Filtering for Clarity: PCC’s Efforts to Clean Financial Reporting Requirements for Private Companies

The Financial Accounting Foundation (FAF) established the Private Company Council (PCC) in 2012 to improve the process of setting accounting standards for private companies. The principal assertion underlying the foundation of the PCC was that users of private company financial statements are significantly different than users of public company financial statements, therefore the accounting language should be tailored accordingly. With 10 years under its belt, now is a good time to review what the PCC has been doing and where it should be going.

by James J. Newhard, CPA Sep 14, 2022, 13:28 PM

The Financial Accounting Foundation (FAF) established the Private

Company Council (PCC) in 2012 to improve the process of setting accounting standards for private companies.

The Financial Accounting Foundation (FAF) established the Private

Company Council (PCC) in 2012 to improve the process of setting accounting standards for private companies. The principal assertion underlying the foundation of the PCC was that users of private company financial statements are significantly different than users of public company financial statements, therefore the accounting language should be tailored accordingly. With 10 years under its belt, now is a good time to review what the PCC has been doing and where it should be going.

Overview

The mandate of the PCC is to recognize that the needs of public and private company financial statement users, preparers, and auditors are not always aligned. So, it was charged with two principal responsibilities:- Determine whether exceptions or modifications to existing nongovernmental U.S. generally accepted accounting principles (U.S. GAAP) are necessary to address the needs of private company financial statement users. It should identify, deliberate, and vote on any proposed changes, which would be subject to endorsement by the Financial Accounting Standards Board (FASB) and submitted for public comment before being incorporated into GAAP.

- Serve as the primary advisory body to the FASB on the appropriate private company treatment for items under active consideration on the FASB’s technical agenda.

Proposed changes should ensure comparability of financial reporting among disparate companies by putting in place a system that recognizes differences (but avoids a “two-GAAP” system).

A Private Company Decision-Making

Framework1 was established, which was followed by a number of initial concepts that eventually became “PCC standards” on intangibles, derivative relief in plain-vanilla swaps, and variable interest entity (VIE) consolidation

relief for related-party leasing arrangements (ASUs 2014-02, 2014-03, 2014-07, and 2014-18). Many early topics resulted in FASB actions that had some private company considerations. The PCC also played a significant role in what is deemed “the

simplification initiative,” which had a direct impact on topics including development-stage entities, discontinued operations, going concern, push-down accounting, extraordinary items, and imputed interest from debt-issuance costs. The decision-making

framework uses five factors to distinguish the financial reporting needs and objectives of nonpublic entities from other entities, and which could drive the identification of alternative applications:

- The type and number of financial statement users and their access to management – The types of users and their needs are major factors in deciding when GAAP should be modified. Not only is report distribution smaller and controlled in private companies, but users often can access management personally if more information is needed. Nonfinancial information also tends to be more important.

- Investment strategies of primary users – Primary users of private company financial statements are not investors tracking their holdings, but rather owners and creditors focused on cash flows to service debt, pay dividends, or fund buyouts.

- Ownership and capital structure – A substantial portion of private companies are pass-through entities that are tax driven. Transfer of ownership is limited. This results in different priorities in areas such as income taxes, reporting equity, and consolidation.

- Accounting resources – Private entities often use small public accounting firms that tend to be “generalists.” This constituency needs plain English standards and more motivation to participate in standard-setting. This is where the cost/benefit issue is key.

- New financial reporting guidance – Practitioners and preparers who work with smaller, private entities often access professional education in smaller doses when compared to large firms, where current developments are analyzed and communicated regularly. Early implementation by public companies is helpful and allows time to learn new requirements. Implementation guidance in the codification should include more private company examples.

Whether and when exceptions or modifications to GAAP are warranted for private companies, the PCC ultimately needs the FASB to agree on the criteria. After a PCC vote of at least two-thirds to advance a proposal, the FASB must ratify by a majority the

elements of existing (or proposed) GAAP being considered for possible exceptions or modifications.

Advisory Successes

In a video recognizing PCC’s 10 years, Candace Wright, PCC chair, cited three areas of accomplishment:

- Outreach to private company stakeholders via town hall meetings and other communications.

- Championing several private company alternatives to some specific standards, as well as PCC’s lobbying for many electable private company practical expedients, implementation deferrals, and reduced disclosure requirements throughout the codification.

- Through its input, PCC has helped make U.S. GAAP stronger and more relevant, not just for private companies but also for all reporting entities, thus making more meaningful information accessible to investors and users.

