The New & Improved CPA Exam: A Look Inside the CPA Evolution Updates

The CPA Evolution initiative, a joint project between the National Association of State Boards of Accountancy (NASBA) and the AICPA, was created to transform the CPA licensure model. It was undertaken to embrace the changing skills and competencies required of CPAs, today and into the future.

by Heather M. Demshock, CPA, CMA, and Robert E. Duquette, CPA Nov 30, 2021, 15:49 PM

The CPA Evolution initiative, a joint project between the National Association of State Boards of Accountancy (NASBA) and the AICPA, was created to transform the CPA licensure model.

It was undertaken to embrace the changing skills and competencies required of CPAs, today and into the future.1

The CPA Evolution initiative, a joint project between the National Association of State Boards of Accountancy (NASBA) and the AICPA, was created to transform the CPA licensure model.

It was undertaken to embrace the changing skills and competencies required of CPAs, today and into the future.1

Entry-level CPAs are handling tasks that require more critical thinking, professional judgment, and problem-solving skills because many of the basic tasks that had been done by new CPAs have been automated or offshored. At the same time, though, the body of knowledge that new CPAs need to know has grown immensely since the last major changes were made to the CPA Exam. According to the AICPA and NASBA, compared with 1980, there are three times as many pages in the Internal Revenue Code, four times as many accounting standards, and five times as many auditing standards. So, ready or not, a new model of the Uniform CPA Exam is launching in January 2024 to cover it all.

The current model of the CPA Exam includes four parts: Regulation (REG), Business Environment and Concepts (BEC), Audit and Attestation (AUD), and Financial Accounting and Reporting (FAR). REG covers ethics and professional responsibilities related to tax, business law, and taxation of property transactions, individuals, and entities. The BEC exam includes a wide range of topics, including enterprise risk management (ERM), internal controls and business processes, economics, financial management, information technology, and operations management. AUD includes all audit-related topics, and FAR consists of the conceptual framework, standard-setting, and financial reporting (including what is required for state and local governments).

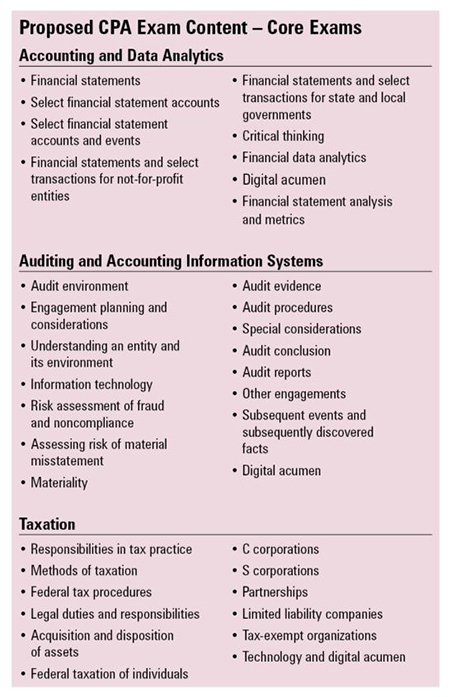

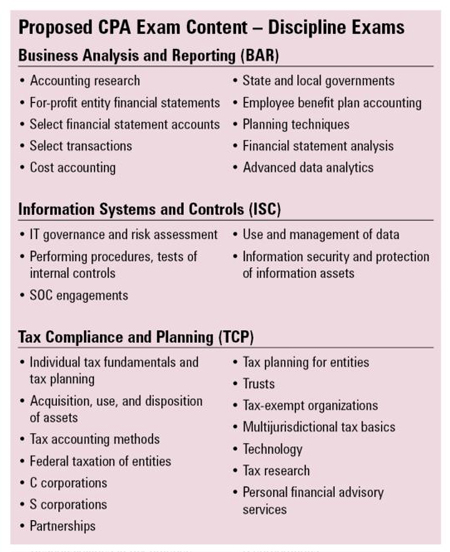

The new CPA Exam being introduced will include three core exam sections: Accounting and Data Analytics, Auditing and Accounting Information Systems, and Taxation. In addition to the core, CPA candidates will have to choose one additional discipline exam from a selection of three: Business Analysis and Reporting (BAR), Information Systems and Controls (ISC), or Tax Compliance and Planning (TCP), as summarized in the chart below.

