Subscribe for Weekly Updates

Your Cost Segregation Questions Answered

By Bruce A. Johnson, CRE, MBA

By Bruce A. Johnson, CRE, MBA

When talking about cost segregation, I find that the same questions come up time and again. In this blog, I’ve pulled together answers to 10 of the most common queries I’ve encountered, plus a few links to additional resources.

What Is a Cost Segregation Study?

Any given property contains a multitude of different assets, and each of them can be expected to have a different useful life. For example, you can confidently expect ceramic flooring to last longer than carpet. Tax law provides guidance on how long different assets might last through the Modified Asset Cost Recovery System (MACRS). The default MACRS class-life for most capital assets is 39 years, or 27.5 years for assets in a multifamily property. That means that if no cost segregation study is performed, assets will typically be depreciated over 39 years for commercial property or 27.5 years for residential. Now, that makes sense for ceramic flooring, but not for carpet. Why should carpet just sit on the books, being depreciated over 39 years?

In a cost segregation study, engineers identify and quantify building assets and then assign each asset a cost. These costs are then segregated into different categories according to their depreciable asset class lives. Base building, or “shell,” assets remain 39-year assets, but many others can be moved into shorter-lived classes:

- 5-year assets: carpet tile, counters, break room sinks, cabinetry and decorative moldings, specialty lighting, dedicated outlets, fire extinguishers, and more.

- 7-year assets: office furniture.

- 15-year assets: land improvements like drainage pipes, parking lots, landscaping, outdoor swimming pools, protective bollards, sidewalks, and more.

By segregating assets into shorter-lived categories, they can be depreciated more quickly, resulting in tax savings and increased cash flow. View this variety of examples to get a sense of the potential benefit.

Can I Do My Own Cost Segregation Study?

The concept of cost segregation is fairly easy to grasp, so many people think that performing a cost segregation study must be easy as well. Actually, performing a quality cost segregation study is no simple feat. It requires the skills and experience of a trained engineer.

The concept of cost segregation is fairly easy to grasp, so many people think that performing a cost segregation study must be easy as well. Actually, performing a quality cost segregation study is no simple feat. It requires the skills and experience of a trained engineer.

Engineers draw on their knowledge of construction methods and related costs as they meticulously work their way through a project site, laboring to account for every possible asset. During a site visit, engineers perform a forensic analysis of the property’s unique details. Then, assets will be “broken out,” assigned costs, and finally placed in the appropriate class-life category. The results must be analyzed from tax and technical perspectives to ensure complete accuracy and compliance with IRS regulations.

In fact, the IRS’s Cost Segregation Audit Techniques Guide lists 13 “Principal Elements of a Cost Segregation Study.” The first element is “Preparation by an Individual with Expertise and Experience,” with the guide explicitly stating that “a study by a construction engineer is more reliable than one conducted by someone with no engineering or construction background.”

In short, studies should be performed by experienced engineers who can provide reports that maximize savings while remaining defensible in the unlikely event of an audit.

Can a CPA Firm Do a Cost Segregation Study?

In some situations, CPA firms may indeed be able to perform a cost segregation study. These firms are generally very large with engineers on staff. Most firms, however, don’t have the resources to manage that, so they often work with a third-party cost segregation provider. It’s important to choose an independent third-party that both the CPA and the client feel is trustworthy, so do your homework before selecting a provider.

Choosing a cost segregation provider – You want to be certain that you and your clients are in the best possible hands. To select a quality cost-segregation provider, consider asking these questions:

- How many studies have been performed by your team?

- Will my study be performed by a degreed engineer? Do you have American Society of Cost Segregation Professionals certified team members on staff?

- Do you provide a complimentary estimate of benefits?

- Is a site visit performed?

- What methodology is used to create the report? What kind of technical/tax review process is involved?

- How frequently will you communicate with me/my client? Can you tailor your level of engagement to our preferences?

- Will you stand behind your work product in the unlikely event of an audit?

- Can you help us craft a comprehensive tax plan that will serve us now and in the future?

- If legislation changes create new savings opportunities, will you revisit my report?

Is Cost Segregation Worth It? I Found this Online Calculator …

Cost segregation can certainly be “worth it” in terms of return on investment. Fees vary, and are generally commensurate with a project’s scope, size, and complexity, but the usual return on investment for a cost segregation report is well over 10 to 1.

Cost segregation bestows benefits beyond accelerated depreciation. The study can provide the data needed to support myriad other tax strategies, preparing you for savings in the future.

