Pa. Office Set Up to Help with IRA Renewable Energy Tax Credits

Pennsylvania Gov. Josh Shapiro created the Office of Critical Investments to maximize the federal funding made available in recent years, particularly through the 2022 Inflation Reduction Act. Louie Krak, infrastructure coordinator with the Office of Critical Investments, discusses the major tax credit incentives that are available to a wide swath of Pennsylvania entities interested in investing in diverse sources of renewable energy.

by Louie Krak Mar 12, 2024, 00:00 AM

Pennsylvania Gov. Josh Shapiro created the Office of Critical Investments to maximize and leverage the historic federal funding made available in recent years through key pieces of legislation, in particular the 2022 Inflation Reduction Act (IRA).

Pennsylvania Gov. Josh Shapiro created the Office of Critical Investments to maximize and leverage the historic federal funding made available in recent years through key pieces of legislation, in particular the 2022 Inflation Reduction Act (IRA).

The mandate for the Office of Critical Investments includes performing outreach on the opportunities that exist for financing renewable energy projects using IRA tax credits, which can amount to 30% to 70% upon completion of an eligible investment.

Prior to the IRA’s passage in 2022, Internal Revenue Code (IRC) Section 48, Investment Tax Credit for Energy Property, provided a maximum credit of 26% in 2020-2022 and was set to decrease to 22% in 2023 and 10% in 2024 and thereafter. However, the IRA increased the value of the tax credit to 30% through 2032 for renewable energy projects under 1 megawatt (MW) of generation output. Projects greater than 1 MW must meet new prevailing wage and apprenticeship requirements to receive the full 30% credit, which decreases to 6% if these requirements are not satisfied. The Section 48 credit and the corresponding IRC Section 45, Production Tax Credit for Electricity from Renewables, are uncapped, so there is no limit to the number of entities that can claim these credits or the amount of total investment that can be generated. Eligible technologies under Section 48 include fuel cell, solar, geothermal, small wind, energy storage, biogas, microgrid controllers, and combined heat and power properties.

In addition to the 30% base credit, the IRA also offers bonus credits that can be stacked to increase the incentives. This would include both the Section 48 and 45 credits, as well as the Domestic Content Bonus Credit, a 10% add-on for projects in which a certain portion of the steel, iron, and manufactured products used in the construction of a qualifying facility are produced in the United States. The U.S. Department of Treasury released interim guidance on this bonus credit in May 2023.

