Treasury is expected to keep up its ambitious pace of regulatory releases related to the TCJA during 2019. The chart below indicates the status of several important guidance projects:

Bluebook Released

On Dec. 20, the JCT released the much-anticipated bluebook, which provides comprehensive technical descriptions of the TCJA and identifies several technical corrections needed. The bluebook isn’t intended to serve as reliance guidance, but it does shed light on congressional intent. Additionally, and perhaps most importantly, the bluebook reflects the technical corrections that Congress recognizes as needed and influences the Treasury and IRS as it writes guidance.Section 263A Regulations

Six years after the issuance of proposed regulations addressing the treatment of “negative additional 263A costs,” the final regulations have been published, and apply to tax years beginning on or after Nov. 20, 2018. For any tax year that both begins before Nov. 20, 2018, and ends after Nov. 20, 2018, the IRS has stated that it will not challenge return positions consistent with the final regulations.Section 263A negative additional amounts generally occur when a taxpayer capitalizes a cost as a Section 471 cost that is greater than the amount required to be capitalized for tax purposes, applying the rules of Section 263A. For example, Section 174 (research) costs or pick-and-pack costs may be capitalized to inventory for financial reporting purposes, but are not required to be capitalized for tax purposes. In addition, certain book-to-tax differences result in an overcapitalization of book inventory costs.

Back when Notice 2007-291 was issued, the IRS stated that, pending the issuance of additional guidance, it would not challenge the inclusion of negative amounts in calculating additional costs under Section 263A or the permissibility of aggregate negative additional Section 263A costs. With the issuance of these regulations, the IRS will be free to challenge a taxpayer’s method of removing negative 263A costs if the method does not comply with the final regulations.

To address compliance, the IRS simultaneously issued Revenue Procedure 2018-56 to modify Revenue Procedure 2018-31 and provide procedures by which a taxpayer may obtain automatic consent to make certain accounting method changes to conform to the final regulations. These include changes to the revised modified simplified production method, changes to revoke a historic absorption ratio election, changes to comply with the new definition of Section 471 costs, and changes to use the new de minimis rules and safe harbors. Revenue Procedure 2018-56 modifies Revenue Procedure 2018-31, and is effective for tax years ending on or after Nov. 20, 2018.

Finally, taxpayers may want to consider using the final regulations and the new automatic accounting method changes provided in Revenue Procedure 2018-56 to assist with overall tax reform planning and analysis.

1 Notice 2007-29, July 16, 2007, Request for Comments and Interim Guidance Regarding Allocation of Costs under the Simplified Methods of Accounting under Section 263A.

Brendan P. Cox, CPA, is a member of both the Pennsylvania CPA Journal Editorial Board and the PICPA Federal Taxation Committee. He can be reached at bpcox1970@gmail.com.