Regardless of which one of the three disciplinary exams a candidate chooses to take, the CPA formula will be the same:

3 Core Exams + 1 Discipline Exam = CPA.

To properly evaluate the new model, a comparison to the old model is necessary. Note that a blueprint has not yet been released by the AICPA for the new model, so this comparison is being completed using the CPA Evolution Model Curriculum released by NASBA and the AICPA in the summer of 2021. The proposed core and discipline exams are summarized in the following chart.

We’ll also look at each content area and provide an overview of where the old exam material (based on the CPA Exam blueprint effective July 20, 2021) will be included in the new structure, evaluate new material being added, and consider what is being deleted. We believe, especially for academia, that it is critical to get an understanding now of the exam (i.e., a core or optional discipline exam) in which content will be tested because that framework impacts which course offerings will include “required” knowledge as opposed to “elective” knowledge; what additional topics and skills will be assessed and need to be integrated into the curriculum; and which topics are being dropped, thus freeing curriculum capacity to handle some of the new content. These changes will probably necessitate curriculum changes in many, if not most, schools, beginning with sophomore-level courses, to prepare students for the 2024 launch of the new exam.

In academia, the curriculum adjustment process is time-consuming and requires considerable effort to identify changes and obtain necessary department and college approvals. Outside of academia, understanding the new exam content and structure will help practitioners guide new staff toward completion of the CPA Exam. It should also help with the employment outlook for new CPAs once employers realize the additional relevant skills their new recruits will bring to the marketplace. The following charts provide an overview of how the content in the old structure will be redistributed in the new exams.

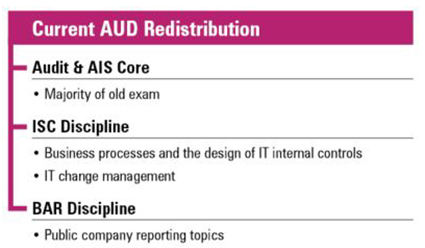

AUD Restructuring – A large portion of the old AUD will be included in the Auditing and AIS core exam. However, a few key items will move to the Information Systems and Controls and the Business Analysis and Reporting discipline exams.

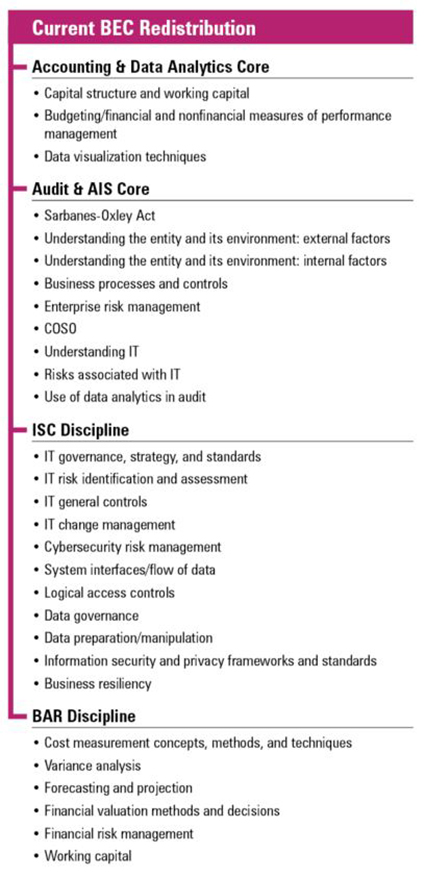

BEC Restructuring – The content of the BEC test will shift around significantly. Some content will appear in two core sections while other areas will shift to optional discipline sections. The understanding is that the content shifted to a discipline exam will be tested at a higher level with more complexity.

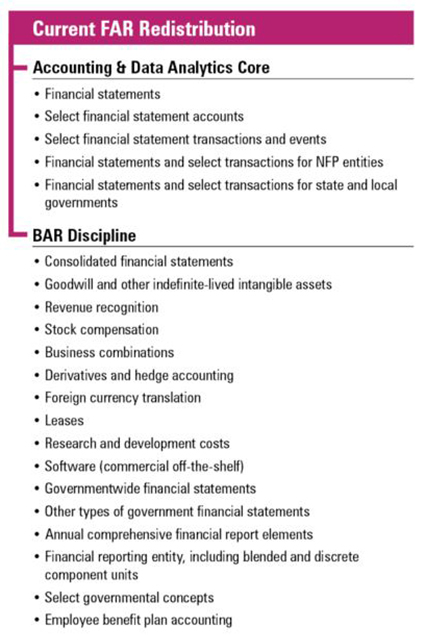

FAR Restructuring – The current FAR exam content has been split between the Accounting and Data Analytics core exam and the Business Analysis and Reporting discipline exam.