It is through this advisory capacity that the PCC has some noteworthy accomplishments. The PCC has helped move U.S. GAAP generally toward simplification and expediency in topics such as ASC 350, Intangibles—Goodwill and Other (streamlining

and reducing complexities in testing for impairment and determining triggering events and the reporting date of related impairment provisions) and ASC 810, Consolidation (including ASU 2018-17 which both superseded and expanded the VIE consolidation

exception provided in ASU 2014-07 as well as targeted simplicity involving decision-making fees to related parties, which impacts both public and private companies alike).

Current Issues

In response to the business turmoil produced by the COVID-19 pandemic, the PCC has been pushing for expanded considerations regarding GAAP and matters of debt (Topic 470), including the handling of Paycheck Protection Program (PPP) loans and the forgiveness

provisions. Existing guidance may not be adequate when subsequent events provide assurance of forgiveness, yet contractual guidance is to be followed. Additionally, matters relating to troubled debt restructuring and modifications may need an alternative

for private companies with regard to the 10% threshold used in debt modification.

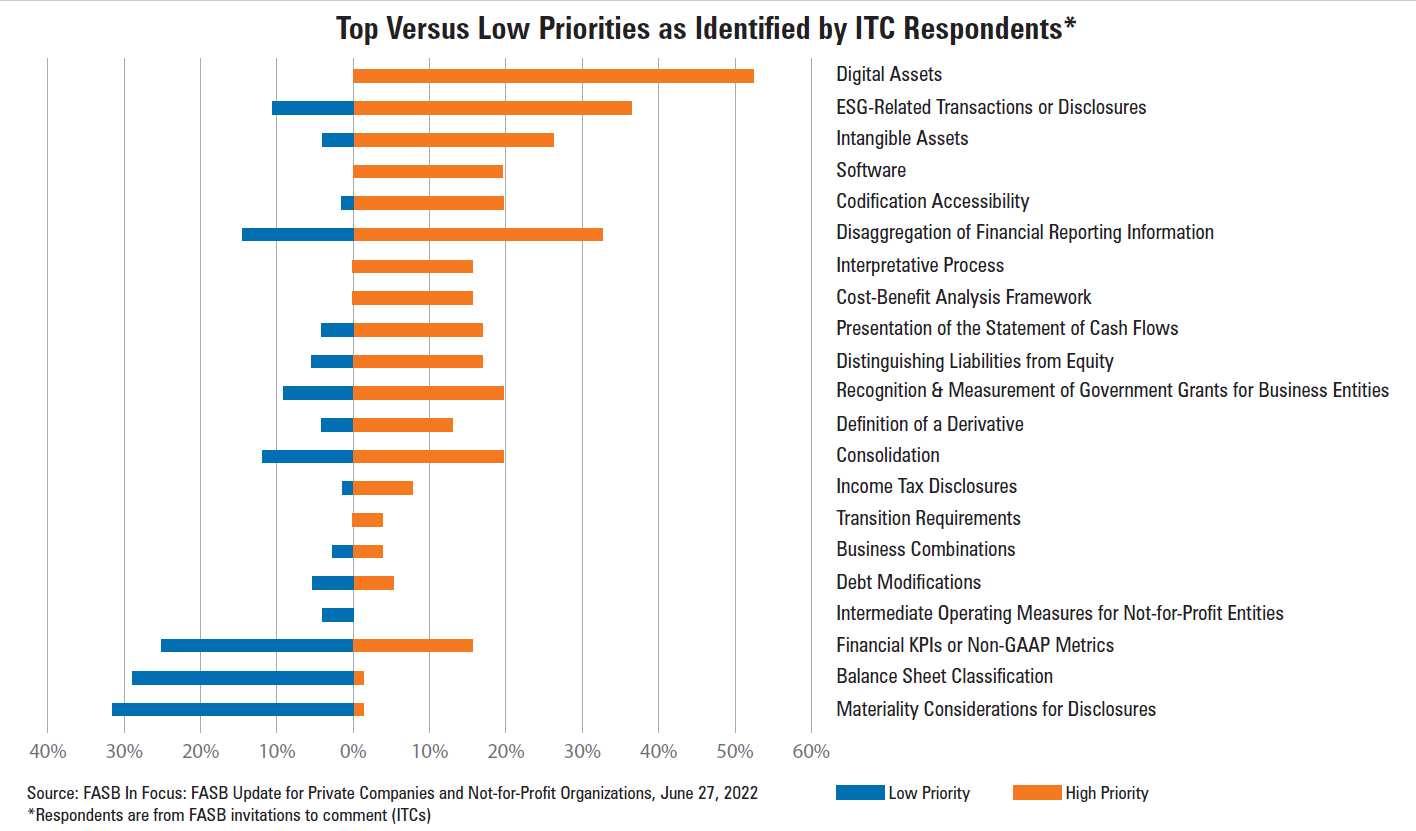

Looking forward to what else eventually may be on the FASB/PCC negotiating table, view the chart. It identifies high and low priority

issues among those responding to FASB invitations to comment. Right now, though, PCC is working on several important efforts. As of April 2022, the issues that follow are on PCC’s agenda.