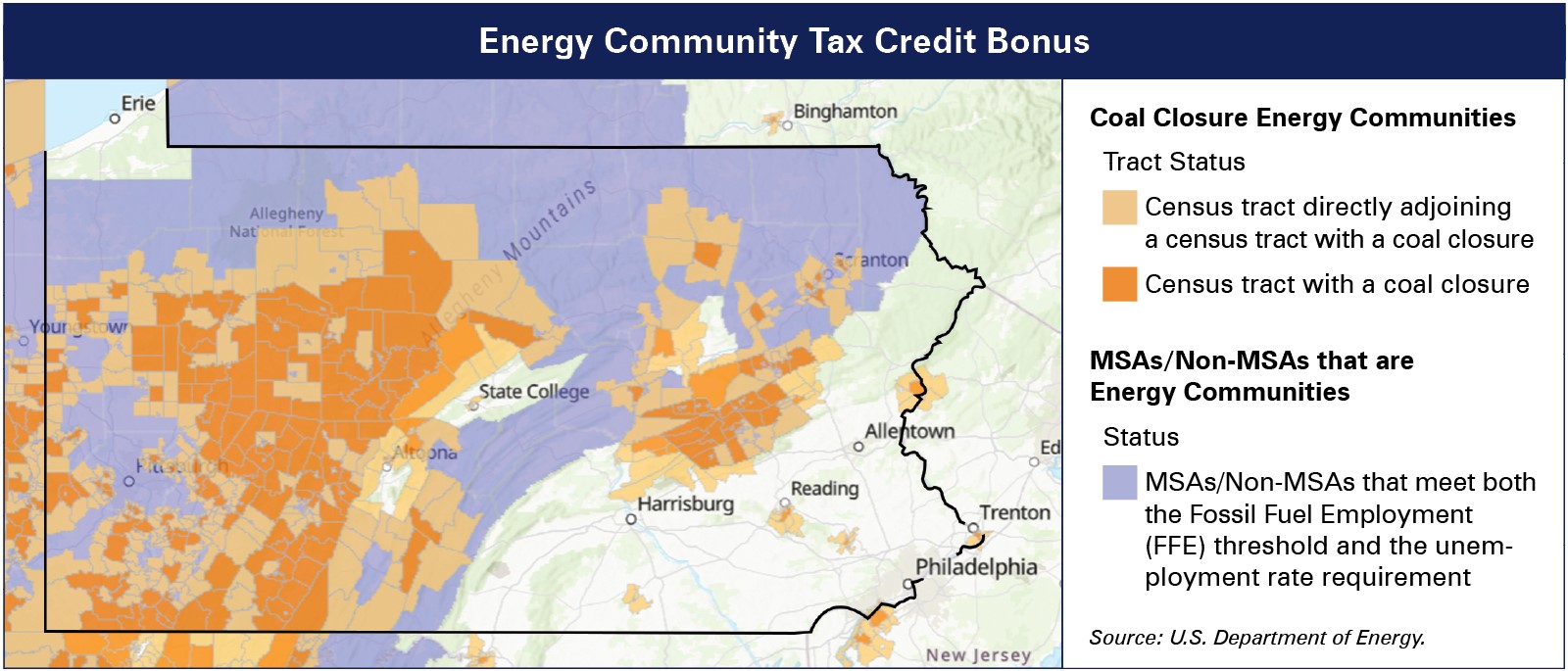

Treasury also issued guidance on the Energy Communities Bonus Credit, which provides a 10% add-on for projects located in areas with closed coal mines or coal-fired power plants, brownfield sites, and areas that have significant employment in, or local tax revenues from, fossil fuels and higher than average unemployment. The U.S. Department of Energy created a mapping tool to help identify Energy Communities. Approximately two-thirds of Pennsylvania qualifies for this bonus credit. Please note that brownfields are not shown on the map.

The IRA created the Low Income Communities Bonus Credit Program that provides an additional credit of 10% to 20% for certain facilities located on Native American tribal land, in federally subsidized housing, in low-income communities, or in low-income economic benefit projects.

IRA tax incentives are available to many Pennsylvania entities interested in investing in diverse sources of renewable energy. Although this article focuses on the Section 48 Investment Tax Credit, the IRA also provides tax credits for commercial clean vehicles, energy-efficient homes and commercial buildings, advanced manufacturing, clean fuel, and several others. Twelve of the tax credits are subject to an Elective Pay provision that expands the pool of entities that can use them.1 Through Elective Pay, or Direct Pay, entities that would otherwise be unable to claim certain tax credits because they do not owe federal income tax can still benefit. By choosing this election, the credit is treated as a payment of tax, with any overpayment resulting in a refund.

Applicable Entities

Applicable entities for IRA credits include the following:

- Tax-exempt organizations under Section 501(a), including Section 501(c) and Section 501(d) organizations.

- State or political division thereof.

- Rural cooperatives.

Treasury does not consider partnerships to be applicable entities under the proposed regulations. This shuts out typical public/private partnerships. Many public comments have been filed requesting that partnerships be included as applicable entities under the final regulations. Alternatively, applicable entities can engage with other entities, such as private developers, by co-owning a project through a tenancy-in-common or by engaging in a joint ownership agreement and electing out of Subchapter K treatment. Taxable C corporations and S corporations are also not considered applicable entities, even if owned by an applicable entity. However, they may elect to be treated as an applicable entity with respect to the IRA tax credits for carbon sequestration, production of clean hydrogen, or advanced manufacturing for five years.

The administrative mechanics of Elective Pay require several steps. First, an applicable entity must identify the qualifying project or activity and pursue it to completion. They should then work with an accountant and attorney to calculate the credit. Once the project has been completed and placed into service, the applicable entity must determine the taxable year in which the project is placed in service and complete an IRS prefiling registration form and obtain a registration number for each applicable credit property. This will include providing information about the applicable entity, which applicable credits they intend to earn, and each eligible project/property that will contribute to the credit. The IRS will provide a registration number for each applicable credit property to include on the tax return as part of making the Elective-Pay selection. Then, they must file Form 990-T and Form 3800, provide the registration number for each eligible property by the tax return due date, and make a valid Elective-Pay selection.2 The applicable entity will receive the amount of the credit in the form of a tax-free cash payment after IRS processing.

Transferability

The IRA introduced another monetization method for commercial and utility-scale energy projects through a transferability provision, which allows for-profit project owners and other ordinary, nonexempt taxpayers to monetize certain tax credits by transferring them to other taxpayers for cash. Previously, only private developers could access the Section 48 and 45 credits. Oftentimes, they would have to turn to the tax credit equity market to form complicated partnerships if the developers lacked sufficient income tax liability relative to their credit-eligible investments to access the full value of the tax credit. In this scenario, developers could transfer credits to an investor in exchange for an equity investment to help finance the project.

Commercial, for-profit companies can now monetize the Investment Tax Credit and Production Tax Credit through the IRA’s transferability provision. This effectively eliminates the additional time and expense incurred when forming complex tax partnerships, affording developers the opportunity to own their projects fully for the life of the project. Furthermore, simplifying these transactions will broaden the pool of potential investors, which will in turn increase demand and competition for the tax credits and allow developers to retain a higher percentage of the value of their tax credits. Transferability will likely also broaden the pool of financeable clean energy projects by providing access to funding for smaller projects that have been historically unattractive to large investors.

Conclusion

The IRA offers unique opportunities to invest in clean energy infrastructure through stackable bonus credits, Elective Pay, and transferability. To maximize the value of IRA tax credits in Pennsylvania, financial and tax professionals must be able to articulate this value to their clients as well as help them navigate the administrative processes to claim the credits. Pennsylvania’s Office of Critical Investments will continue to spread this message, but it will rely on the financial community to ascertain the magnitude of the opportunity to drive forward transformative projects.

1 For projects or facilities beginning construction in 2024 or later, Elective Pay for the Section 48 Investment Tax Credit and Section 45 Production Tax Credit phases down and is eventually eliminated if the domestic content requirement is not met.

2 An applicable entity can include multiple applicable credit properties (i.e., registration identification numbers) on the same 990-T Form if they are for the same applicable tax year.

Louie Krak is energy infrastructure coordinator with the Pennsylvania Governor’s Office of Critical Investments. He can be reached at lkrak@pa.gov.

Leave a commentOrder by

Newest on top Oldest on top