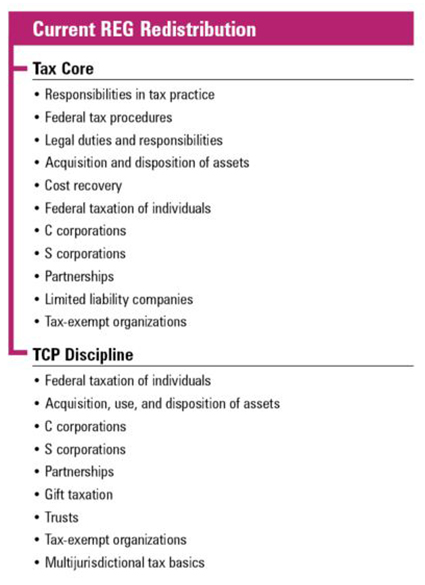

REG Restructuring – The tax portion of the current REG exam has mostly been split between the Tax core exam and the Tax Compliance and Planning discipline exam. Some topics may appear in a core section as well as in a discipline section.

The content in the discipline exam will be tested at a higher level, with more scope and additional considerations.

New Content

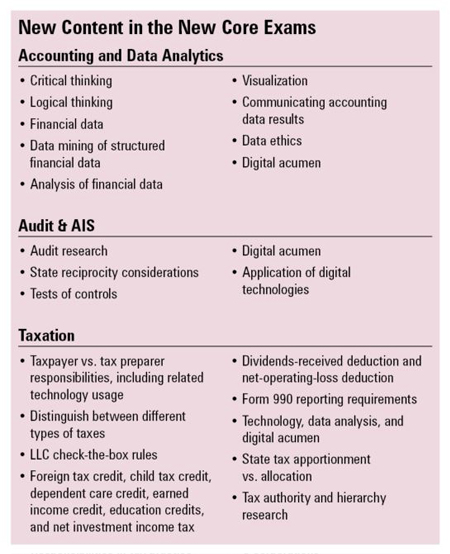

The content included within the new exam model should reflect the increased knowledge demands graduates face entering the workforce. According to a member of the AICPA board of examiners, the board is “trying to embrace what’s changing in the profession and the business environment and the skills a newly licensed CPA will need to possess for licensure.”2 The additions to the exam are considered essential to continue to protect the public interest. The following chart lists supposedly previously untested material that now will be included in the core exams, according to the proposed Model Curriculum.

Note, this list may include topics that are, in fact, already included in the current exam but are not specifically identified that way in its blueprint.

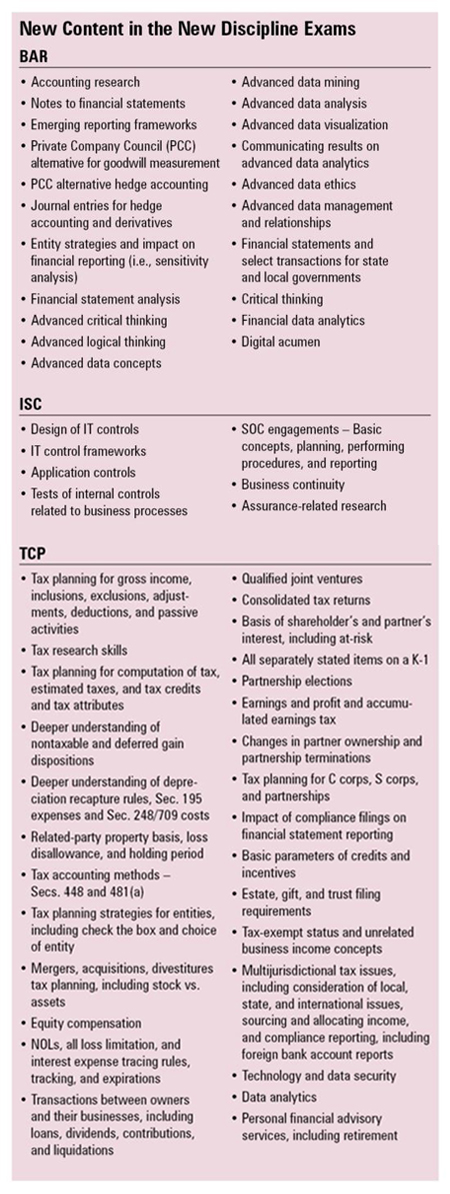

The new discipline exams will include a considerable amount of new content. The intention behind these exams is that candidates would select one of the three exams based on interest, employer recommendations, or the accounting curriculum they

have completed. If a topic is in the current exam model and is listed as content being proposed for a new discipline exam, it is because additional issues and considerations on that topic have been added.