Additionally, the right provider will stay up to date on current legislation. So, if new savings opportunities become available, your cost segregation study can be revisited, possibly adding even more return on your investment.

Because cost segregation is nuanced, and the facts and circumstances of every project vary, online calculators provide general estimates at best. Take those results with a grain of salt. A quality cost segregation provider will provide you with a complimentary estimate of benefits after reviewing your specific fact pattern.

What Kinds of Commercial Real Estate Can Cost Segregation Be Performed On?

Office buildings, hotels, and retail space often come to mind when people think of cost segregation, but it can be performed on any type of commercial real estate. In fact, some of the hottest property types for cost segregation today include the following:

- Industrial/manufacturing facilities

- Auto dealerships

- Self-storage facilities

- Assisted-living facilities

Cost segregation can even be performed on nonprofit tenants in otherwise for-profit spaces, a trend we’re seeing quite a bit of lately.

Does Cost Segregation Create New Deductions?

Moving assets into shorter-lived categories doesn’t generate new deductions. Rather, it accelerates the deductions so the taxpayer gets the depreciation benefit sooner, taking advantage of the time-value of money.

When Is the Best Time to Perform a Cost Segregation Study?

The best time to perform a cost segregation study is immediately after a property is placed in service to maximize savings from day one. However, if that was not possible, the IRS allows the benefits from previous years to be claimed using a “look-back” cost segregation study. By reclassifying assets to their correct lives, taxpayers can “catch-up” on all the depreciation they would have gotten had the study been performed on day one. Look-back studies require the use of Form 3115.

Can I Use Cost Segregation in a Renovation Scenario or Is It Only for Newly Constructed or Acquired Properties?

Cost segregation is a great tax strategy to use on newly constructed or acquired properties, or on those constructed or acquired several years ago. But impending renovations are also an excellent cost segregation trigger. It might seem counterintuitive to perform a detailed study of assets that you plan to dispose of. Why quantify assets that are on their way out? The answer is simple. If these assets are quantified through a cost segregation study before they are retired, you can use that data to take advantage of a strategy called partial asset disposition (PAD) election. PAD elections permit a taxpayer to write off the remaining depreciable basis of a disposed asset in the year it was removed. This can be an incredible tax-savings strategy, but requires a complete record of the assets in question.

What Is Bonus Depreciation, and How Is it Connected to Cost Segregation?

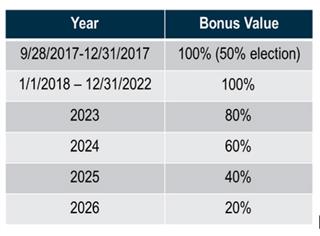

Bonus depreciation permits the additional write-off of an eligible asset’s value in addition to standard depreciation. New assets with class lives of 20 years or less are eligible, which significantly boosts tax savings. The Tax Cuts and Jobs Act (TCJA) of 2017 allows bonus depreciation to be taken on used assets placed in service on or after Sept. 28, 2017. Cost segregation is an effective tool used to determine and document which assets have eligible class lives and are, therefore, eligible for this incentive.

The bonus depreciation rate is 100% for eligible assets placed in service between Sept. 28, 2017, and Dec. 31, 2022. The rate decreases to 80% for projects placed in service in 2023, and will continue to decline by 20% annually through 2026.

Cost segregation studies still bring great benefit, even at lower bonus rates.

What Is Qualified Improvement Property and How Is It Connected to Cost Segregation?

Qualified improvement property (QIP) is defined as any improvement to an interior portion of a building that is nonresidential real property if the improvement is placed in service after the date the building was first placed in service by any taxpayer. (If you want more clarity on this definition, read Capstan’s blog that breaks it down piece by piece.) The CARES Act of 2020 assigned QIP a 15-year recovery period. By assigning QIP a class-life of less than 20 years, the CARES Act made QIP bonus-eligible, which is a huge boon for taxpayers.

A cost segregation study is the key to this incentive as well. It provides the comprehensive data required to categorize and assign cost values to QIP assets.

Bruce A. Johnson, CRE, MBA, is a partner at Capstan Tax Strategies. He works closely with commercial real estate owners and accounting firms to provide practical, creative, and customized engineering-based tax solutions. Johnson can be reached at bjohnson@capstantax.com.

Sign up for PICPA's weekly professional and technical updates by completing this form.

Statements of fact and opinion are the authors’ responsibility alone and do not imply an opinion on the part of the PICPA's officers or members. The information contained herein does not constitute accounting, legal, or professional advice. For actionable advice, you must engage or consult with a qualified professional.

Leave a commentOrder by

Newest on top Oldest on top