Profit Interests and the Interrelationship with Partnership Accounting – Profit interests are a special class of equity used in partnerships or LLCs, the purpose of which is to give employees the opportunity to participate in the equity upon an offering or sale or as incentive compensation. Thus,

profit interest awards can be used to provide a compensatory incentive, akin to a performance bonus, a profit-sharing arrangement, or a deferred-compensation contract.

From a U.S. GAAP perspective, applicable guidance would be governed

by Topic 710, Compensation – General, or Topic 718, Compensation – Stock Compensation. Upon recognition, the former would be classified as a liability (present valued), while the latter requires evaluation of whether it should

be classified as equity or liability (fair valued).

The PCC recommends that the FASB address the issue of determining the appropriate scope of guidance for profit interest awards: when a reporting entity grants profit interests as

compensation, it must identify which authoritative guidance is applicable to measure, recognize, and present (classify) the award and the related compensation cost. Per the PCC, there is no current authoritative guidance that explicitly discusses

profit interests; entities sometimes arrive at accounting conclusions that make the accounting for profit interests inconsistent with the accounting for economically similar arrangements; and profit interests have become a more common form of compensation.

In fact, the PCC has found that the single largest population using profit interest awards is private equity portfolio companies. The PCC supports developing illustrative examples to include in the codification along with additional education materials

to mitigate practice diversity, but this is not enough. PCC notes this would provide neither a private company alternative nor a practical expedient.

ASC 842 Implementation Issues – After the last COVID deferral

expires, 2022 is the year ASC 842, Leases, must be adopted and applied by private companies. PCC is concerned with the challenges private companies will face, including evaluating individually immaterial lease agreements that may or may not

be material in the aggregate, allocating costs to lease and nonlease components (and extent of companies that will claim the single-lease component practical expedient), addressing diversity in practice in the accounting for contingent lease incentives,

capitalization thresholds, and the use of leasing software by private companies.2

In June 2022, a FASB/PCC Update for Private Companies re-emphasized that year-to-year leases that have long been renewed (usually related-party

leases) must look to substance over form and must apply ASC 842 over the expected length of the lease term that is reasonably certain to be exercised. Many contend this is different than what the standard states: related-party leases are assessed

using the same lens used for nonrelated-party leases. This remains a significant private company issue.

A post implementation review (PIR) on the leasing standard is monitoring application and implementation among nonpublic companies;

performing outreach and surveys with preparers, practitioners, and users; and exercising practical expedients for future assessments and PIR conclusions and findings.

PCC members continue to press the private company concerns noting

that many related-party leases are between entities under common control. Some of those leases have written terms that may not be at arm’s length, while many other leases are unwritten. PCC members emphasize that those factors make it difficult

for private companies to determine the existence of legally enforceable terms of a related-party arrangement for purposes of applying ASC 842. The PCC proposed establishing ways in which it (or the FASB) could assist private company stakeholders in

applying the related-party lease requirements in ASC 842 through educational materials (such as a FASB staff Q&A) and/or codification improvements. Finally, the PCC proposed performing outreach with private company stakeholders to determine whether

the issue with applying the ASC 842 related-party lease requirements is limited to common control arrangements or includes other related-party arrangements.

Credit Losses – As the 2023 implementation of the

current expected credit losses (CECL) requirements for private companies rapidly approaches, the recently issued ASU 2022-02, Financial Instruments – Credit Losses (Topic 326): Troubled Debt Restructurings and Vintage Disclosures is

a response to earlier PCC observations/comments and the PIR on the credit loss provisions in ASU 2016-13, Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. It is important to note

that the FASB’s PIR had been conducted prior to the majority of private companies adopting and implementing CECL. Although the PCC has shared concerns on nonpublic entities’ readiness to adopt the CECL guidance, which is effective for

nonpublic calendar entities Jan. 1, 2023, the FASB concluded that it would not further defer the effective date for nonpublic companies.

Accounting for Government Grants – When it comes to presenting government

grants, feedback to FASB indicates that in the absence of authoritative guidance, businesses typically analogize to IAS 20, Accounting for Government Grants and Disclosure of Government Assistance, or Subtopic 958-605, Not-for-Profit Entities – Revenue Recognition.

The PCC notes that private companies lean more toward IAS 20, and encourages FASB to research the presentation of government grants in financial statements. The PCC also cites user preferences for gross vs. net presentation, and encourages FASB to

evaluate presentation optionality, as it creates inconsistency.