Deletions

The amount of new content in the proposed CPA Exam model is significant. Only a few major deletions, however, have been identified. The most notable are as follows:

- Process management

- Journal entries for income tax provisions

- Capital structure

- Drafting audit reports

- Base erosion and anti-abuse tax

- Foreign-derived intangible income

- Built-in gains tax for S corporations

- All nontax (i.e., business law topics) currently included in REG.

One could easily argue this list must be an oversight given their relevance and significance. It is, therefore, possible that these topics will be added back later as the new exam blueprint is developed and updated with stakeholder input.

Considerations

There are quite a few considerations to evaluate going forward. The most basic is how do colleges and universities prepare for these substantial changes? Smaller colleges with limited faculty and funds could have a tougher time adapting their curriculum to accommodate the changes. Potential solutions, subject to internal budget constraints, could be rehauling the curriculum, training current faculty, or creating partnerships with larger universities to provide courses outside the scope of expertise of the small departments. Hopefully, textbook publishers and CPA Exam review providers will assist with a quick release of revised textbooks or addendums to current material to give faculty a guide to what content they believe should be covered, in what order, and for which piece of the exam.

Because so much content is being added and very little is being removed from the exams, faculty may have to make tough decisions on topics currently being taught: some may have to be eliminated or de-emphasized to cover the breadth of the material being tested. This has the potential consequence of less depth for more breadth, at least to be able to fulfill the accounting major requirement for most students and allow them to be successful in the core exams. Another possibility is that colleges will design their curricula to adequately prepare students for the core exams, but vary in their coverage of discipline exam topics.

It remains unclear where the line will be drawn when content is included on a core exam and a discipline exam. For example, critical thinking and logical thinking will be included on the Accounting and Data Analytics core, while advanced critical thinking and advanced logical thinking will be included on the Business Analysis and Reporting exam. Where is the ceiling for one and the floor for the other? Another example of content included on both a core exam and a discipline exam is tax related to partnerships and S corporations, specifically the tax issues related to computing basis, transactions between owners and their entities, and understanding the implications of the separately flowing items from K-1s. There are many other topics throughout the new model with this same dual-coverage ambiguity. What makes a topic advanced versus not advanced? Will there be something tangible that can be used to determine the distinction (e.g., the future blueprint or a set of criteria)? Without clear guidelines, there will be difficulties in designing an effective curriculum and efficiently preparing students.

What’s Next

In the coming months, the AICPA and NASBA are expected to share details on the development of the exams as they continue to solicit stakeholder feedback. In July 2021, a content survey was released to help guide the development of the exam. Data

was gathered from stakeholders using that survey from July to September 2021. The next step in the timeline is a Practice Analysis Exposure Draft expected in July 2022. This will contain content task statements identifying the skills that will be

assessed on the new exam. Finally, the AICPA and NASBA are expected to announce new exam details to candidates and publish new blueprints in January 2023, with an expected exam launch date of Jan. 1, 2024. To stay up to date, faculty can get the latest

updates on the CPA Evolution initiative by joining AICPA’s faculty hour webcast series.3

1 www.evolutionofcpa.org

2 Ken Tysiac, “Content for Redesigned CPA Exam Takes Shape,” Journal of Accountancy (July 7, 2021). www.journalofaccountancy.com/news/2021/jul/redesigned-cpa-exam-content.html

3 www.thiswaytocpa.com/faculty

Heather M. Demshock, CPA, CMA, is an associate professor of accounting and chair of the accounting department for Lycoming College in Williamsport, and a member of the Pennsylvania CPA Journal Editorial Board. She can be reached at demshock@lycoming.edu.

Robert E. Duquette, CPA, is professor of practice in the College of Business at Lehigh University, a retired EY senior tax partner, and a member of the Pennsylvania CPA Journal Editorial Board. He can be reached at red209@lehigh.edu.

Leave a commentOrder by

Newest on top Oldest on top