Accounting for and Disclosure of Intangibles – On this research project (which includes software costs, internally developed intangibles, and R&D),

FASB respondents primarily highlighted challenges from the increasing divergence of entities’ book values and market capitalizations on balance sheets of internally developed intangibles, the divergence of recognition and measurement guidance

for different intangible assets, the complexity and lack of relevance of evolving software guidance, and the lack of decision-useful information for users.

The PCC cites the increased prevalence of intangible assets in private companies,

particularly acquired intangible assets vs. internally generated. Further, PCC notes that private companies often present acquired software as property, plant, and equipment (PP&E) and developed software as intangibles.

Accounting for Financial Instruments with Environmental, Social, and Governance (ESG) Linked Features and Regulatory Credits – ESG-Linked Financial Instruments is a research project in response to a growing focus among interested parties, including investors, credit rating agencies, lenders, preparers, regulators, and policy makers. Feedback from invitations to comment (ITCs)

identified issues related to the application of GAAP, including the following:

* Whether or not ESG-related provisions within financial instruments are required to be bifurcated and separately accounted for as stand-alone derivatives.

* The bifurcation criteria to be applied for an embedded derivative to ESG-linked financial instruments is both costly and complex.

* ESG features frequently meet the bifurcation criteria, thus requiring them to be separately

accounted for as derivatives.

* If bifurcation is required, then estimating the fair value of ESG features requires significant judgment, and the fair value of such features may not provide decision-useful information to users of

financial statements.

The PCC says ESG is an emerging area that is becoming more prevalent for private companies and more important when making capital allocation decisions. There is an expectation for increased ESG reporting

in the future.

Accounting for and Disclosure of Digital Assets – Digital assets is a newly added project to the FASB technical agenda due to increasing application, but with various applied accounting and disclosures.

Crypto is one significant subset of digital assets, and the use of crypto (e.g., bitcoin) is as prevalent for private companies as it is for public companies. Accordingly, digital assets are a private company matter that necessitates PCC advocacy.

A divergence occurs around whether to apply indefinite-lived intangible asset guidance to digital assets or whether fair value financial instruments/inventory guidance would apply. Fueling uncertainty are the AICPA practice aid, Accounting for and Auditing of Digital Assets (a nonauthoritative guide), the interpretive guidance in AICPA’s 2021 Brokers and Dealers in Securities – Accounting Guide, and the SEC-issued Spotlight on Initial Coin Offerings3 (ICOs). Congress has called

upon FASB to “create accurate and consistent financial reporting of a large and fast-growing financial asset class.” In addition to these U.S. factors, the IASB, as recently as April 2022, voted to not add a project on cryptocurrencies

and related transactions.

PCC members acknowledge that digital assets are a growing area of interest for private company preparers and practitioners. The PCC cites the need for guidance on the recognition, measurement, and balance

sheet classification of digital assets, as well as enhanced internal controls needed to audit digital assets, the volatility inherent in using the impairment model, and the accounting for digital assets used to settle receivables.

Digital

asset accounting and disclosure matters will definitely, and increasingly, impact private company financial statements. Given the fundamental purpose of the PCC, it will clearly need to assess potential private company relief to what may be an extremely

complex reporting topic.

Looking Forward

With the accelerating growth of intellectual, technological, and social advancements, it is imperative that FASB and PCC respond in a manner that measures, recognizes, presents, and discloses these factors in a meaningful, consistent, and comparative

manner. How private companies report on these matters must make sense to the consumers of their financial reports and not get bogged down in indecipherable GAAP presentations. It has become extremely important – maybe more so than 10 years ago

– that there be an insightful and influential advocate for private companies. Private companies need the PCC to be strong and active as new and ever more complex financial reporting concerns arise.

1 This deemed “differential framework” is titled Private Company Decision-Making Framework, A Guide for Evaluating Financial Accounting and Reporting for Private Companies.

2 Though outside the scope of the FASB/PCC, the AICPA Code of Professional Conduct recently issued independence interpretations ET 1.295.145 – Information System Services and ET 1.295.113 – Assisting Attest Clients with Implementing Accounting Standards, which certainly impact CPAs in public practice trying to help attest clients adopt and implement ASC 842.

3 www.sec.gov/ICO

James J. Newhard, CPA, is a sole practitioner in Paoli, a CPE presenter for Kaplan Financial Education, and a past-president of PICPA’s Greater Philadelphia Chapter. He serves on numerous PICPA committees, including the Pennsylvania CPA Journal Editorial Board. He can be reached at jim@jjncpa.com.

Leave a commentOrder by

Newest on top Oldest on top